Get the free DEFINED BENEFIT PLAN RETIREMENT ESTIMATE REQUEST

Show details

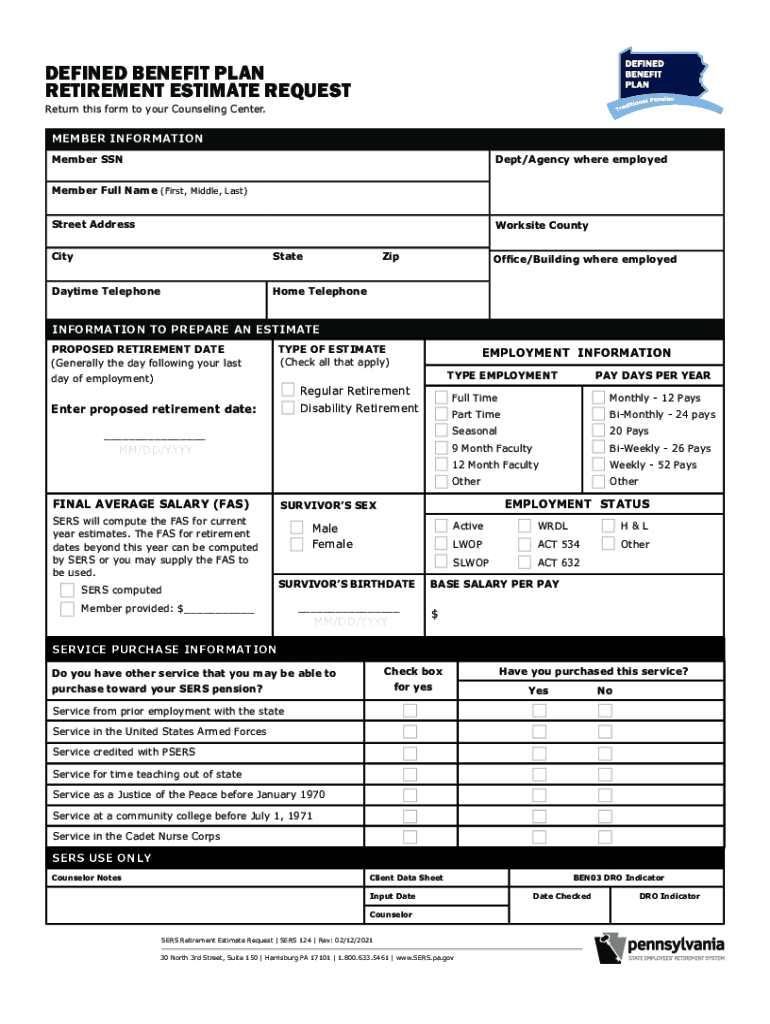

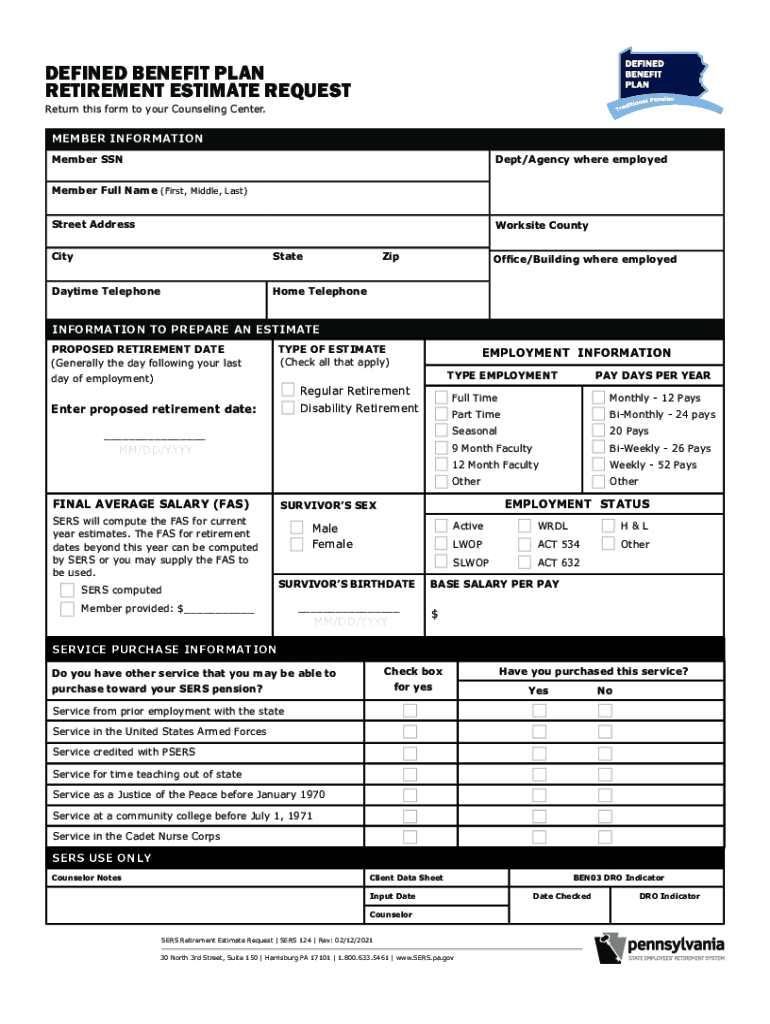

DEFINED BENEFIT PLAN RETIREMENT ESTIMATE REQUEST Return this form to your Counseling Center. MEMBER INFORMATION Member Concept/Agency where employedMember Full Name (First, Middle, Last) Street AddressWorksite

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign defined benefit plan retirement

Edit your defined benefit plan retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your defined benefit plan retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit defined benefit plan retirement online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit defined benefit plan retirement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out defined benefit plan retirement

How to fill out defined benefit plan retirement

01

To fill out a defined benefit plan retirement, follow these steps:

02

Gather all necessary information: Start by gathering all relevant documents and information related to your employment, such as your employment contract, salary details, years of service, and any additional contributions made to the plan.

03

Understand the plan's rules: Familiarize yourself with the specific rules and regulations of your defined benefit plan retirement. This may include factors like vesting periods, retirement age, pension calculation formula, and benefit options.

04

Calculate your benefit: Use the provided formula or calculator to determine your potential retirement benefit. This calculation typically involves factors like your average salary, credited service, and a predetermined multiplier.

05

Choose your payout option: Once you have calculated your benefit, you will often have multiple payout options to choose from. Options may include a lump sum payment, annuity, or a combination of both. Consider your financial goals and consult with a financial advisor if needed.

06

Complete the necessary forms: Fill out the required forms provided by your employer or retirement plan administrator accurately and thoroughly. Take note of any supporting documentation required, such as proof of birth, marital status, or beneficiary information.

07

Submit the forms: Once you have completed the forms, submit them to your employer or retirement plan administrator. Ensure that you adhere to any deadlines specified and keep copies of all documentation for your records.

08

Review your confirmation: After submitting the forms, you may receive a confirmation of your retirement plan election. Review the confirmation carefully to ensure that all details are correct and aligned with your expectations.

09

Seek professional advice if necessary: If you have any doubts or concerns throughout the process, consider seeking advice from a financial planner or retirement specialist who can provide guidance tailored to your specific situation.

10

Monitor your retirement account: Keep track of your retirement account periodically to verify that contributions are being made correctly and monitor the growth of your retirement savings.

11

Stay informed: Stay updated on any changes to the plan's rules or regulations that may affect your retirement benefits. Attend informational sessions or read communication from your plan administrator to stay informed.

Who needs defined benefit plan retirement?

01

Defined benefit plan retirement is beneficial for individuals who:

02

- Seek a guaranteed source of income in retirement: A defined benefit plan offers a predictable and stable income stream during retirement, which can provide peace of mind and financial security.

03

- Have a long-term employment commitment: These plans are often offered by employers as a way to reward long-term employees. If you plan to stay with the same employer for an extended period, a defined benefit plan retirement can be advantageous.

04

- Prefer minimal investment risk: Unlike defined contribution plans, where investment performance affects account balances, defined benefit plans protect participants from market fluctuations. This makes it suitable for individuals who are risk-averse.

05

- Have a limited understanding or interest in investment management: Defined benefit plans relieve individuals of the responsibility of managing their investments. The plan administrator handles investment decisions, allowing participants to focus on other aspects of retirement planning.

06

- Value the potential for a higher retirement income: Defined benefit plans often provide higher retirement income compared to defined contribution plans, particularly for individuals with a lengthy work history and higher compensation.

07

- Are willing to commit to the plan's requirements: Defined benefit plans typically come with certain requirements, such as a specific number of years of service or reaching a certain age. Individuals who are willing to meet these requirements can benefit from this type of retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit defined benefit plan retirement from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your defined benefit plan retirement into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute defined benefit plan retirement online?

pdfFiller has made filling out and eSigning defined benefit plan retirement easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete defined benefit plan retirement on an Android device?

Complete your defined benefit plan retirement and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is defined benefit plan retirement?

A defined benefit plan retirement is a type of retirement plan in which the employer guarantees a specified monthly benefit to the employee upon retirement.

Who is required to file defined benefit plan retirement?

Employers who offer defined benefit plans are required to file reports with the IRS and the Department of Labor.

How to fill out defined benefit plan retirement?

You can fill out defined benefit plan retirement by providing information about the plan's funding, benefits, and participants on the required forms provided by the IRS and Department of Labor.

What is the purpose of defined benefit plan retirement?

The purpose of defined benefit plan retirement is to provide a guaranteed income stream to employees upon retirement, based on a predetermined formula.

What information must be reported on defined benefit plan retirement?

Information such as plan funding status, participant data, and benefit payments must be reported on defined benefit plan retirement forms.

Fill out your defined benefit plan retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Defined Benefit Plan Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.