Get the free Estate distribution spreadsheet

Show details

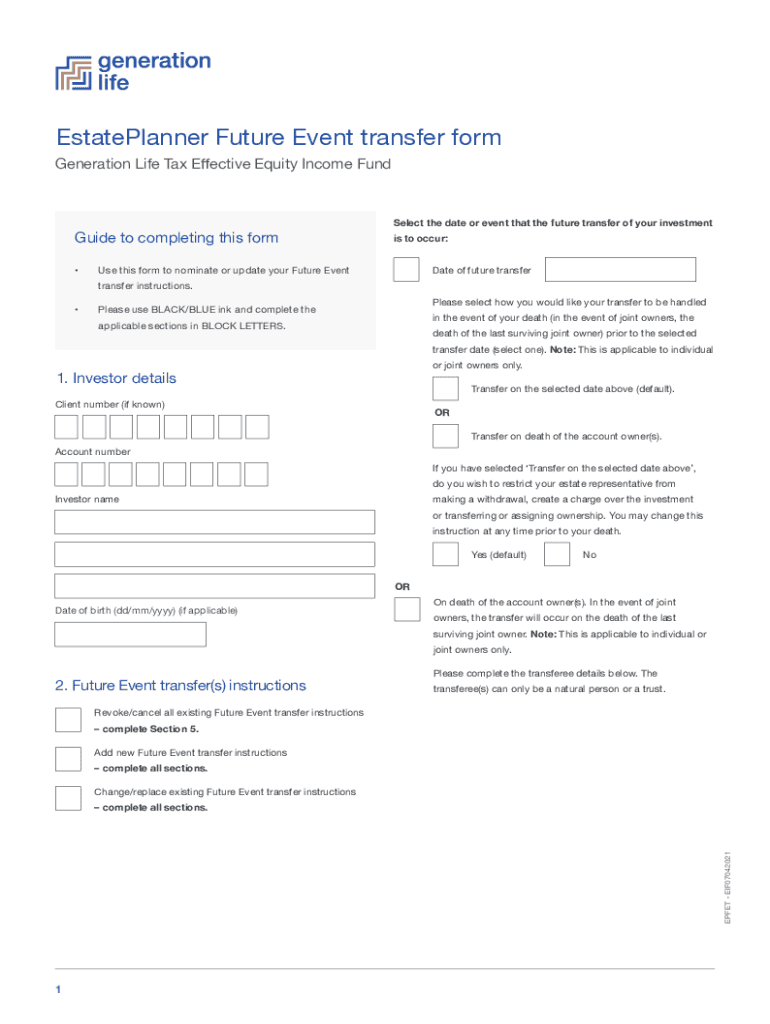

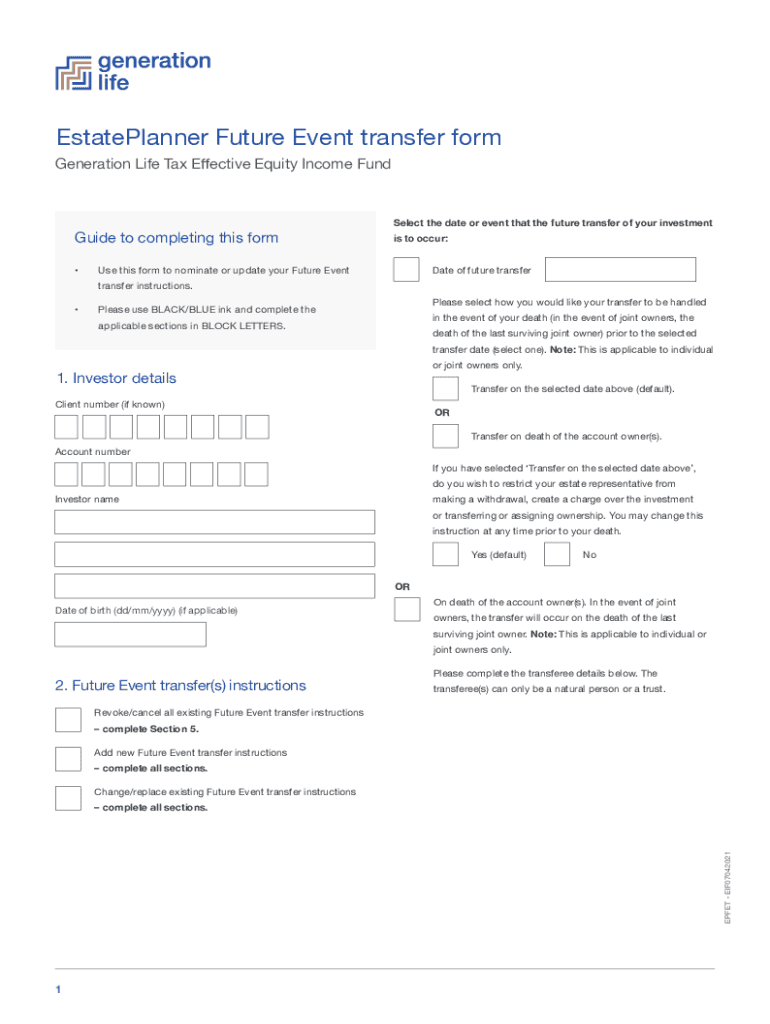

EstatePlanner Future Event transfer regeneration Life Tax Effective Equity Income Fungicide to completing this form Select the date or event that the future transfer of your investment is to occur:Use

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate distribution spreadsheet

Edit your estate distribution spreadsheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate distribution spreadsheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate distribution spreadsheet online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estate distribution spreadsheet. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate distribution spreadsheet

How to fill out estate distribution spreadsheet

01

To fill out an estate distribution spreadsheet, follow these steps:

02

Start by gathering all the necessary information, such as the names of the heirs or beneficiaries, the assets of the estate, and any outstanding debts.

03

Create a spreadsheet using a program like Microsoft Excel or Google Sheets. Label the columns with the relevant categories, such as heir/beneficiary names, asset descriptions, values, and percentage distribution.

04

Enter the names of the heirs or beneficiaries in the first column.

05

List the assets of the estate in the second column. This can include properties, investments, bank accounts, vehicles, or any other valuable items.

06

Assign a value to each asset in the third column. If possible, use appraisals or market values to determine accurate amounts.

07

Calculate the total value of all assets at the bottom of the third column.

08

Decide on the percentage distribution of the estate among the heirs or beneficiaries. Enter these percentages in the fourth column.

09

Calculate the distributable value for each heir or beneficiary by multiplying the total value of the assets by their respective percentages.

10

Enter the distributable value for each heir or beneficiary in the fifth column.

11

Double-check all entries for accuracy before finalizing the spreadsheet.

12

Save a copy of the completed estate distribution spreadsheet for your records.

13

Share the spreadsheet with relevant parties, such as legal professionals or heirs, if necessary.

14

Remember, it's always a good idea to consult with an estate planning attorney or financial advisor for guidance during this process.

15

Once you have filled out the estate distribution spreadsheet, you will have a clear overview of how the estate will be distributed among the heirs or beneficiaries.

16

Be sure to update the spreadsheet if any changes occur, such as new assets or adjustments to the distribution percentages.

Who needs estate distribution spreadsheet?

01

An estate distribution spreadsheet is useful for individuals or families who are planning their estates or managing the distribution of assets after the death of a loved one.

02

It can be particularly beneficial in the following scenarios:

03

- Someone wanting to ensure equitable distribution of assets among multiple heirs or beneficiaries.

04

- Couples or individuals who want to document their wishes for estate distribution and avoid potential conflicts among family members.

05

- Executors or administrators of an estate who need to keep track of all the assets, debts, and beneficiaries.

06

- Estate planning attorneys or financial advisors who assist clients in creating comprehensive estate plans.

07

By using an estate distribution spreadsheet, these individuals can have a clear overview of the estate's assets and how they will be divided, facilitating the administration process and minimizing potential disputes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my estate distribution spreadsheet in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your estate distribution spreadsheet and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete estate distribution spreadsheet on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your estate distribution spreadsheet, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out estate distribution spreadsheet on an Android device?

On an Android device, use the pdfFiller mobile app to finish your estate distribution spreadsheet. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is estate distribution spreadsheet?

The estate distribution spreadsheet is a document used to track and record the distribution of assets from a deceased person's estate to their beneficiaries.

Who is required to file estate distribution spreadsheet?

The executor or administrator of the deceased person's estate is typically required to file the estate distribution spreadsheet.

How to fill out estate distribution spreadsheet?

To fill out the estate distribution spreadsheet, one must list all the assets of the estate, the beneficiaries, and the distribution of assets to each beneficiary.

What is the purpose of estate distribution spreadsheet?

The purpose of the estate distribution spreadsheet is to ensure that the assets of the deceased person's estate are distributed appropriately and according to the wishes outlined in the will.

What information must be reported on estate distribution spreadsheet?

The estate distribution spreadsheet must include details of all assets in the estate, the value of each asset, the beneficiaries, and the distribution plan.

Fill out your estate distribution spreadsheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Distribution Spreadsheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.