NZ IR 590 2018-2025 free printable template

Show details

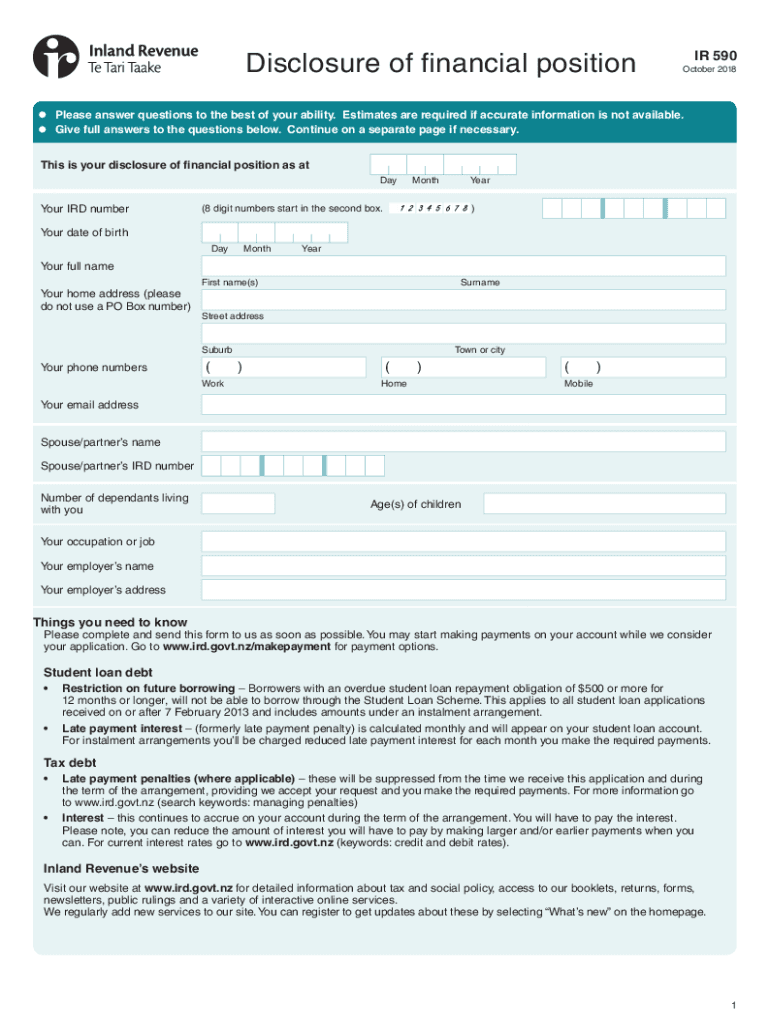

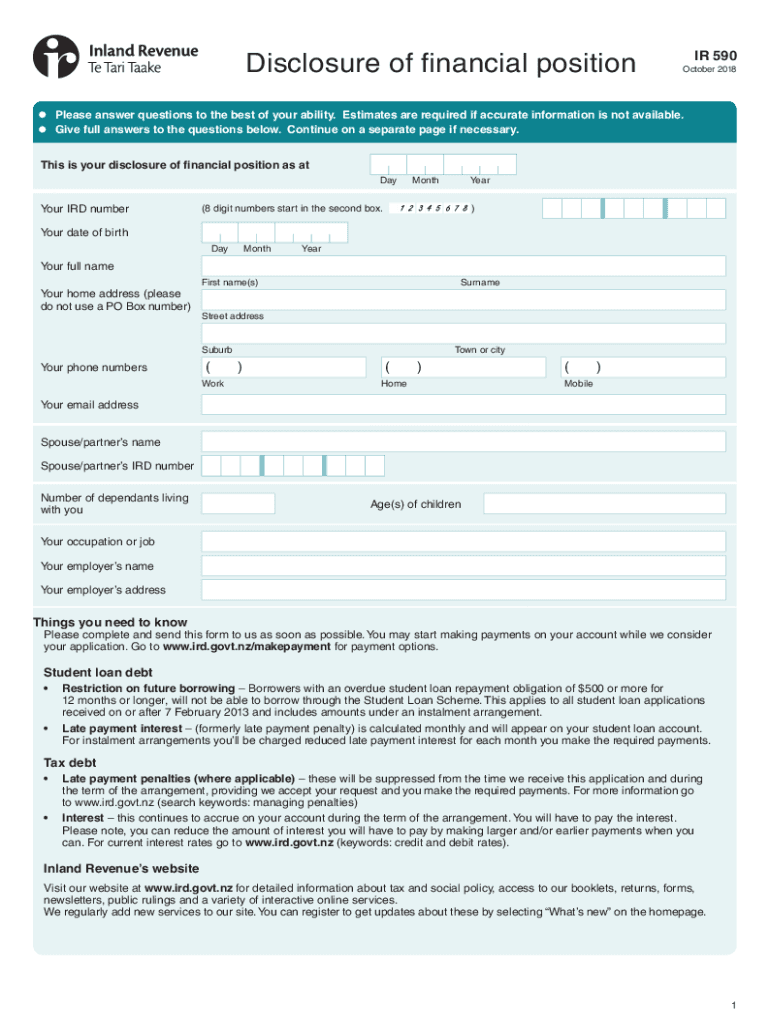

Disclosure of financial position IR 590

October 2018 Please answer questions to the best of your ability. Estimates are required if accurate information is not available.

Give full answers to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ir 590 form

Edit your ir590 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ir590 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ir 590 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ir590 form ird. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR 590 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ir590 ird form

How to fill out NZ IR 590

01

Obtain the NZ IR 590 form from the Inland Revenue website or your local Inland Revenue office.

02

Fill in your personal details including your name, address, and IRD number in the designated sections.

03

Provide the type of income being reported, ensuring it corresponds with the correct box.

04

Report any relevant deductions or expenses that apply to your situation.

05

Double-check all entries for accuracy to avoid delays in processing.

06

Sign and date the form at the bottom, certifying that the information provided is true and correct.

07

Submit the completed form either online through the Inland Revenue portal or via mail to the appropriate address.

Who needs NZ IR 590?

01

Individuals who are required to report their income for tax purposes in New Zealand.

02

Self-employed individuals or contractors needing to declare earnings.

03

Tax residents who need to submit additional tax returns to the Inland Revenue.

Fill

ir590 form nz

: Try Risk Free

People Also Ask about

What are items of income in respect of a decedent?

Income in Respect of a Decedent (IRD) is all the income a decedent would have received had death not occurred, but was not properly includible in his/her final income tax return. IRD must be included in the income of the decedent's estate, if the estate receives it.

What is the IRD deduction?

Decedent (IRD) deduction is short for Income in Respect of a Decedent tax deduction. It is based on the income from any earnings, dividends, sales commissions, bonuses, or distributions from an individual retirement account (IRA) owed to individuals at the time of their death.

What is the format of the IRD?

The IRD number is a unique number issued by Inland Revenue. The IRD number format used by Inland Revenue is an eight or nine digit number in the format 99999999 or 999999999 (depending on when it was first issued).

What is an IRD transaction?

An interest rate differential (IRD) weighs the contrast in interest rates between two similar interest-bearing assets. Most often it is the difference between two interest rates. Traders in the foreign exchange market use IRDs when pricing forward exchange rates.

What is included in IRD?

Examples of IRD include: Uncollected salary, wages, bonuses, commissions and vacation or sick pay. Distributions from deferred compensation. Stock options exercised.

What is the Form I-590?

Form I-590, Registration for Classification as Refugee.

How do I get a fee waiver for replacement naturalization certificate?

In some cases, you may be able to request a Form N-565 fee waiver if you are unable to pay the fees due to financial hardship. To request a fee waiver, you will need to submit Form I-912, Request for Fee Waiver, along with your application.

What form refugee needs to fill out?

If you want to apply for asylum, you must file your Form I-589 with EOIR. To locate where to file your Form I-589 with EOIR: Use the EOIR hotline or online system to locate an address for the immigration court where you must file your Form I-589.

What is the form for permanent resident card?

I-485, Application to Register Permanent Residence or Adjust Status. ALERT: If you file Form I-485, Application to Register Permanent Residence or Adjust Status, on or after Dec. 23, 2022, then you must use the 12/23/22 edition of Form I-485 or we will reject your filing.

What is the form I-590 registration for classification as a refugee?

The Form I-590 is the primary document in all refugee case files and becomes part of the applicant's A-file. It is the application form by which a person seeks refugee classification and resettlement in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ir590 2018-2025 form online?

The editing procedure is simple with pdfFiller. Open your ir590 2018-2025 form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit ir590 2018-2025 form in Chrome?

Install the pdfFiller Google Chrome Extension to edit ir590 2018-2025 form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit ir590 2018-2025 form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign ir590 2018-2025 form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is NZ IR 590?

NZ IR 590 is a form used in New Zealand for reporting income received from dividends or interest to the Inland Revenue Department.

Who is required to file NZ IR 590?

Individuals or entities that receive dividend or interest income in New Zealand and need to report this income for tax purposes are required to file NZ IR 590.

How to fill out NZ IR 590?

To fill out NZ IR 590, you need to provide your personal details, the amount of dividend or interest income received, and any relevant tax credits or deductions.

What is the purpose of NZ IR 590?

The purpose of NZ IR 590 is to ensure accurate reporting of dividend and interest income to the Inland Revenue, allowing for proper taxation and compliance.

What information must be reported on NZ IR 590?

The information that must be reported on NZ IR 590 includes your name, IRD number, details of the income received, tax paid on that income, and any other relevant details that support your income claims.

Fill out your ir590 2018-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ir590 2018-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.