Get the free Rating and underwriting assumptions ... - Kaiser Permanente

Show details

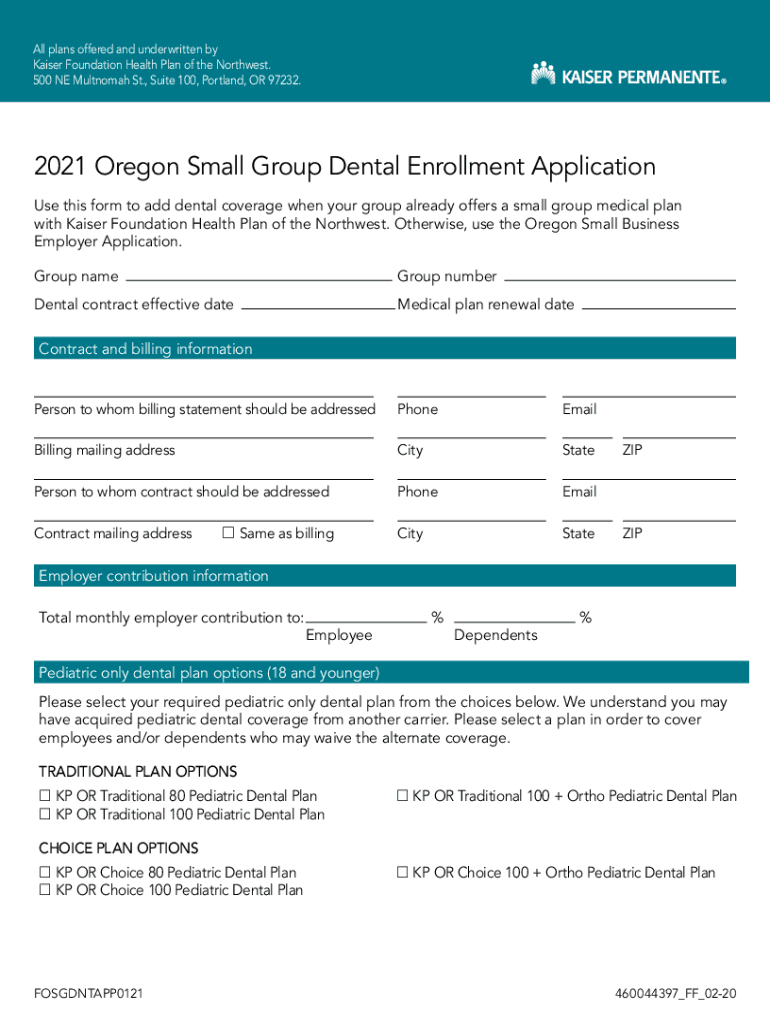

All plans offered and underwritten by Kaiser Foundation Health Plan oftheNorthwest. 500 NE Multnomah St., Suite 100, Portland, OR 97232.2021 Oregon Small Group Dental Enrollment Application Use this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rating and underwriting assumptions

Edit your rating and underwriting assumptions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rating and underwriting assumptions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rating and underwriting assumptions online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rating and underwriting assumptions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rating and underwriting assumptions

How to fill out rating and underwriting assumptions

01

To fill out rating and underwriting assumptions, follow these steps:

02

Identify the specific rating and underwriting assumptions required for your project or analysis.

03

Analyze the data and information available to you, such as historical performance, market trends, and industry benchmarks.

04

Determine the key factors that impact the rating and underwriting assumptions, such as creditworthiness, market conditions, and regulatory requirements.

05

Quantify the assumptions using appropriate metrics, such as probabilities, percentages, or financial ratios.

06

Document the assumptions clearly and concisely, ensuring they are understandable and transparent for stakeholders who will review or use the ratings and underwriting.

07

Review and validate the assumptions with relevant experts, stakeholders, or internal committees.

08

Periodically update the assumptions as new information becomes available or conditions change, ensuring they remain accurate and relevant.

09

Communicate the assumptions effectively to all parties involved, such as investors, underwriters, or risk managers.

Who needs rating and underwriting assumptions?

01

Rating and underwriting assumptions are needed by various stakeholders involved in financial analysis, risk assessment, and investment decision-making processes. These may include:

02

- Investors who are evaluating the creditworthiness and risk of an investment opportunity.

03

- Underwriters who are determining the terms, conditions, and pricing of insurance policies or financial products.

04

- Credit rating agencies that assign credit ratings to entities or securities.

05

- Risk analysts who are assessing the likelihood and potential impact of various risks in a project or investment.

06

- Regulators who need to monitor and oversee the financial health and stability of institutions or markets.

07

- Financial institutions or lenders who require accurate underwriting assumptions to make informed lending decisions.

08

- Auditors who review the appropriateness and reasonableness of assumptions for financial reporting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute rating and underwriting assumptions online?

Filling out and eSigning rating and underwriting assumptions is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out rating and underwriting assumptions using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign rating and underwriting assumptions and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit rating and underwriting assumptions on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign rating and underwriting assumptions right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is rating and underwriting assumptions?

Rating and underwriting assumptions are the factors and criteria used by insurance companies to evaluate risk and set premium rates for policies.

Who is required to file rating and underwriting assumptions?

Insurance companies are required to file rating and underwriting assumptions with regulatory authorities.

How to fill out rating and underwriting assumptions?

Rating and underwriting assumptions are typically filled out by actuaries and underwriters based on statistical data and risk analysis.

What is the purpose of rating and underwriting assumptions?

The purpose of rating and underwriting assumptions is to ensure that insurance companies have a solid basis for pricing policies and managing risk.

What information must be reported on rating and underwriting assumptions?

Rating and underwriting assumptions must include details on factors such as demographic data, claims history, and market trends.

Fill out your rating and underwriting assumptions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rating And Underwriting Assumptions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.