Get the free ALTA Homeowner's Policy

Show details

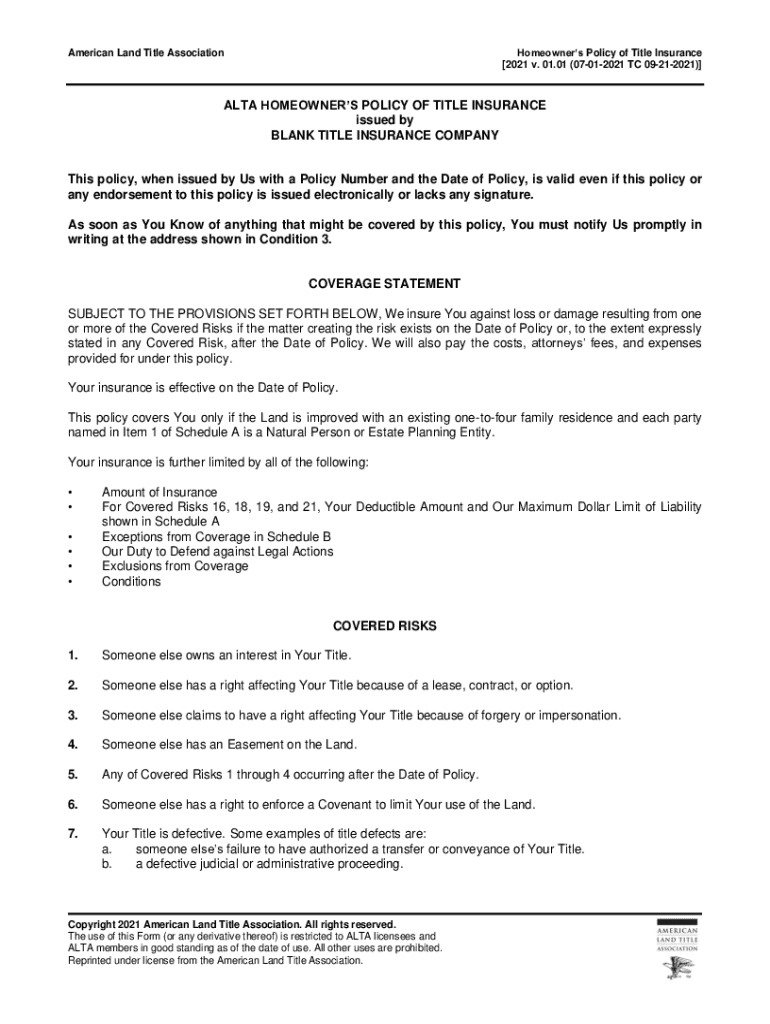

Homeowners Policy of Title Insurance 2021 v. 01.01 (07012021 TC 09212021) American Land Title AssociationALTA HOMEOWNERS POLICY OF TITLE INSURANCE issued by BLANK TITLE INSURANCE COMPANYThis policy,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alta homeowners policy

Edit your alta homeowners policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alta homeowners policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alta homeowners policy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit alta homeowners policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alta homeowners policy

How to fill out alta homeowners policy

01

Start by reading the instructions and terms and conditions of the Alta homeowners policy thoroughly.

02

Provide accurate and complete information about the property you want to insure. This includes the address, type of structure, year of construction, square footage, and any special features or amenities.

03

Mention the desired coverage amount for different sections of the policy, such as dwelling, personal property, liability, and additional living expenses. Consider the value of your belongings, the potential risks in your area, and your personal preferences.

04

Indicate any additional coverages or endorsements you may need, such as flood insurance, earthquake insurance, or personal liability umbrella coverage.

05

Provide details about any existing claims or losses, as it may affect your eligibility or premiums.

06

Clearly state the effective date and duration of the policy. Decide whether you want coverage for a specific period or on an ongoing basis with automatic renewals.

07

Carefully review all the information provided before submitting the application. Ensure accuracy and completeness to avoid any future complications or claim denials.

08

Submit the filled-out Alta homeowners policy application along with any required documents and payment for the premium.

09

After submission, keep a copy of the completed policy for your records and store it in a safe place.

10

Regularly review and update your Alta homeowners policy to ensure it remains suitable for your changing needs and circumstances.

Who needs alta homeowners policy?

01

Alta homeowners policy is relevant for individuals who own or plan to own a residential property. It provides coverage and financial protection against risks such as property damage, theft, personal liability, and additional living expenses.

02

Homeowners who want to safeguard their property, belongings, and themselves from unexpected events should consider getting an Alta homeowners policy.

03

It can be beneficial for both homeowners who live in their property and those who rent it out, as it provides protection for both the physical structure and personal belongings.

04

Additionally, lenders or mortgage companies may require borrowers to have homeowners insurance before approving a loan or mortgage.

05

Overall, anyone who values their residential property and wants financial security against unforeseen circumstances should consider obtaining an Alta homeowners policy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit alta homeowners policy from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like alta homeowners policy, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in alta homeowners policy without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing alta homeowners policy and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit alta homeowners policy on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute alta homeowners policy from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is alta homeowners policy?

An alta homeowners policy is a type of insurance that provides coverage for damages to a home and its contents.

Who is required to file alta homeowners policy?

Homeowners are required to file an alta homeowners policy in order to protect their property.

How to fill out alta homeowners policy?

To fill out an alta homeowners policy, homeowners must provide information about their property, possessions, and desired coverage.

What is the purpose of alta homeowners policy?

The purpose of alta homeowners policy is to protect homeowners from financial losses due to damages to their property.

What information must be reported on alta homeowners policy?

Information such as property details, personal possessions, and desired coverage must be reported on an alta homeowners policy.

Fill out your alta homeowners policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alta Homeowners Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.