Get the free Tips and Tricks to Solve Alphabet Series Questions ...

Show details

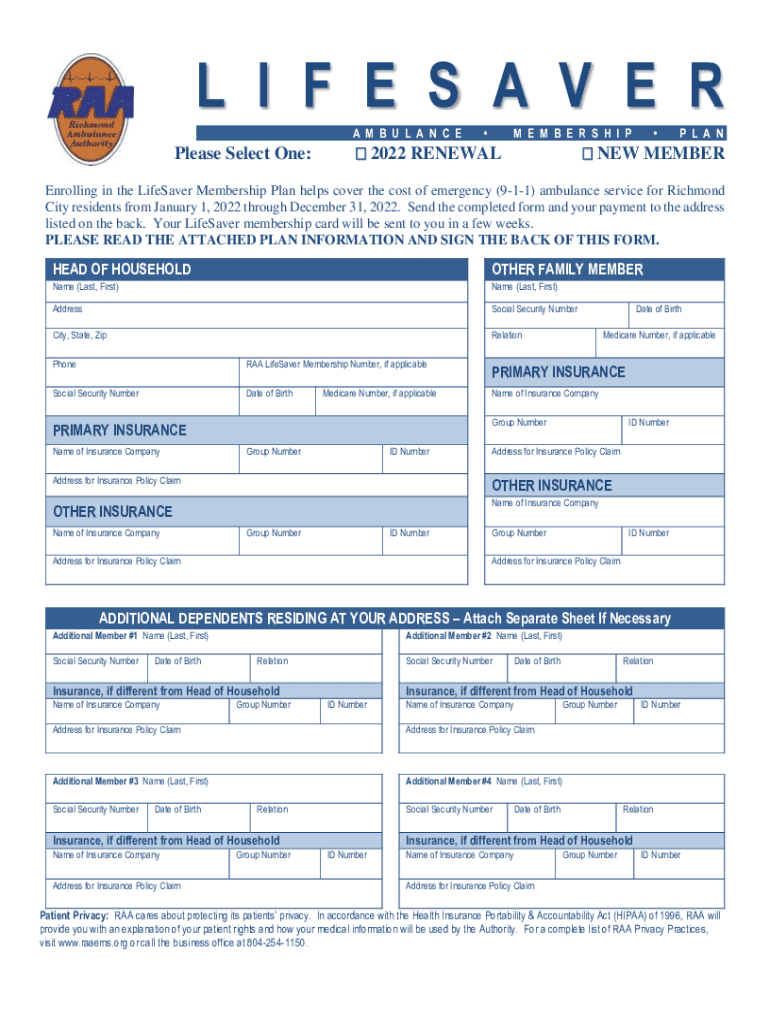

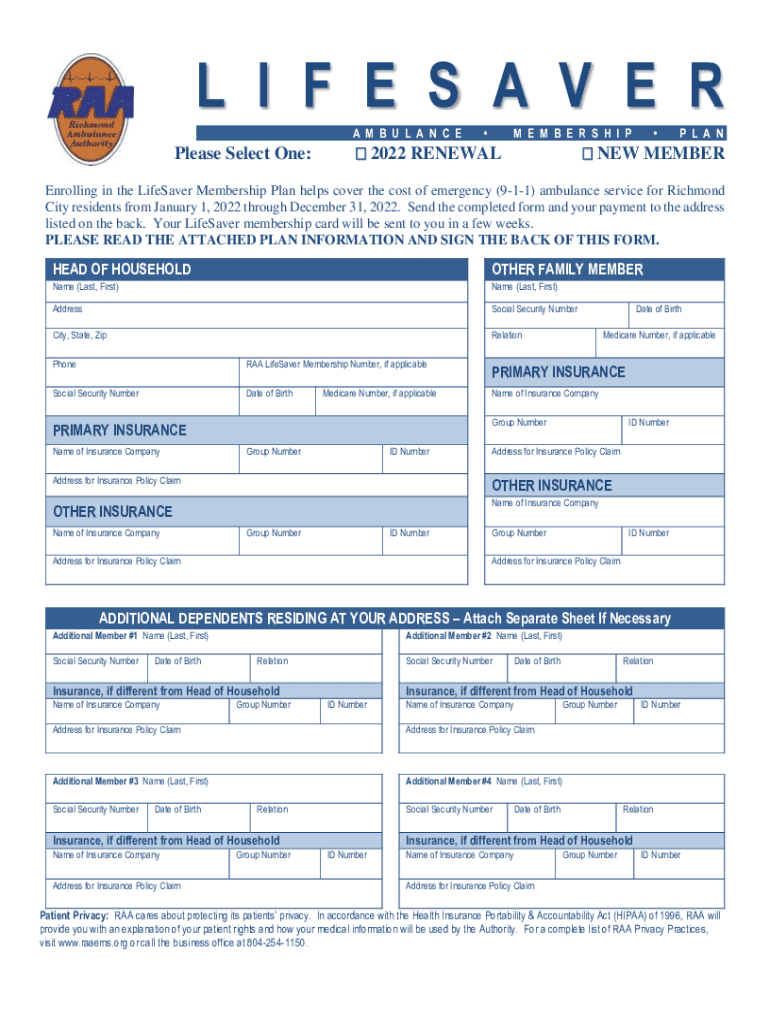

L I F E S A V E R A M B U L A N CE Please Select One’M E M B E R S H I P 2022 RENEWAL L A N NEW MEMBEREnrolling in the Lifesaver Membership Plan helps cover the cost of emergency (911) ambulance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tips and tricks to

Edit your tips and tricks to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tips and tricks to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tips and tricks to online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tips and tricks to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tips and tricks to

How to fill out tips and tricks to

01

Start by identifying the specific topic or subject that the tips and tricks are related to.

02

Research and gather relevant information and strategies that can help improve performance or achieve desired outcomes in that particular area.

03

Organize the tips and tricks in a clear and easy-to-follow format, preferably in bullet points or numbered lists.

04

Use concise and straightforward language to explain each tip or trick.

05

Provide examples or illustrations whenever possible to enhance understanding.

06

Consider categorizing the tips and tricks based on different skill levels or specific objectives.

07

Proofread and review the content to ensure accuracy and clarity.

08

Format the tips and tricks document in a visually appealing manner, using headings, subheadings, and appropriate formatting styles.

09

Consider adding visual aids such as images or diagrams to enhance the presentation.

10

Test the tips and tricks yourself or seek feedback from others to validate their effectiveness.

11

Update and revise the tips and tricks regularly to keep them up to date and relevant.

Who needs tips and tricks to?

01

Anyone who wants to enhance their knowledge or skills in a particular subject or area can benefit from tips and tricks.

02

Students looking for effective study techniques or exam preparation strategies.

03

Professionals seeking ways to improve their productivity or advance in their careers.

04

Hobbyists or enthusiasts looking for tips and tricks to enhance their skills or enjoyment in their chosen activities.

05

Entrepreneurs or business owners looking for innovative strategies or insights to achieve success.

06

Individuals facing challenges or difficulties in a specific area and seeking guidance to overcome them.

07

People who want to stay updated with the latest trends and best practices in a particular field.

08

Anyone who is curious and eager to learn new things and explore different perspectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tips and tricks to to be eSigned by others?

Once you are ready to share your tips and tricks to, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit tips and tricks to straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing tips and tricks to.

How do I fill out tips and tricks to on an Android device?

On Android, use the pdfFiller mobile app to finish your tips and tricks to. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tips and tricks to?

Tips and tricks to is a guide that provides useful advice and strategies to help individuals or businesses improve their performance in various tasks or activities.

Who is required to file tips and tricks to?

Individuals or businesses that earn tips as a part of their income, such as restaurant employees or service providers, are typically required to file tips and tricks to.

How to fill out tips and tricks to?

To fill out tips and tricks to, gather all relevant information on earned tips, complete the necessary forms accurately, and provide any supporting documentation required by tax authorities.

What is the purpose of tips and tricks to?

The purpose of tips and tricks to is to ensure accurate reporting of tip income for tax purposes and to provide a clear record of earnings for both employees and tax authorities.

What information must be reported on tips and tricks to?

The information that must be reported typically includes the total amount of tips earned, any taxes withheld, and details on the employment and service context related to the tips.

Fill out your tips and tricks to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tips And Tricks To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.