Get the free Additional Tax Deductible Donation

Show details

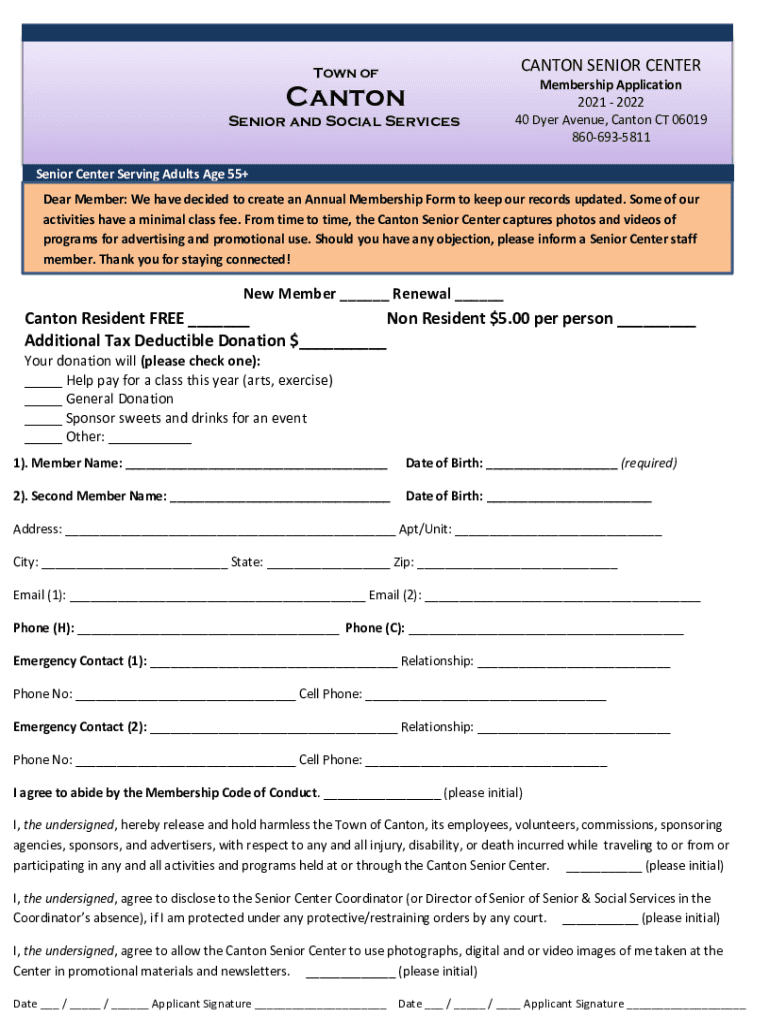

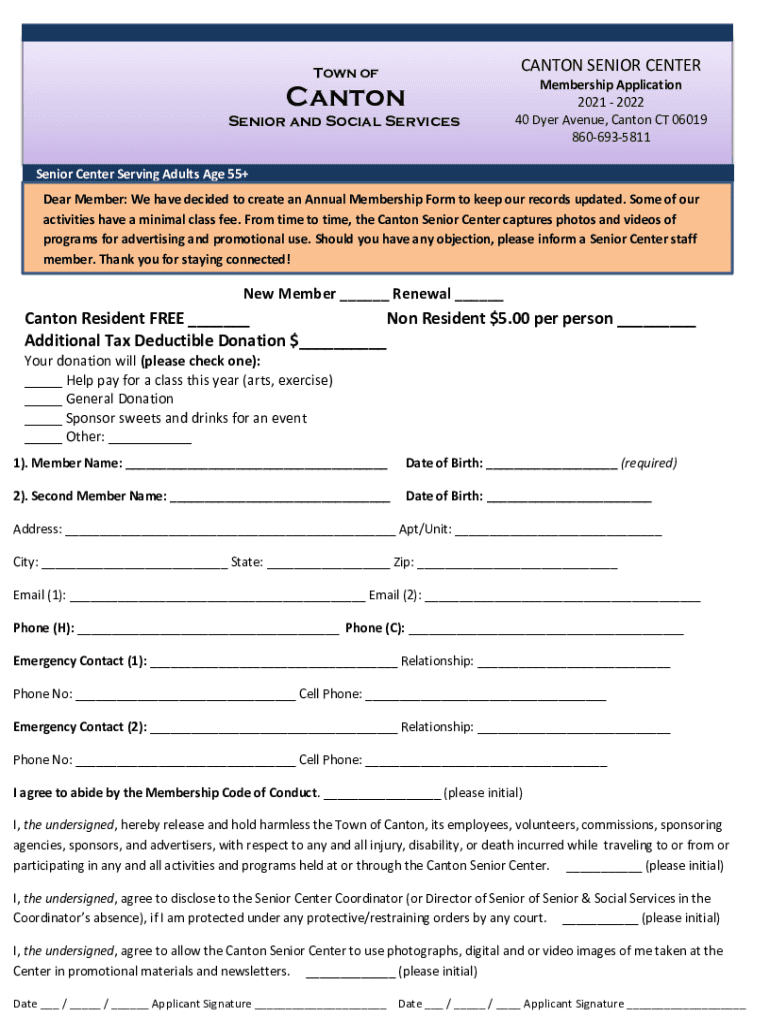

CANTON SENIOR Entertain of Canton Senior and Social ServicesMembership Application 2021 2022 40 Dyer Avenue, Canton CT 06019 8606935811Senior Center Serving Adults Age 55+ Dear Member: We have decided

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign additional tax deductible donation

Edit your additional tax deductible donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional tax deductible donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing additional tax deductible donation online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit additional tax deductible donation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out additional tax deductible donation

How to fill out additional tax deductible donation

01

To fill out additional tax deductible donation, you will need the following steps:

02

Start by gathering all necessary documents and receipts related to your donations.

03

Determine the contribution limit for tax deductible donations based on your income and tax bracket.

04

Complete the relevant tax forms provided by your tax authority, such as Form 1040 in the United States.

05

Report the total amount of your tax deductible donations in the appropriate section of the tax form.

06

Provide detailed information about each donation, including the name of the charity, date of donation, and the monetary value.

07

Attach copies of supporting documents, such as receipts or acknowledgment letters, to verify your donations.

08

Double-check all the information before submitting the tax form to ensure accuracy.

09

Keep copies of the filled-out tax form and supporting documents for your records.

Who needs additional tax deductible donation?

01

Additional tax deductible donations can be beneficial for individuals or businesses who want to reduce their tax liabilities and support charitable causes simultaneously.

02

Some potential beneficiaries of additional tax deductible donations include:

03

- Individuals who want to lower their taxable income by deducting qualified donations.

04

- Businesses that aim to receive tax benefits and enhance their corporate social responsibility.

05

- Nonprofit organizations that rely on donations to fund their mission and operations.

06

- Taxpayers who wish to contribute to eligible charities and make a positive impact on society.

07

It is important to consult with a tax professional or refer to the specific tax regulations in your country to understand the exact requirements and benefits associated with additional tax deductible donations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send additional tax deductible donation to be eSigned by others?

When your additional tax deductible donation is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit additional tax deductible donation in Chrome?

Install the pdfFiller Google Chrome Extension to edit additional tax deductible donation and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the additional tax deductible donation in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your additional tax deductible donation right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is additional tax deductible donation?

Additional tax deductible donation refers to contributions made to qualified charitable organizations that can be subtracted from taxable income.

Who is required to file additional tax deductible donation?

Individuals or organizations who make donations to eligible charities and wish to claim a tax deduction on their tax return are required to file additional tax deductible donation.

How to fill out additional tax deductible donation?

To fill out additional tax deductible donation, individuals or organizations need to keep detailed records of their charitable contributions and report the total amount on their tax return using the appropriate forms provided by the IRS.

What is the purpose of additional tax deductible donation?

The purpose of additional tax deductible donation is to encourage charitable giving by providing a tax incentive for individuals and organizations to donate to qualified charities.

What information must be reported on additional tax deductible donation?

The information that must be reported on additional tax deductible donation includes the name and address of the charity, the date and amount of the contribution, and any supporting documentation such as receipts or acknowledgment letters from the charity.

Fill out your additional tax deductible donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Tax Deductible Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.