Get the free Foreign currency risk management Pak Rupee PKR is the ...

Show details

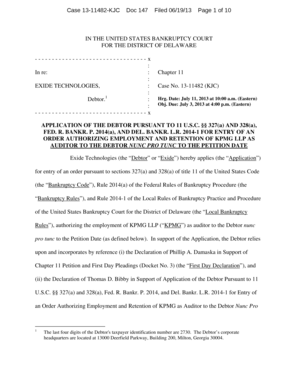

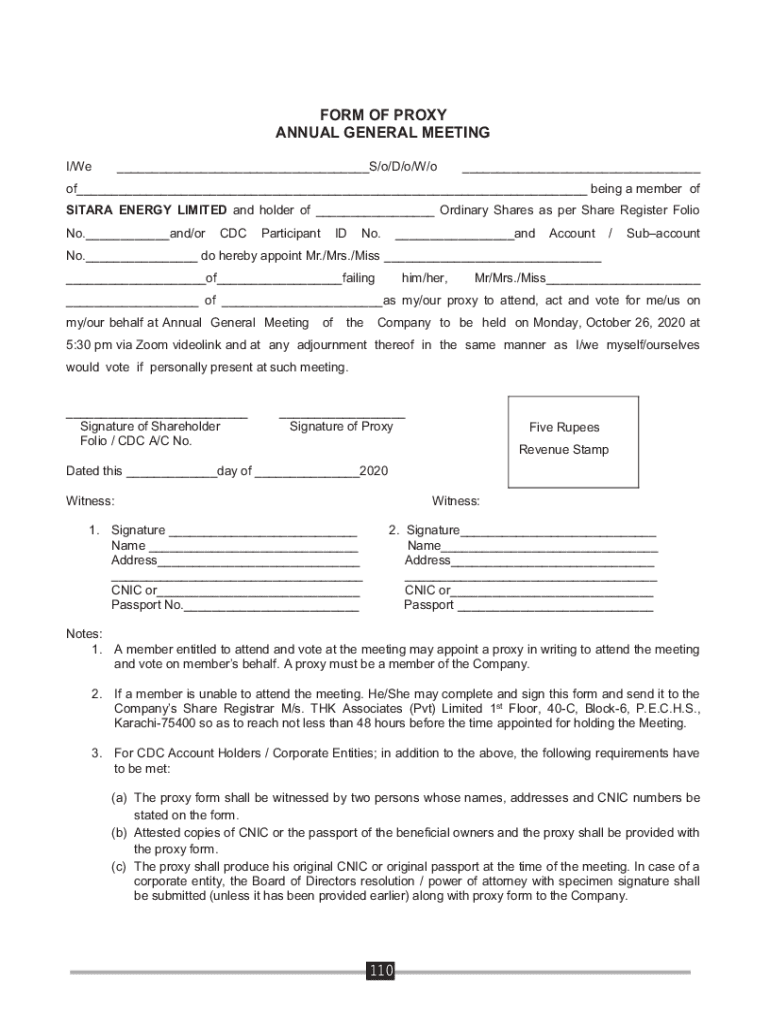

FORM OF PROXY ANNUAL GENERAL MEETING I/We S/o/D/o/W/o of being a member of SITAR ENERGY LIMITED and holder of Ordinary Shares as per Share Register Folio No. and/orCDCParticipantIDNo. Account/Subaccount.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign currency risk management

Edit your foreign currency risk management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign currency risk management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foreign currency risk management online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit foreign currency risk management. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign currency risk management

How to fill out foreign currency risk management

01

Identify your exposure to foreign currency risk by calculating the percentage of your expenses or revenues that are denominated in a foreign currency.

02

Determine your risk tolerance by assessing how much foreign currency fluctuation you can tolerate without negatively impacting your business.

03

Set specific objectives for your foreign currency risk management, such as minimizing cash flow volatility or protecting profit margins.

04

Analyze different hedging strategies, such as forward contracts, options, or currency swaps, and choose the most suitable ones for your business.

05

Implement the chosen hedging strategies by contacting a financial institution or currency broker to execute the necessary transactions.

06

Monitor and evaluate the effectiveness of your foreign currency risk management on a regular basis, making adjustments as needed to align with your objectives.

07

Stay informed about macroeconomic and geopolitical developments that can impact currency exchange rates, and adjust your risk management strategies accordingly.

Who needs foreign currency risk management?

01

Any business that has significant international transactions or operates in multiple countries with different currencies can benefit from foreign currency risk management.

02

Importers and exporters who deal with foreign suppliers or customers are particularly vulnerable to foreign currency risk and can mitigate it through risk management strategies.

03

Multinational corporations with subsidiaries in various countries need to manage foreign currency risk to ensure stability in their consolidated financial statements.

04

Investors and portfolio managers who hold assets denominated in foreign currencies can use risk management techniques to protect against unfavorable currency movements.

05

Small businesses that rely on imported goods or compete with foreign companies can also benefit from foreign currency risk management to maintain competitiveness and profitability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in foreign currency risk management without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing foreign currency risk management and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the foreign currency risk management in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your foreign currency risk management and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit foreign currency risk management on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign foreign currency risk management on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is foreign currency risk management?

Foreign currency risk management involves strategies and techniques used by businesses to protect against potential losses due to fluctuations in exchange rates.

Who is required to file foreign currency risk management?

Businesses engaged in international trade or investments are typically required to file foreign currency risk management.

How to fill out foreign currency risk management?

Foreign currency risk management forms are typically filled out by documenting foreign currency exposures, hedging strategies, and risk management policies.

What is the purpose of foreign currency risk management?

The purpose of foreign currency risk management is to mitigate risks associated with changes in foreign exchange rates that could impact a business's financial performance.

What information must be reported on foreign currency risk management?

Information such as exposure to foreign currencies, hedging instruments used, risk management processes, and the impact of exchange rate changes on financial statements must be reported on foreign currency risk management.

Fill out your foreign currency risk management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Currency Risk Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.