Get the free Collection Due Process Hearing, Form #09.026PDFTax ... - sos idaho

Show details

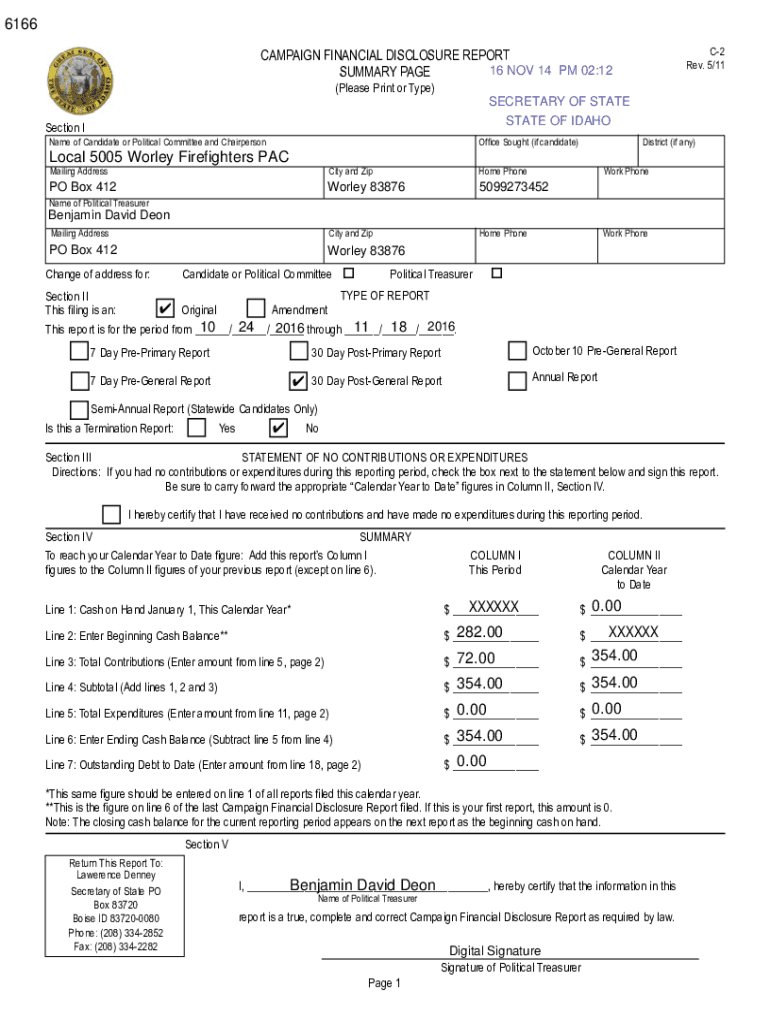

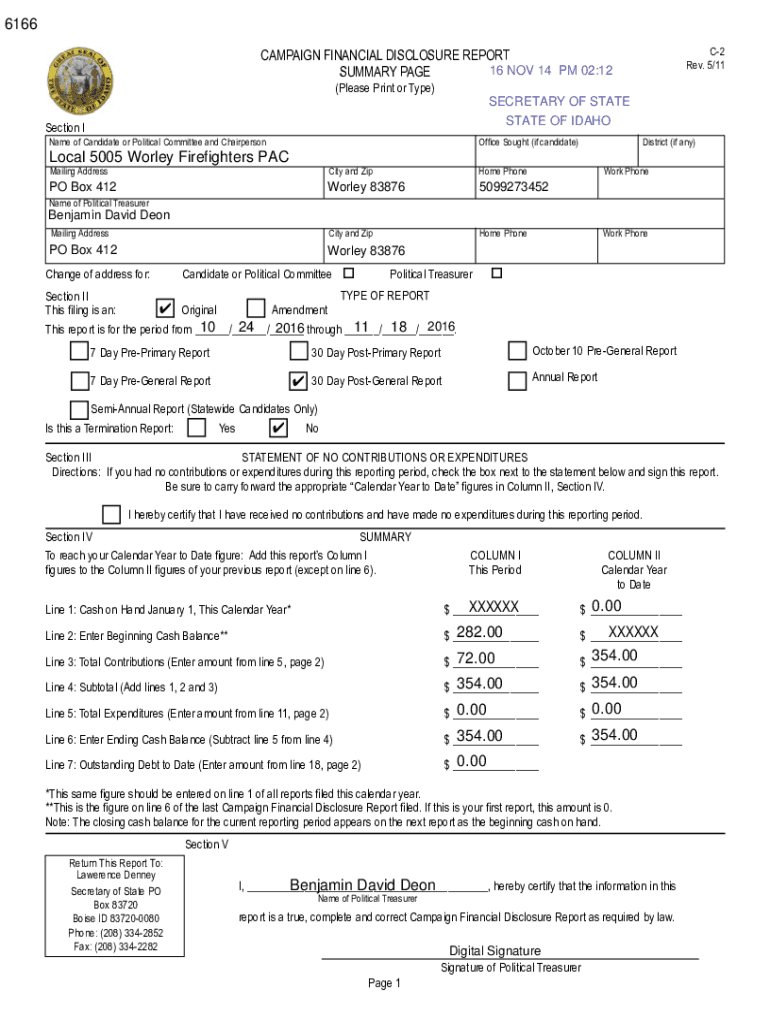

6166 C2 Rev. 5/11CAMPAIGN FINANCIAL DISCLOSURE REPORT 16 NOV 14 PM 02:12 SUMMARY PAGE (Please Print or Type) SECRETARY OF STATE OF IDAHOSection Office Sought (if candidate)Name of Candidate or Political

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign collection due process hearing

Edit your collection due process hearing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your collection due process hearing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit collection due process hearing online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit collection due process hearing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out collection due process hearing

How to fill out collection due process hearing

01

Check the deadline for filing a request for a collection due process hearing. It is usually 30 days from the date of the notice you received from the IRS.

02

Prepare a written request for a collection due process hearing. Include your name, contact information, taxpayer identification number, and the tax period at issue.

03

Clearly state your reasons for disagreeing with the IRS's collection actions and provide any supporting documentation or evidence.

04

Submit the request to the appropriate IRS office or address as indicated in the notice you received.

05

Keep a copy of your request and any supporting documents for your records.

06

Wait for a response from the IRS regarding the scheduling of your collection due process hearing.

07

Attend the hearing on the designated date and present your case to the IRS appeals officer.

08

Follow any further instructions or requests from the appeals officer in order to resolve the matter.

Who needs collection due process hearing?

01

Anyone who has received a notice from the IRS regarding their unpaid tax debt and wishes to challenge the proposed collection actions.

02

Taxpayers who believe they have valid reasons for not being able to pay their tax debt or who have evidence to support their position.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute collection due process hearing online?

pdfFiller has made it easy to fill out and sign collection due process hearing. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit collection due process hearing on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing collection due process hearing right away.

How do I complete collection due process hearing on an Android device?

Use the pdfFiller app for Android to finish your collection due process hearing. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is collection due process hearing?

Collection due process hearing is a formal review process that allows taxpayers to challenge IRS collection actions before an impartial administrative law judge.

Who is required to file collection due process hearing?

Taxpayers who receive a Notice of Intent to Levy or a Notice of Federal Tax Lien from the IRS are required to file a collection due process hearing.

How to fill out collection due process hearing?

Taxpayers can fill out the collection due process hearing by submitting Form 12153, Request for a Collection Due Process or Equivalent Hearing, to the IRS.

What is the purpose of collection due process hearing?

The purpose of collection due process hearing is to provide taxpayers with an opportunity to dispute the IRS's collection actions and explore alternative payment options.

What information must be reported on collection due process hearing?

Taxpayers must provide their basic information, details of the tax debt, reasons for disputing the IRS's collection actions, and any proposed alternative payment arrangements.

Fill out your collection due process hearing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Collection Due Process Hearing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.