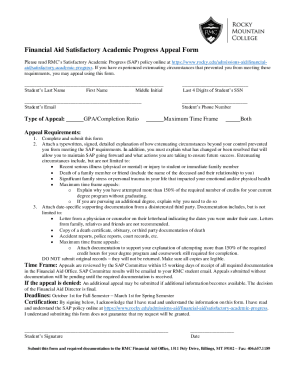

Get the free Dependent Tax and Resources Worksheet Office of Financial Aid

Show details

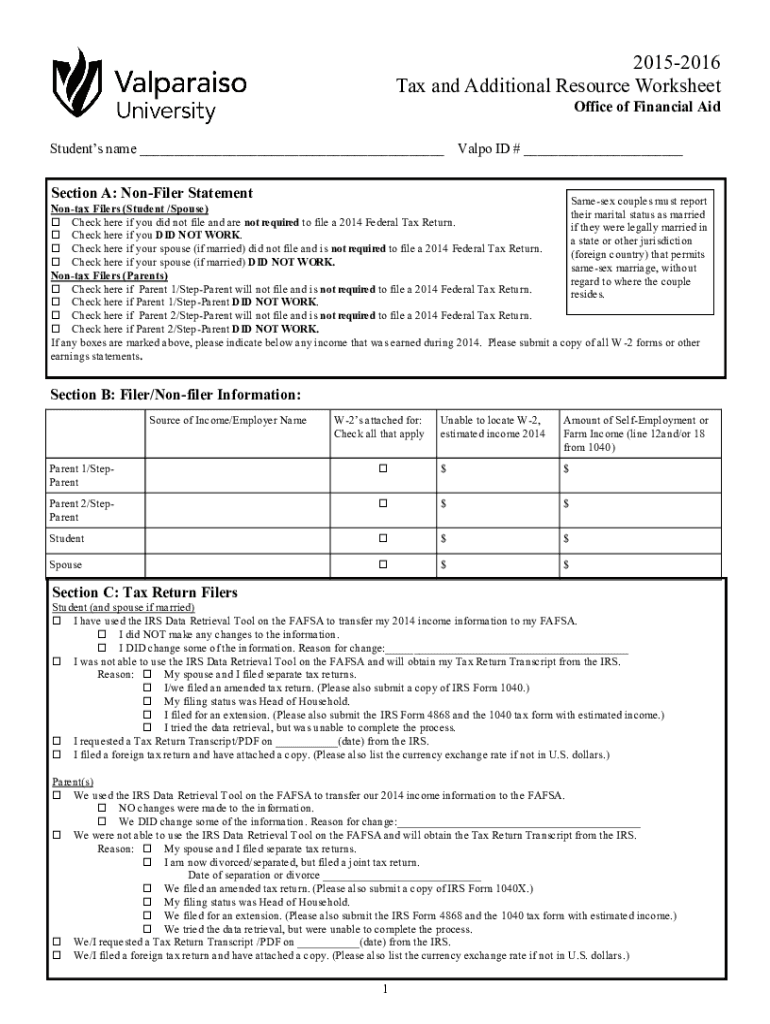

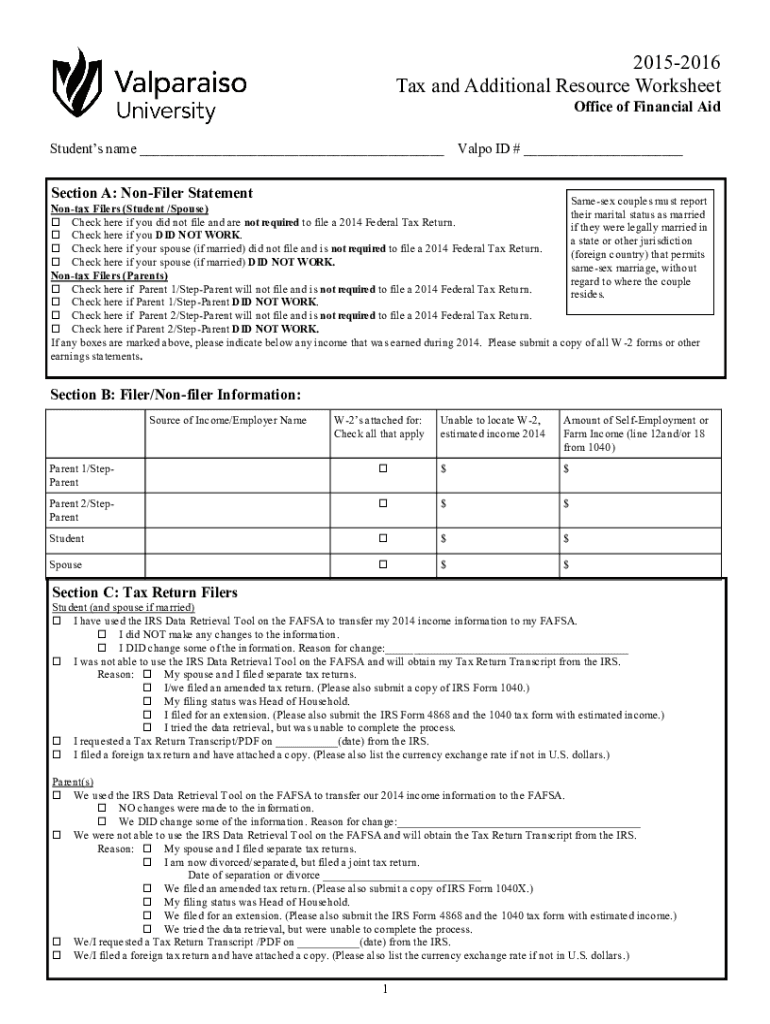

20152016 Tax and Additional Resource Worksheet Offices of Financial Aid Students name Alpo ID # Section A: Confider StatementSamesex couples must report Nontax Filers (Student /Spouse) their marital

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dependent tax and resources

Edit your dependent tax and resources form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dependent tax and resources form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dependent tax and resources online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dependent tax and resources. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dependent tax and resources

How to fill out dependent tax and resources

01

To fill out dependent tax and resources, follow these steps:

02

Determine if you are eligible to claim dependents for tax purposes. Generally, dependents can be your children, stepchildren, foster children, siblings, parents, or other relatives who rely on you for support.

03

Gather all the necessary documents related to your dependents, such as their social security numbers, dates of birth, and any applicable tax forms they may have received.

04

Determine the appropriate tax forms to use. In the United States, for example, you may need to use Form 1040 or Form 1040A, along with additional schedules and attachments for reporting dependent-related information.

05

Understand the eligibility criteria for claiming certain tax benefits related to dependents, such as the Child Tax Credit or the Child and Dependent Care Credit. Make sure you meet all the requirements to maximize your tax savings.

06

Fill out the relevant sections of the tax forms accurately and completely. Provide all necessary details about your dependents, including their names, relationships to you, and any other required information.

07

Double-check your work for accuracy and completeness. Mistakes or omissions may result in delays in processing your tax return or even trigger a tax audit.

08

Keep copies of all the documents you submit, including the filled-out tax forms, supporting documentation related to your dependents, and any correspondence with tax authorities.

09

File your tax return by the applicable deadline, making sure to include any required payments or refund claims related to your dependents.

10

Review any tax notices or notifications you receive after filing your tax return. If there are any issues or discrepancies regarding your dependents, take prompt action to resolve them with the tax authorities.

11

Consider consulting a tax professional or using tax software to ensure accurate reporting and maximize your tax benefits related to dependents.

Who needs dependent tax and resources?

01

Dependent tax and resources are typically needed by individuals or households who have dependents that rely on them for financial support. This includes but is not limited to:

02

- Parents who have children under their care

03

- Guardians or foster parents who support foster children

04

- Individuals who financially support their elderly parents or relatives

05

- People who financially support their siblings or other family members

06

- Caregivers who provide for individuals with disabilities or special needs

07

These individuals may qualify for certain tax benefits when they correctly fill out dependent tax and resources forms, potentially reducing their tax liability or increasing their tax refunds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dependent tax and resources directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your dependent tax and resources and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in dependent tax and resources?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your dependent tax and resources to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit dependent tax and resources on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as dependent tax and resources. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is dependent tax and resources?

Dependent tax and resources refers to the process of reporting and providing financial information related to dependents, such as children or family members, for taxation purposes.

Who is required to file dependent tax and resources?

Individuals who have dependents must file dependent tax and resources.

How to fill out dependent tax and resources?

Dependent tax and resources can be filled out by providing accurate and detailed financial information about the dependents, including their names, ages, and any financial support provided.

What is the purpose of dependent tax and resources?

The purpose of dependent tax and resources is to accurately report and assess the financial support provided to dependents for taxation purposes.

What information must be reported on dependent tax and resources?

Information that must be reported on dependent tax and resources includes the names and ages of dependents, as well as any financial support provided to them.

Fill out your dependent tax and resources online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dependent Tax And Resources is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.