Get the free MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT - courts state va

Show details

This document is a motion and notice regarding a proposed income deduction order for support payments in the Commonwealth of Virginia, including requests for income deductions from the respondent's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motion and notice of

Edit your motion and notice of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motion and notice of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motion and notice of online

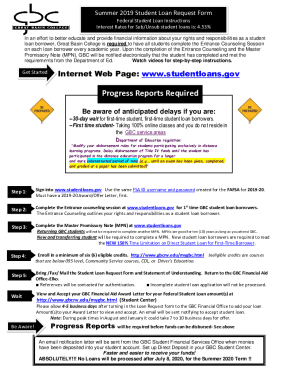

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit motion and notice of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motion and notice of

How to fill out MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT

01

Begin by obtaining the official form for the Motion and Notice of Proposed Income Deduction Order for Support.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the name and contact information of the other party involved in the support order.

04

Specify the type of support being requested, such as child support or spousal support.

05

Clearly state the reasons for the income deduction and the amount requested.

06

Include any relevant case numbers or identifiers related to the support order.

07

Ensure you follow any jurisdiction-specific instructions for the form, including specific wording or additional necessary documents.

08

Sign and date the form in the designated areas to validate the motion.

09

Make copies of the completed form for your records and for serving to the other party.

10

File the form with the appropriate court, following local filing rules and procedures.

Who needs MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT?

01

Individuals who are receiving court-ordered support payments and require a reliable method to ensure payment collection.

02

Persons obligated to pay support and who wish to formalize the income deduction process to avoid future payment issues.

03

Custodial or non-custodial parents seeking to establish or enforce child support obligations.

Fill

form

: Try Risk Free

People Also Ask about

Why did I get an earnings withholding order?

An earnings withholding order is a court-ordered legal document. It requires an employer to withhold up to 25 percent of an employee's wages. This money is paid to a creditor until the employee pays off their debt. A creditor is a person or business that is owed money.

What is an income withholding order?

Income withholding is a deduction of a payment for child support from a parent's income. This order can be from a court or administratively ordered by a child support agency.

What is an order for income deduction?

What Is an Income Deduction Order? Similar to a wage garnishment order, an income deduction order requires your employer to withhold a certain amount of money from your wages to satisfy your financial obligations.

What is the difference between a garnishment and a deduction?

Paycheck deductions are amounts withheld from an employee's pay. This includes things like approved pension contributions and health care expenses. Wage garnishment laws allow a creditor who obtains a court order to require your employer to set aside part of your paycheck and send this directly to your creditor.

What is income order?

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT?

The MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT is a legal document filed in court that requests the court to issue an order deducting a specified amount from a person's income to fulfill child support or spousal support obligations.

Who is required to file MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT?

Typically, the person receiving support payments, such as a custodial parent or spouse, is required to file this document if they wish to initiate direct income deductions from the payer's wages.

How to fill out MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT?

To fill out this form, individuals must provide relevant information including the names and addresses of both parties, the amount to be deducted, and any existing orders of support. It's important to follow the specific instructions provided by the court.

What is the purpose of MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT?

The purpose of this document is to facilitate the collection of support payments by allowing for a portion of the obligated payer's income to be automatically deducted and sent to the recipient, ensuring timely payment of support obligations.

What information must be reported on MOTION AND NOTICE OF PROPOSED INCOME DEDUCTION ORDER FOR SUPPORT?

The information that must be reported includes the names and addresses of the parties involved, the amount of support owed, the payer's employer information, and any existing support obligations or orders.

Fill out your motion and notice of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motion And Notice Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.