IRS 1120-POL 2021 free printable template

Show details

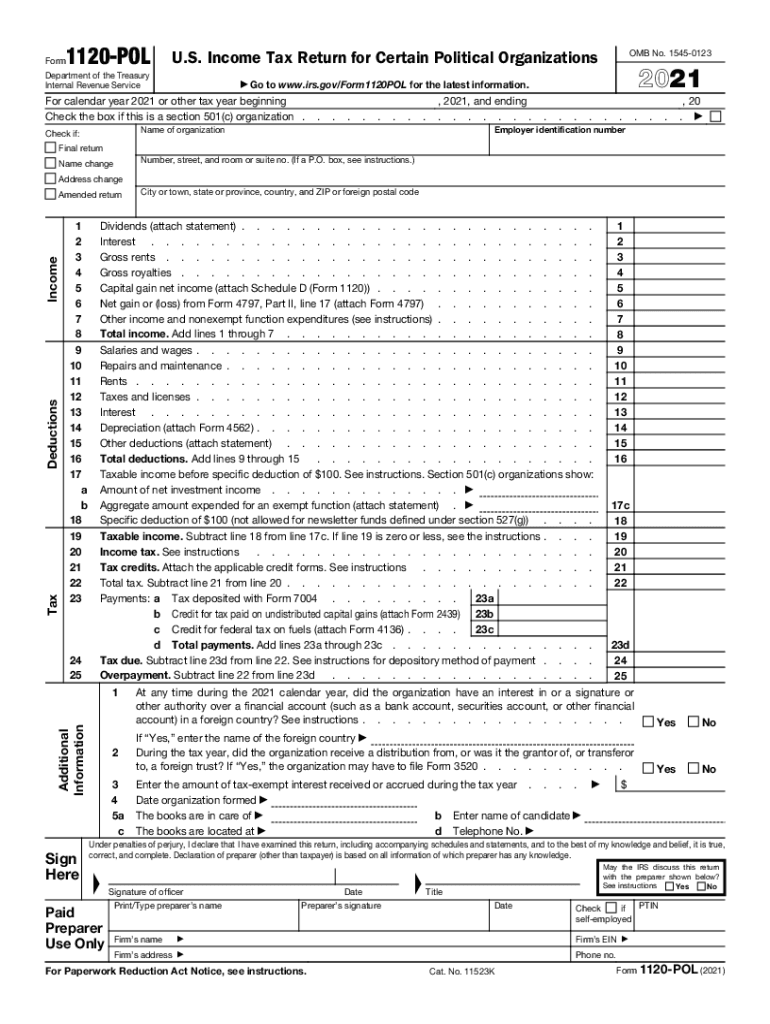

For the latest information about developments related to Form 1120-POL such as legislation enacted after it was published go to What s New 21 tax rate. P. L. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate effective for tax years beginning after 2017. Phone Help If you have questions and/or need help completing Form 1120-POL please call 877-829-5500. Section 951A is effective for tax years of foreign corporations beginning after 2017 and to tax years of...U.S. shareholders in which or with which such tax years of foreign Shareholder Calculation of Global Intangible Low-Taxed Income GILTI to figure the domestic corporation s GILTI and attach it to Form 1120-POL. See section 951A for more information. Form 8994 Employer Credit for Paid Family and Medical Leave. Form 8994 can be filed with Form 1120-POL. This is a new general business credit explained in P. L. 115-97 section 13403. Complete every applicable entry space on Form 1120-POL. Do not write...See attached instead of completing the entry spaces. Cat. No. 11523K Form 1120-POL 2018 Page 2 Section references are to the Internal Revenue Code unless otherwise noted. Future developments. File Form 1120-POL with the Ogden UT 84201 office or agency is located in a foreign country or a U.S. possession the address for mailing their return should be P. This toll-free telephone service is available Monday through Friday. Who Must File tax exempt must file Form 1120-POL if it has any political...organization taxable income. 2018 and ending. Employer identification number Name of organization Check if OMB No* 1545-0123 Final return Number street and room or suite no. If a P. O. box see instructions. Name change Address change Deductions Income Amended return Tax a b Dividends attach statement. Other income and nonexempt function expenditures see instructions. Total income. Add lines 1 through 7. Salaries and wages. Repairs and maintenance. Rents. Taxes and licenses. Depreciation attach...Form 4562. Other deductions attach statement. Total deductions. Add lines 9 through 15. Taxable income before specific deduction of 100. See instructions. Section 501 c organizations show Amount of net investment income. Aggregate amount expended for an exempt function attach statement. Specific deduction of 100 not allowed for newsletter funds defined under section 527 g. Income tax. See instructions Tax credits. Attach the applicable credit forms. See instructions Total tax. Subtract line 21...from line 20. Payments a Tax deposited with Form 7004. 23a b Credit for tax paid on undistributed capital gains attach Form 2439 23b c Credit for federal tax on fuels attach Form 4136. 23c d Total payments. Add lines 23a through 23c. Tax due. Subtract line 23d from line 22. See instructions for depository method of payment. Overpayment. Subtract line 22 from line 23d Additional Information 5a c 17c 23d At any time during the 2018 calendar year did the organization have an interest in or a...signature or other authority over a financial account such as a bank account securities account or other financial account in a foreign country See instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-POL

How to edit IRS 1120-POL

How to fill out IRS 1120-POL

Instructions and Help about IRS 1120-POL

How to edit IRS 1120-POL

Editing IRS 1120-POL can be necessary to correct errors prior to submission. Use a reliable PDF editor like pdfFiller to make adjustments to the form. Upload the form, make the necessary changes, and save the updated version for filing.

How to fill out IRS 1120-POL

Filling out IRS 1120-POL requires accurate input of information regarding a political organization’s taxable income. Gather relevant financial details, then follow these steps:

01

Provide the organization’s name, address, and Employer Identification Number (EIN).

02

Document income earned, including contributions and other revenue sources.

03

Enter allowable deductions such as operational expenses.

04

Calculate the tax owed based on taxable income.

05

Sign and date the form to affirm accuracy and compliance.

About IRS 1120-POL 2021 previous version

What is IRS 1120-POL?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-POL 2021 previous version

What is IRS 1120-POL?

IRS 1120-POL is a tax form used by political organizations to report income and calculate taxes owed on that income. It specifically caters to organizations that are classified under 527 of the Internal Revenue Code.

What is the purpose of this form?

The primary purpose of IRS 1120-POL is to ensure that political organizations report their income accurately and pay any taxes due. This form helps the IRS monitor compliance with tax regulations pertaining to political entities.

Who needs the form?

Political organizations whose net taxable income exceeds $100 must file the IRS 1120-POL. These organizations include those primarily involved in political activities, fundraising, and advocacy.

When am I exempt from filling out this form?

Organizations that do not meet the income threshold or maintain tax-exempt status under section 501(c)(3) of the Internal Revenue Code typically do not need to file this form. Additionally, if no taxable income is generated, exemption applies.

Components of the form

The IRS 1120-POL includes several key components such as identifying information about the organization, income and deduction lines, and the tax computation section. Each area requires specific financial data to ensure accurate reporting.

What are the penalties for not issuing the form?

Failure to file IRS 1120-POL can result in penalties. The IRS may impose fines based on the amount of unpaid taxes or a minimum penalty for late filing. Organizations risk losing their political organization status, which can impact fundraising and advocacy activities.

What information do you need when you file the form?

When filing IRS 1120-POL, organizations need the following information:

01

Organization's full legal name and EIN.

02

Gross income details including all sources of revenue.

03

Specific expenses incurred during the tax year.

04

Calculations for tax owed.

05

Signatures of individuals authorized to represent the organization.

Is the form accompanied by other forms?

IRS 1120-POL may accompany other forms depending on the organization’s activities. For instance, supporting schedules may be required to detail contributions and expenses further, ensuring complete financial transparency.

Where do I send the form?

The completed IRS 1120-POL form should be mailed to the address specified in the form instructions. Ensure you check for any updates on mailing addresses that may change periodically.

See what our users say