Get the free Tax Management System RFP

Show details

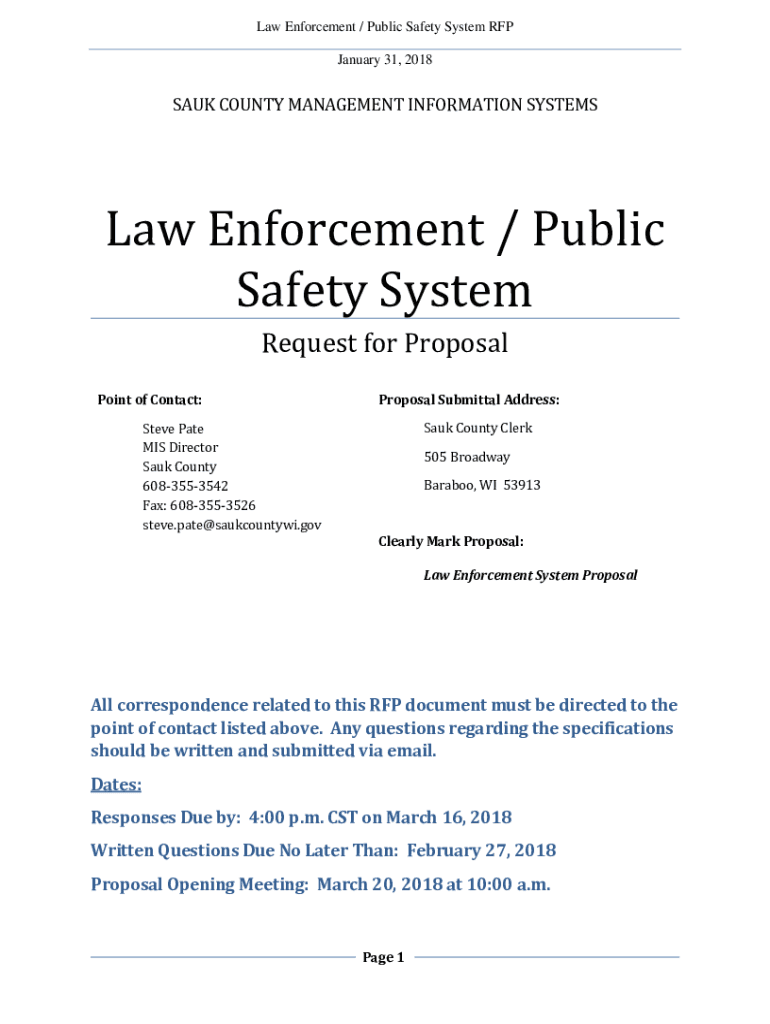

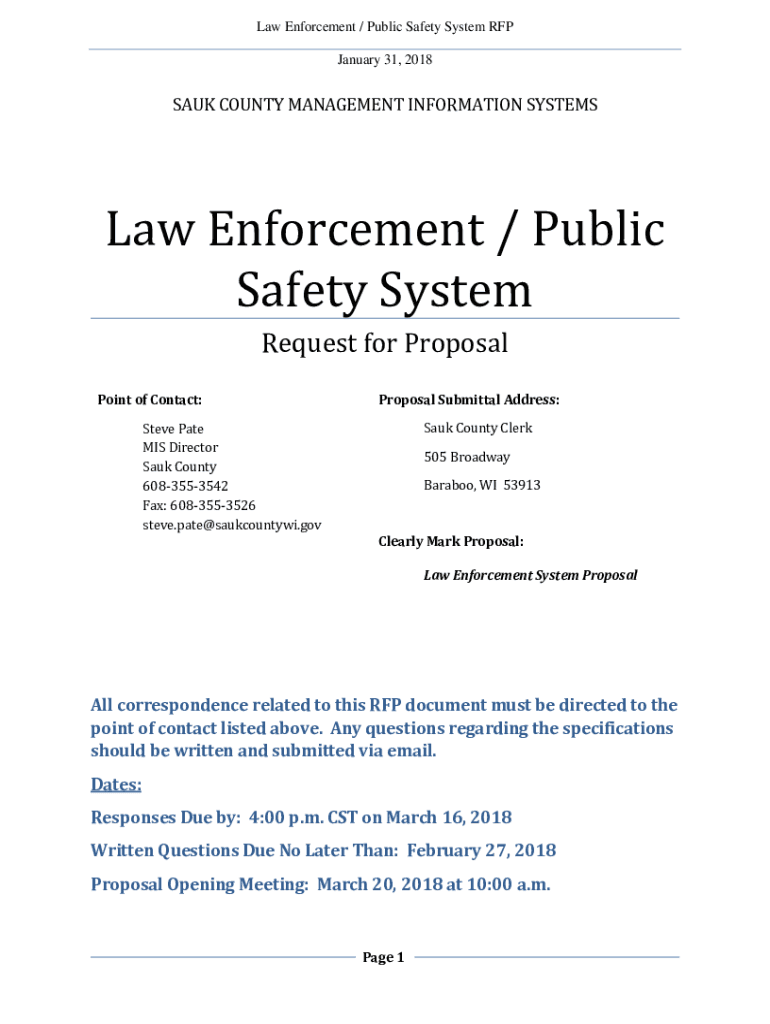

Law Enforcement / Public Safety System RFP January 31, 2018SAUK COUNTY MANAGEMENT INFORMATION Systems Enforcement / Public Safety System Request for Proposal Point of Contact:Proposal Submittal Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax management system rfp

Edit your tax management system rfp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax management system rfp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax management system rfp online

To use the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax management system rfp. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax management system rfp

How to fill out tax management system rfp

01

To fill out a tax management system RFP, follow these steps:

02

Begin by gathering all the necessary information about your current tax management needs and requirements.

03

Research and identify potential vendors or software solutions that offer tax management systems.

04

Create a detailed request for proposal (RFP) document outlining your specific requirements, including functionality, integration capabilities, reporting features, and any other important factors.

05

Clearly define the timeline and deadlines for the RFP submission and vendor selection process.

06

Reach out to the identified vendors to request their participation in the RFP process.

07

Review and compare the proposals received from different vendors, considering factors such as cost, functionality, scalability, customer support, and implementation process.

08

Evaluate the vendors based on their experience, reputation, and ability to meet your specific tax management needs.

09

Conduct demonstrations or presentations with shortlisted vendors to gain a better understanding of their system's capabilities.

10

Seek references from the vendors and contact their existing clients to gather feedback and insights about their tax management system.

11

Make a final decision and select the vendor that best meets your requirements and offers the most value for your investment.

12

Communicate the decision to the selected vendor and initiate the contract negotiation and implementation process.

Who needs tax management system rfp?

01

Tax management system RFP is needed by organizations and businesses that are looking to upgrade or implement a tax management system.

02

This can include companies of all sizes, ranging from small startups to large enterprises, as well as accounting firms and tax consultants who provide tax-related services.

03

Government agencies and non-profit organizations that deal with tax management and compliance also benefit from having a tax management system RFP to ensure they choose the right solution for their needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax management system rfp in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign tax management system rfp and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the tax management system rfp electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tax management system rfp in minutes.

How do I complete tax management system rfp on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your tax management system rfp. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is tax management system rfp?

Tax management system RFP is a request for proposal that outlines the requirements and needs for a tax management system.

Who is required to file tax management system rfp?

Government agencies and organizations looking to implement or upgrade their tax management system are required to file the RFP.

How to fill out tax management system rfp?

Fill out the tax management system RFP by providing information about your organization, detailing the requirements for the system, and specifying any budget constraints.

What is the purpose of tax management system rfp?

The purpose of tax management system RFP is to solicit proposals from vendors who can provide a system that meets the needs of the organization.

What information must be reported on tax management system rfp?

Information such as organization details, system requirements, budget, timeline, and evaluation criteria must be reported on the tax management system RFP.

Fill out your tax management system rfp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Management System Rfp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.