Get the free State budget balancing strategies: COVID19 and the Great ...

Show details

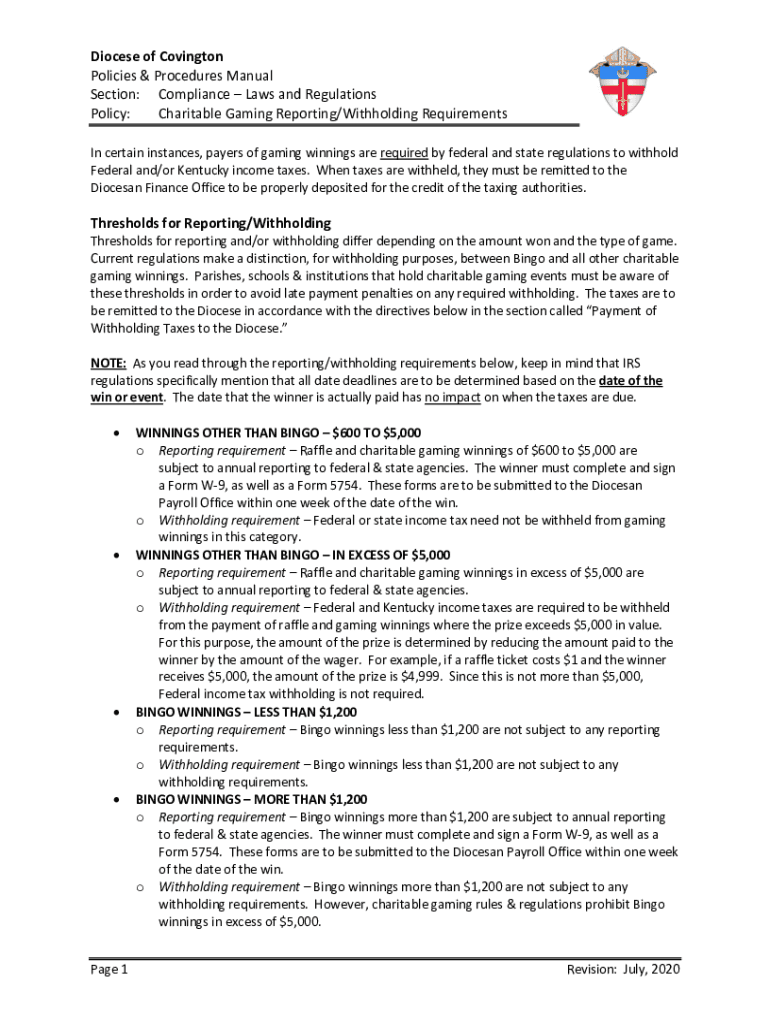

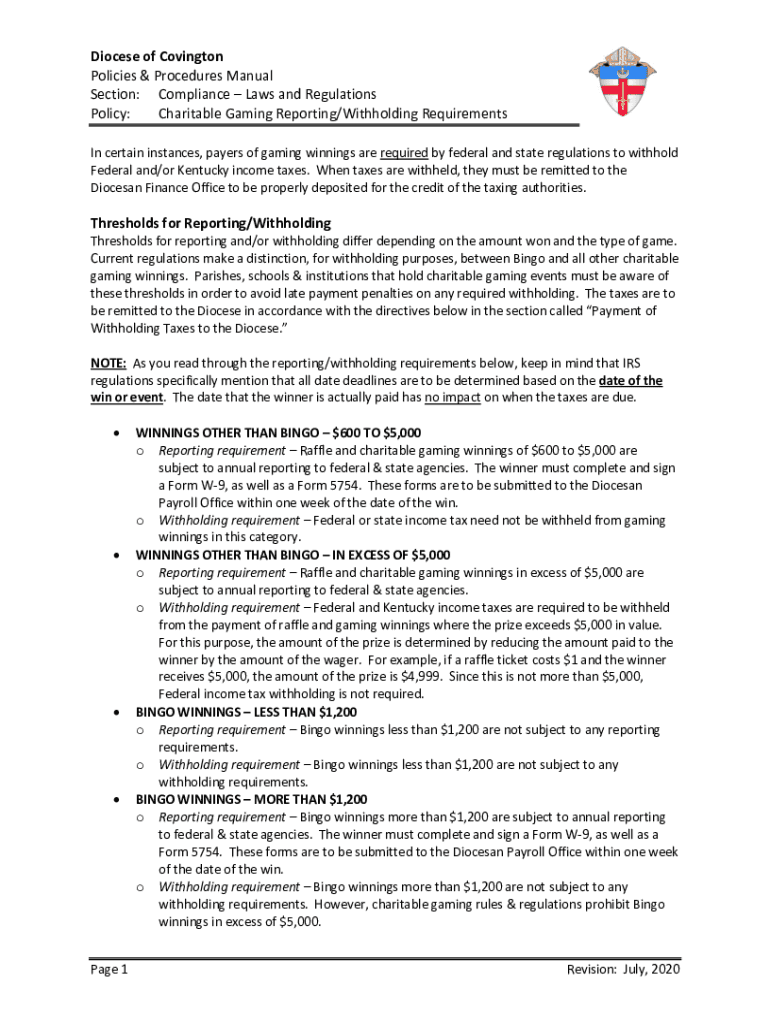

Diocese of Covington Policies & Procedures Manual Section: Compliance Laws and Regulations Policy: Charitable Gaming Reporting/Withholding Requirements In certain instances, payers of gaming winnings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state budget balancing strategies

Edit your state budget balancing strategies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state budget balancing strategies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state budget balancing strategies online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit state budget balancing strategies. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state budget balancing strategies

How to fill out state budget balancing strategies

01

Identify all sources of revenue for the state budget, including taxes, fees, and other income.

02

Calculate the total amount of revenue expected to be collected for the upcoming period.

03

Analyze the current state expenditures and categorize them into different areas such as education, healthcare, infrastructure, etc.

04

Evaluate the effectiveness and necessity of each expenditure category to determine potential areas for reduction or reallocation.

05

Prioritize essential expenditure categories and identify areas where budget cuts can be made without significantly impacting services.

06

Explore options for increasing revenue, such as introducing new taxes or revising current tax policies.

07

Estimate the potential impact of each revenue-increasing measure and assess its feasibility and public acceptance.

08

Develop a comprehensive plan for balancing the state budget, taking into account both expenditure reductions and revenue increases.

09

Implement the budget balancing strategies and closely monitor their progress and impact on the state's financial stability.

10

Periodically review and adjust the budget balancing strategies to ensure continued effectiveness and adaptability to changing economic conditions.

Who needs state budget balancing strategies?

01

State governments and their financial departments need state budget balancing strategies.

02

Economists and financial experts who provide advisory services to state governments.

03

Citizens and taxpayers who are concerned about the financial stability and sustainability of their state.

04

Public officials responsible for managing and overseeing the state budget.

05

Policy makers and lawmakers who play a role in shaping state fiscal policies.

06

Investors and creditors who monitor the financial health of states before making investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute state budget balancing strategies online?

Completing and signing state budget balancing strategies online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit state budget balancing strategies on an Android device?

With the pdfFiller Android app, you can edit, sign, and share state budget balancing strategies on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out state budget balancing strategies on an Android device?

On an Android device, use the pdfFiller mobile app to finish your state budget balancing strategies. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is state budget balancing strategies?

State budget balancing strategies are plans or approaches implemented to ensure that a state's budget remains in equilibrium, with revenues matching expenses.

Who is required to file state budget balancing strategies?

State government officials, such as governors, finance directors, or budget analysts, are typically responsible for preparing and filing state budget balancing strategies.

How to fill out state budget balancing strategies?

State budget balancing strategies are typically filled out by analyzing revenue sources, identifying expenditure needs, and proposing adjustments to balance the budget.

What is the purpose of state budget balancing strategies?

The purpose of state budget balancing strategies is to maintain fiscal responsibility, avoid deficits, and ensure that the state can fund necessary programs and services.

What information must be reported on state budget balancing strategies?

State budget balancing strategies may include revenue projections, expenditure forecasts, cost-saving measures, and any proposed budget cuts or revenue increases.

Fill out your state budget balancing strategies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Budget Balancing Strategies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.