Get the free NRI Taxation - Chetan R. Vora & Associates - international ufp

Show details

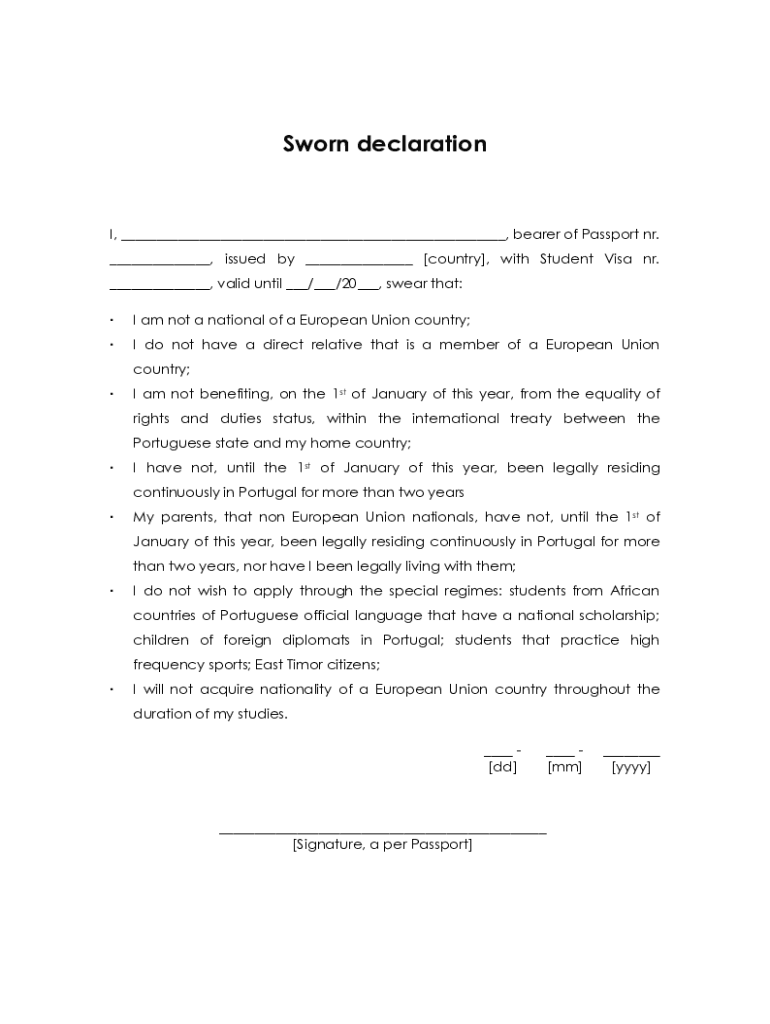

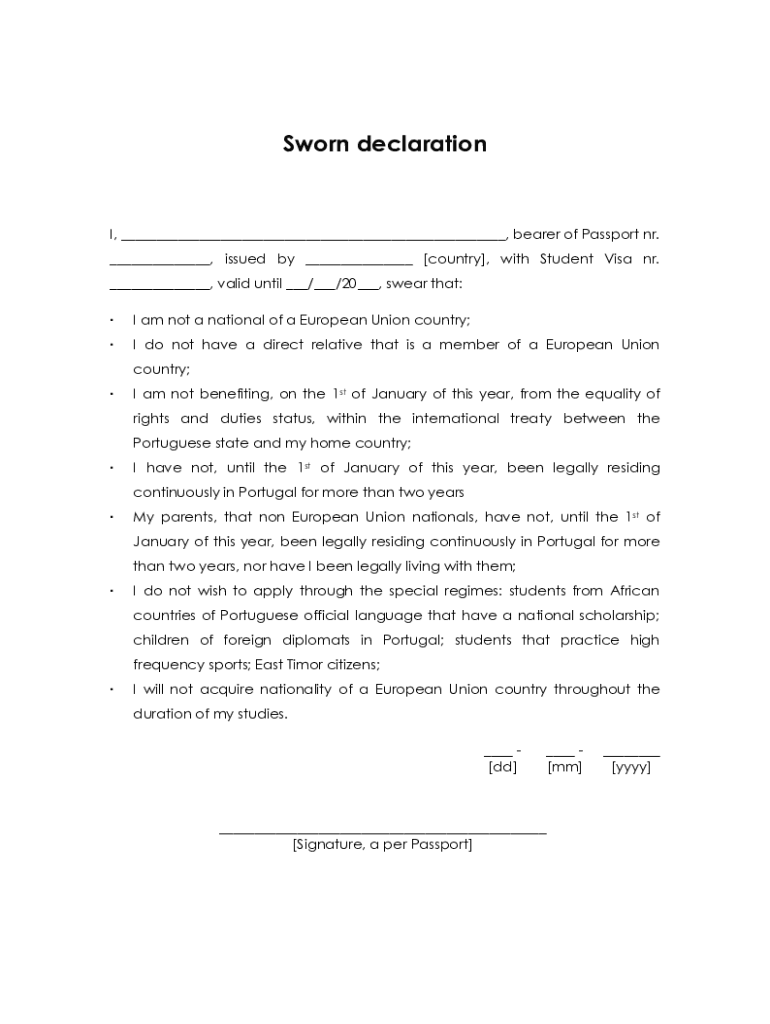

Sworn declaration, bearer of Passport NR. , issued by country, with Student Visa NR. , valid until / /20, swear that: I am not a national of a European Union country;I do not have a direct relative

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nri taxation - chetan

Edit your nri taxation - chetan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nri taxation - chetan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nri taxation - chetan online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nri taxation - chetan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nri taxation - chetan

How to fill out nri taxation - chetan

01

To fill out NRI taxation, follow these steps:

02

Determine your tax residency status: As an NRI, you may be considered a resident or non-resident for tax purposes. Assess your residential status based on the number of days you have spent in India during the financial year.

03

Collect necessary documents: Gather all the relevant documents such as Form 16, Form 26AS, bank statements, investment details, and any other income-related documents.

04

Calculate your taxable income: Calculate your total income earned in India including salary, rental income, capital gains, and other sources. Deduct eligible exemptions, deductions, and allowances to arrive at your taxable income.

05

Determine your tax liability: Use the appropriate income tax slab rates and calculate your tax liability. Consider any applicable Double Taxation Avoidance Agreement (DTAA) to mitigate tax liabilities arising from international income.

06

File income tax return: Fill out the prescribed ITR form for NRI taxpayers, such as ITR-2, ITR-3, or ITR-6, depending on your income sources and business activities. Provide accurate and complete information, ensuring all income, assets, and liabilities are disclosed.

07

Pay any outstanding taxes: If you have any outstanding tax dues, pay them using the appropriate tax payment methods like online banking or demand drafts.

08

Verify and submit your return: Before submitting your return, review all the information provided and cross-verify it for accuracy. Once satisfied, submit your return using your registered account on the Income Tax Department's e-Filing portal.

09

Keep records and respond to notices: Maintain a copy of your filed return along with all supporting documents. In case you receive any tax notices or communication from the Income Tax Department, respond promptly and provide the necessary information.

10

Seek professional assistance if required: If you are uncertain about any aspect of NRI taxation or need personalized advice, consider consulting a tax professional or chartered accountant specializing in NRI taxation.

11

Note: The above steps are general guidelines and may vary depending on individual circumstances. It is advisable to consult a professional tax advisor for specific advice related to your NRI taxation obligations.

Who needs nri taxation - chetan?

01

NRI taxation is relevant for individuals who fall under the category of Non-Resident Indians (NRIs). Some typical scenarios where NRI taxation applies include:

02

- Indian citizens working abroad for extended periods

03

- Individuals who have moved abroad for employment, business, or education purposes

04

- NRIs earning income in India through investments, rental properties, or any other sources

05

- Individuals with financial assets or bank accounts in India

06

- Individuals planning to file income tax returns in India due to their income or assets being subject to Indian tax laws.

07

It is important for NRIs to fulfill their taxation obligations in order to comply with Indian tax laws and avoid any penalties or legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the nri taxation - chetan electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your nri taxation - chetan in minutes.

How can I edit nri taxation - chetan on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing nri taxation - chetan right away.

Can I edit nri taxation - chetan on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign nri taxation - chetan on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is nri taxation - chetan?

NRI taxation refers to the tax regulations imposed on individuals who are classified as Non-Resident Indians (NRI) by the Indian government.

Who is required to file nri taxation - chetan?

Any individual who is classified as a Non-Resident Indian (NRI) and has taxable income in India is required to file NRI taxation.

How to fill out nri taxation - chetan?

NRI taxation can be filled out by submitting the relevant forms and documents to the Indian tax authorities through online or offline channels.

What is the purpose of nri taxation - chetan?

The purpose of NRI taxation is to ensure that Non-Resident Indians (NRIs) pay taxes on their income earned in India and comply with the Indian tax laws.

What information must be reported on nri taxation - chetan?

Information such as income earned in India, foreign income, assets held in India, tax deductions, and exemptions must be reported on NRI taxation.

Fill out your nri taxation - chetan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nri Taxation - Chetan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.