Get the free Small Business Relief Program Application City of Irondale, Alabama

Show details

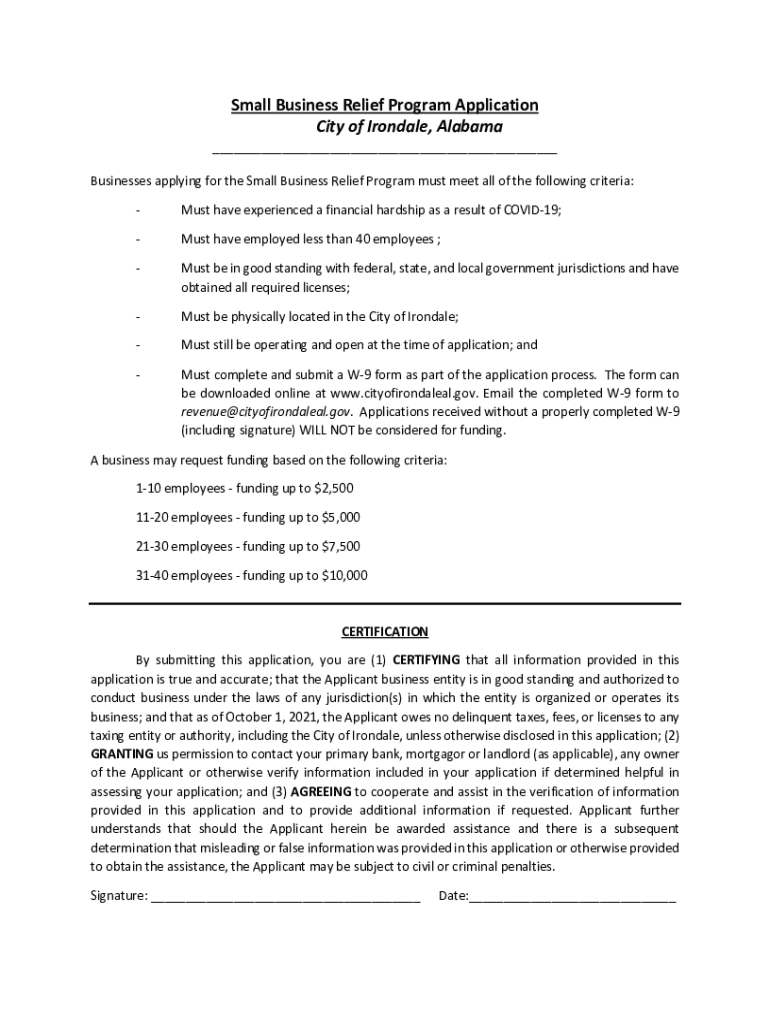

Small Business Relief Program Application City of Iron dale, Alabama Businesses applying for the Small Business Relief Program must meet all the following criteria: Must have experienced a financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business relief program

Edit your small business relief program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business relief program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business relief program online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small business relief program. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business relief program

How to fill out small business relief program

01

Start by gathering all necessary financial documentation, such as income statements, balance sheets, and tax returns.

02

Research different small business relief programs available in your area and select the one that best suits your needs.

03

Download the application form from the program's official website or obtain it from the relevant government agency.

04

Carefully read the instructions provided with the application form to understand the eligibility criteria and required supporting documents.

05

Fill out the application form accurately and ensure that all required fields are completed.

06

Attach the necessary financial documentation and any additional supporting documents as specified in the application instructions.

07

Double-check the completed application form and supporting documents for any errors or missing information.

08

Submit the application form and supporting documents through the designated submission method, such as online submission or mailing it to the relevant office.

09

Keep a copy of the submitted application form and supporting documents for your records.

10

Follow up on the status of your application by contacting the program's official contact person or helpline.

11

If your application is approved, ensure that you understand the terms and conditions of the relief program and comply with any reporting or other requirements.

12

If your application is not approved, consider seeking assistance from other available small business relief programs or explore alternative options to support your business.

Who needs small business relief program?

01

Small business owners who have been adversely affected by economic challenges, such as a downturn in sales, disruptions in supply chains, mandatory shutdowns, or reduced customer demand.

02

Businesses experiencing financial distress, such as mounting debt, difficulty in meeting payroll or rent obligations, or the risk of bankruptcy.

03

Start-ups or new businesses that have not yet generated sufficient revenue to sustain their operations.

04

Businesses in industries heavily impacted by the current economic climate, such as hospitality, travel, retail, or entertainment.

05

Minority-owned or disadvantaged businesses that face unique obstacles and disproportionately bear the economic impact of crises.

06

Self-employed individuals or freelancers who rely on their business income for livelihood.

07

Small businesses that do not qualify for traditional financing options or have limited access to credit.

08

Small business owners who require financial assistance to cover operating costs, retain employees, or pivot their business model to adapt to changing market conditions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find small business relief program?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the small business relief program in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the small business relief program in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your small business relief program and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out small business relief program using my mobile device?

Use the pdfFiller mobile app to fill out and sign small business relief program on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is small business relief program?

The small business relief program is a government initiative designed to provide financial assistance and support to small businesses facing economic hardship.

Who is required to file small business relief program?

Small businesses meeting certain criteria such as revenue threshold and employee count are required to file for the small business relief program.

How to fill out small business relief program?

To fill out the small business relief program, businesses need to provide detailed information about their financial situation, impact of COVID-19, and any other relevant data requested in the application form.

What is the purpose of small business relief program?

The purpose of the small business relief program is to help struggling small businesses stay afloat during challenging times by offering financial aid and resources.

What information must be reported on small business relief program?

Businesses are required to report their revenue, expenses, number of employees, impact of COVID-19 on their operations, and any other relevant financial information.

Fill out your small business relief program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Relief Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.