CT DRS CT-706 NT 2021 free printable template

Show details

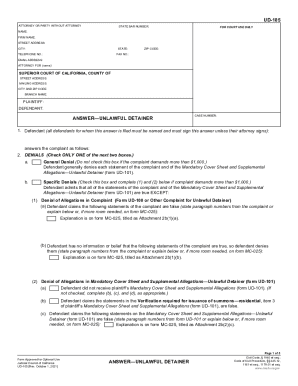

Reset Footprint Form Save Formerly Only With Probate Courtroom CT706 State of Connecticut(Rev. 06/21)Connecticut Estate Tax Return (for Nontaxable Estates)For estates of decedents dying during calendar

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT DRS CT-706 NT

Edit your CT DRS CT-706 NT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CT-706 NT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CT-706 NT online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CT DRS CT-706 NT. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-706 NT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CT DRS CT-706 NT

How to fill out CT DRS CT-706 NT

01

Gather the necessary documentation, including details of the estate and beneficiaries.

02

Obtain the CT DRS CT-706 NT form from the Connecticut Department of Revenue Services website.

03

Fill out your name and the decedent's information in the appropriate sections.

04

List all assets and liabilities of the estate in the corresponding sections of the form.

05

Calculate the total value of the estate and any applicable exemptions.

06

Complete the signature section, ensuring it is signed and dated.

07

Submit the completed form to the Connecticut Department of Revenue Services by the due date.

Who needs CT DRS CT-706 NT?

01

Individuals who are settling an estate that meets the requirements for non-taxable estates in Connecticut.

02

Executors or administrators of estates where the value is below the estate tax threshold.

03

Beneficiaries or heirs of estates requiring formal documentation for the distribution of assets.

Fill

form

: Try Risk Free

People Also Ask about

How to file CT state taxes for free?

VITA. Visit Connecticut's 2-1-1 website and 'Free Tax Help' for updates, including Virtual VITA. Federal and State Tax Assistance: The Volunteer Income Tax Assistance (VITA) Program offers free tax help for low-to moderate-income (under $58,000) people who cannot prepare their own tax returns.

How do you fill out a tax return?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

How do I file a tax return in Canada?

Ways to do your taxes NETFILE-certified tax software (electronic filing) Through a tax preparer using EFILE-certified tax software (electronic filing) Community volunteer tax clinic. Paper tax return. File my Return - Automated phone line (by invitation only)

How does CT income tax work?

Connecticut has a graduated individual income tax, with rates ranging from 3.00 percent to 6.99 percent. Connecticut also has a 7.50 percent corporate income tax rate. Connecticut has a 6.35 percent state sales tax rate and levies no local sales taxes.

How do I file CT sales tax?

You have two options for filing and paying your Connecticut sales tax: File online File online at the Connecticut Department of Revenue Services. You can remit your payment through their online system. AutoFile – Let TaxJar file your sales tax for you. We take care of the payments, too.

How can I fill my own Income Tax Return?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit CT DRS CT-706 NT from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your CT DRS CT-706 NT into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the CT DRS CT-706 NT in Gmail?

Create your eSignature using pdfFiller and then eSign your CT DRS CT-706 NT immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out CT DRS CT-706 NT using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign CT DRS CT-706 NT and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

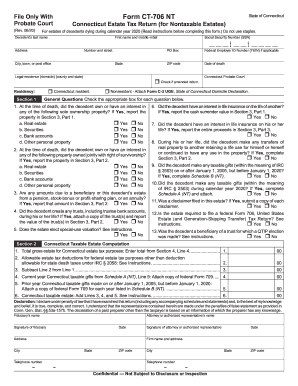

What is CT DRS CT-706 NT?

CT DRS CT-706 NT is a form used in the state of Connecticut for reporting the estate tax liability of individuals who have passed away. It is specifically designated for estates that are not required to file a full estate tax return.

Who is required to file CT DRS CT-706 NT?

Individuals whose estates have a gross value below the Connecticut estate tax exemption threshold are required to file the CT DRS CT-706 NT to claim an exemption from the estate tax.

How to fill out CT DRS CT-706 NT?

To fill out CT DRS CT-706 NT, the filer must provide relevant information about the deceased individual’s estate, including details about assets, liabilities, and any deductions. The form must be completed in accordance with the instructions provided by the Connecticut Department of Revenue Services.

What is the purpose of CT DRS CT-706 NT?

The purpose of CT DRS CT-706 NT is to serve as a simplified form for reporting and resolving estate tax obligations for estates that do not exceed the filing threshold, streamlining the process for eligible taxpayers.

What information must be reported on CT DRS CT-706 NT?

CT DRS CT-706 NT must report information such as the deceased individual's name, date of death, details of the estate’s assets, liabilities, and any deductions sought, along with signatures of the executor or other authorized individuals.

Fill out your CT DRS CT-706 NT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CT-706 NT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.