File date is as of August 31, 2007.

We have no correspondence with you

You have mailed the following

Please note that the deadline for filing is 10:00 p.m. on the last business day of each month for those filers who do not itemize deductions. File the return by 10:00 p.m.

If you have filed a return, but are unable to make corrections to address on the tax return, so your return is filed timely, contact the Connecticut Department of Financial Services at.

You are required to file a return if one of the following applies:

You were named as a dependent for your spouse or former spouse

You were named as a dependent for a child

You have a disabled child

You are claiming a veteran's spousal exemption because you are a member of the U.S. Armed Forces or National Guard.

If you were required to file a return, you must file a return for each year for which you owe the taxes. You are not relieved of those financial obligations because you filed a return.

If you filed a return, but the return was not properly filed due to failure to follow filing requirements in this manual, you must file a corrected return and pay the taxes that are due.

If it appears on the form that your return is complete for any year, it should be filed. If the return was filed on time and properly completed, all the following must be true:

Full name

Date of birth

Surname or first name

Social Security number

Federal Employer ID number

Federal Employer ID number

For taxpayers over the age of 70 filing Form 1040NR and Form 1040, the date of birth and Social Security numbers should be entered at step 1a.

When the proper year of birth is not entered as part of the instructions or in the table of credits at step 4, taxpayers under the age of 70 filing Form 1040NR or Form 1040 may use any year in which they are over age 70 to qualify for the earned income credit.

You can find the exact dates for filing all of your Connecticut forms at CT-505.

You can find the correct return information to include on all the various forms in the Instructions and Tables at CT-505.

CT DRS CT-706 NT 2007 free printable template

Show details

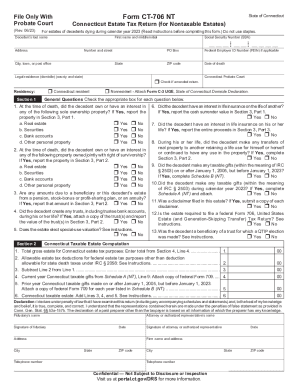

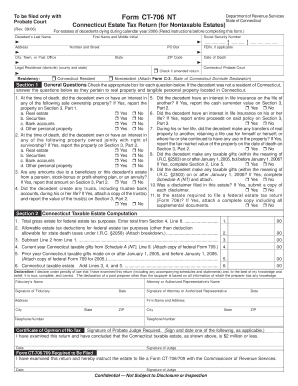

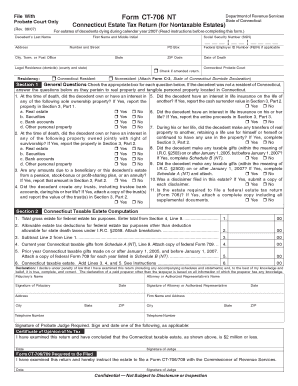

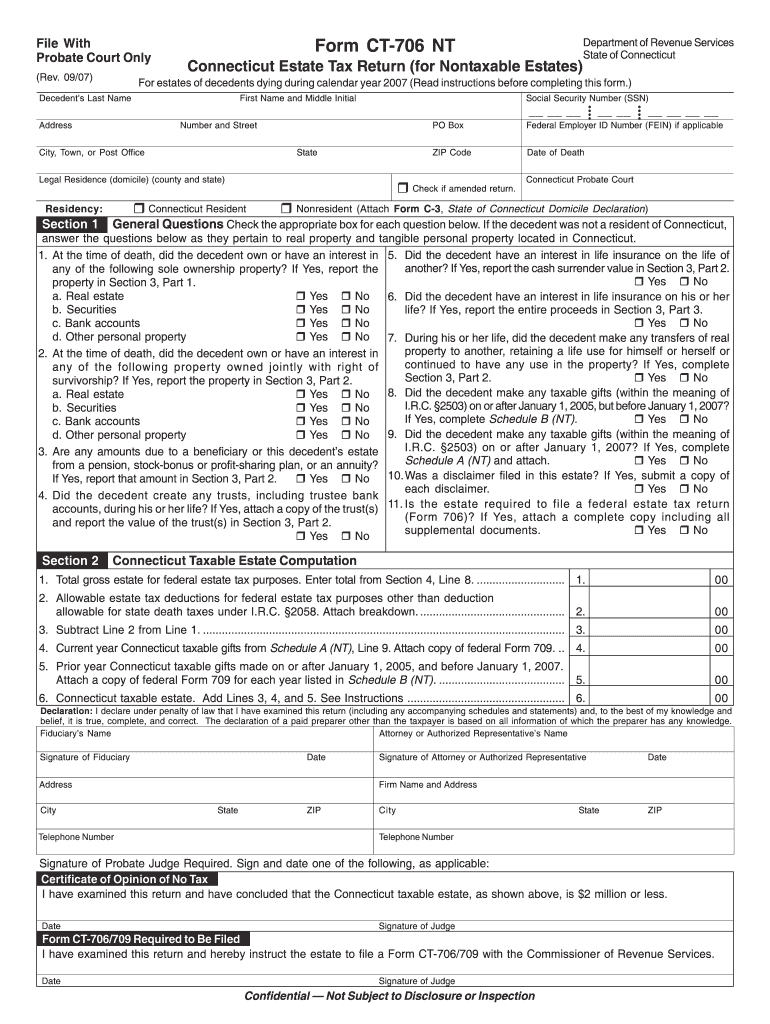

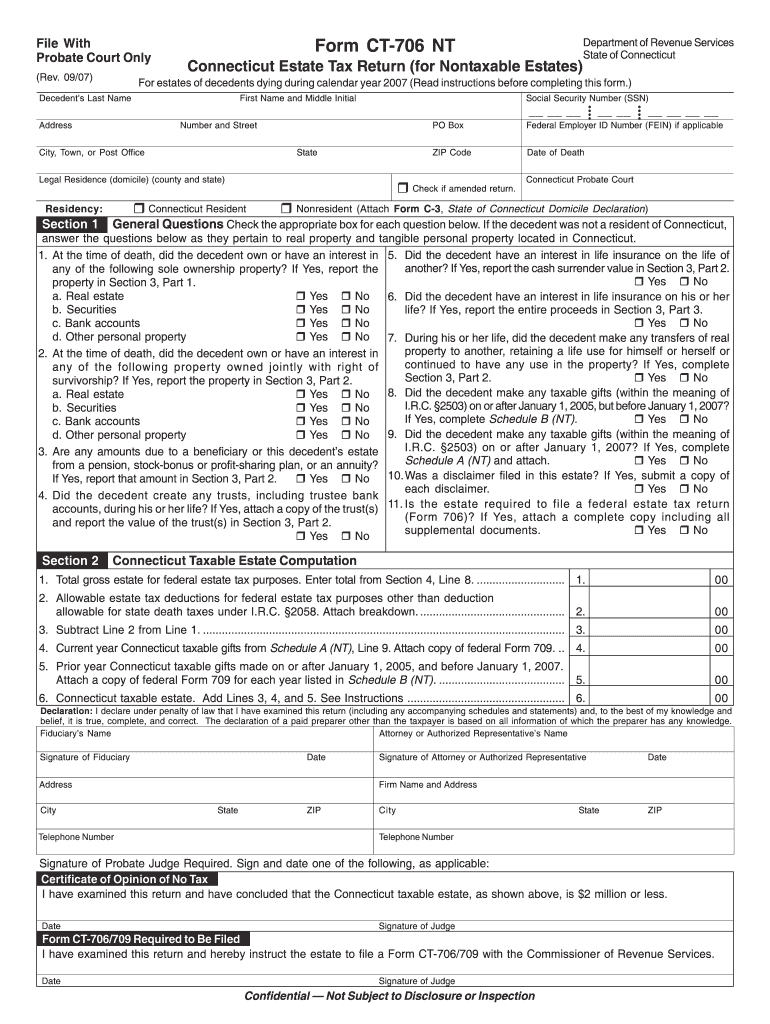

File With Probate Court Only Rev. 09/07 Form CT-706 NT Connecticut Estate Tax Return for Nontaxable Estates For estates of decedents dying during calendar year 2007 Read instructions before completing this form. Decedent s Last Name Address First Name and Middle Initial PO Box State Legal Residence domicile county and state Residency Social Security Number SSN Federal Employer ID Number FEIN if applicable ZIP Code Number and Street City Town or Post Office Section 1 Department of Revenue...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 2007 ct 706 nt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 ct 706 nt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2007 ct 706 nt online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2007 ct 706 nt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

CT DRS CT-706 NT Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about 2007 ct 706 nt

Who must file CT-706?

How do I file an extension for a 706?

What is the extension of time to file Form 706?

What is a CT-706 NT form?

Is there an extension of time to file CT-706 NT?

Do I need to file a Connecticut gift tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ct 706 nt form?

The ct 706 nt form is a tax form used to report and calculate the federal estate tax for nonresident decedents.

Who is required to file ct 706 nt form?

The ct 706 nt form must be filed by the executor or administrator of the estate of a nonresident decedent if the estate's gross value exceeds the applicable federal estate tax exemption amount.

How to fill out ct 706 nt form?

To fill out the ct 706 nt form, you need to provide information about the deceased person, the estate assets, and calculate the federal estate tax liability. The form includes sections for personal information, details of the estate property, and calculation of taxes.

What is the purpose of ct 706 nt form?

The purpose of the ct 706 nt form is to determine the federal estate tax liability for nonresident decedents and report it to the Internal Revenue Service (IRS).

What information must be reported on ct 706 nt form?

The ct 706 nt form requires the reporting of information such as the decedent's personal details, details of the estate property, deductions, credits, and calculations of taxes. It also requires any supporting documents to be attached.

When is the deadline to file ct 706 nt form in 2023?

The deadline to file the ct 706 nt form in 2023 is typically nine months after the decedent's date of death. However, it is advisable to consult the IRS or a tax professional for specific deadlines and any possible extensions.

What is the penalty for the late filing of ct 706 nt form?

The penalty for late filing of the ct 706 nt form can vary depending on the circumstances. The penalty is generally calculated based on the amount of tax owed and the number of days the filing is late. It is best to consult the IRS guidelines or a tax professional for specific information.

How do I modify my 2007 ct 706 nt in Gmail?

2007 ct 706 nt and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit 2007 ct 706 nt in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 2007 ct 706 nt and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit 2007 ct 706 nt on an Android device?

You can make any changes to PDF files, such as 2007 ct 706 nt, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your 2007 ct 706 nt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.