Get the free How to Report and Pay Taxes on Your 1099-NEC IncomeWhen Should Businesses Use Tax Fo...

Show details

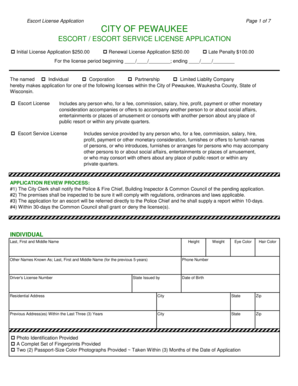

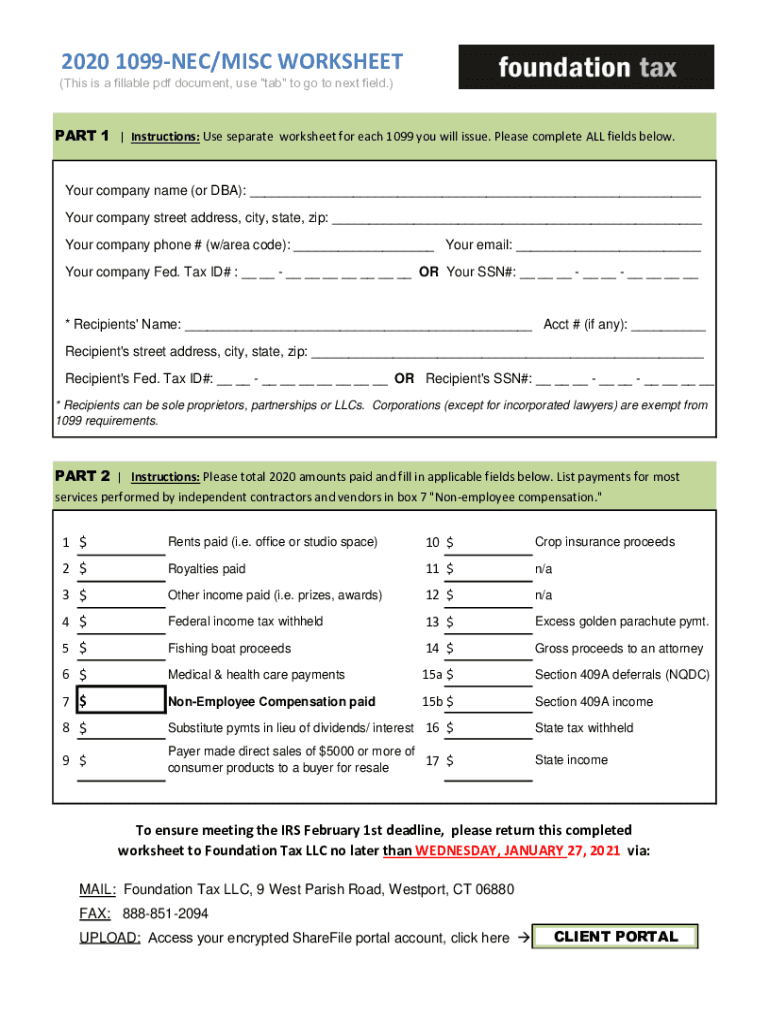

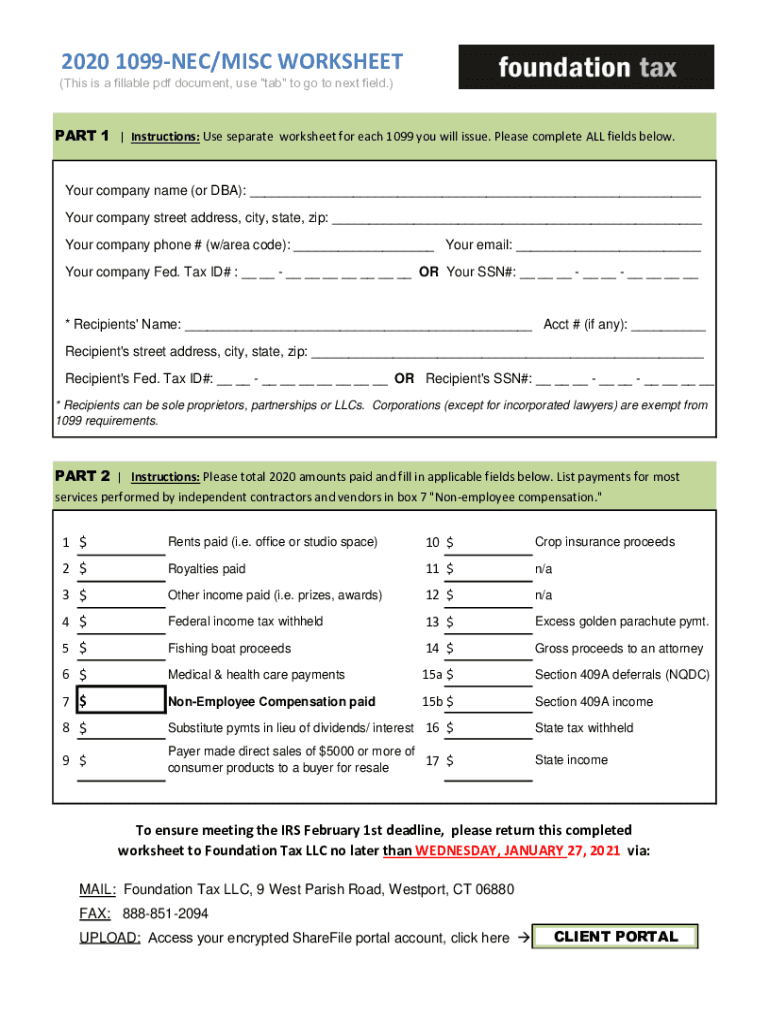

AM I REQUIRED TO FILE A 1099NEC OR 1099MISC? As a business taxpayer, the IRS requires you to issue and file a Form 1099NEC or 1099MISC to each person or company to whom you paid $600 or more in 2020.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to report and

Edit your how to report and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to report and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to report and online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to report and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to report and

How to fill out how to report and

01

Start by gathering all the necessary information about the topic you want to report on.

02

Determine the purpose of your report. Are you reporting on an event, a research study, or a business project?

03

Create a clear and concise title for your report.

04

Write an introduction that provides an overview of the report and its objectives.

05

Break down the body of the report into sections. Each section should cover a specific aspect or subtopic.

06

Use bullet points or numbers to organize your points within each section.

07

Provide background information, evidence, and examples to support your points.

08

Use clear and professional language throughout the report.

09

Summarize the key findings or conclusions in a dedicated section.

10

Write a conclusion that wraps up the main points and reinforces the objectives of the report.

11

Proofread and edit your report for grammar, spelling, and formatting errors.

12

Add any necessary appendices or references at the end of the report.

13

Review and revise your report as needed before finalizing it.

Who needs how to report and?

01

Anyone who wants to communicate information effectively and present it in a structured manner can benefit from knowing how to write a report.

02

Students often need to write reports as part of their academic coursework.

03

Researchers and scientists use reports to communicate the findings of their studies.

04

Professionals in various industries may need to write reports for business purposes, such as project updates, market research, or financial analysis.

05

Government agencies and organizations rely on reports to convey important information and make informed decisions.

06

Journalists and media professionals often write reports to cover news events or investigative stories.

07

Individuals who want to document and report incidents or events, such as accidents or customer complaints, may also need to know how to write a report.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find how to report and?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the how to report and in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the how to report and electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your how to report and in seconds.

How do I fill out how to report and on an Android device?

On Android, use the pdfFiller mobile app to finish your how to report and. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is how to report and?

How to report and is a process of submitting information or data to a specific entity or organization.

Who is required to file how to report and?

Anyone who has relevant information or data that needs to be reported is required to file how to report and.

How to fill out how to report and?

How to report and can be filled out by following the instructions provided by the relevant entity or organization.

What is the purpose of how to report and?

The purpose of how to report and is to ensure transparency and accuracy of the information being submitted.

What information must be reported on how to report and?

The information that must be reported on how to report and can vary depending on the requirements of the specific entity or organization.

Fill out your how to report and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Report And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.