DC OTR D-76 2021 free printable template

Get, Create, Make and Sign DC OTR D-76

How to edit DC OTR D-76 online

Uncompromising security for your PDF editing and eSignature needs

DC OTR D-76 Form Versions

How to fill out DC OTR D-76

How to fill out DC OTR D-76

Who needs DC OTR D-76?

Instructions and Help about DC OTR D-76

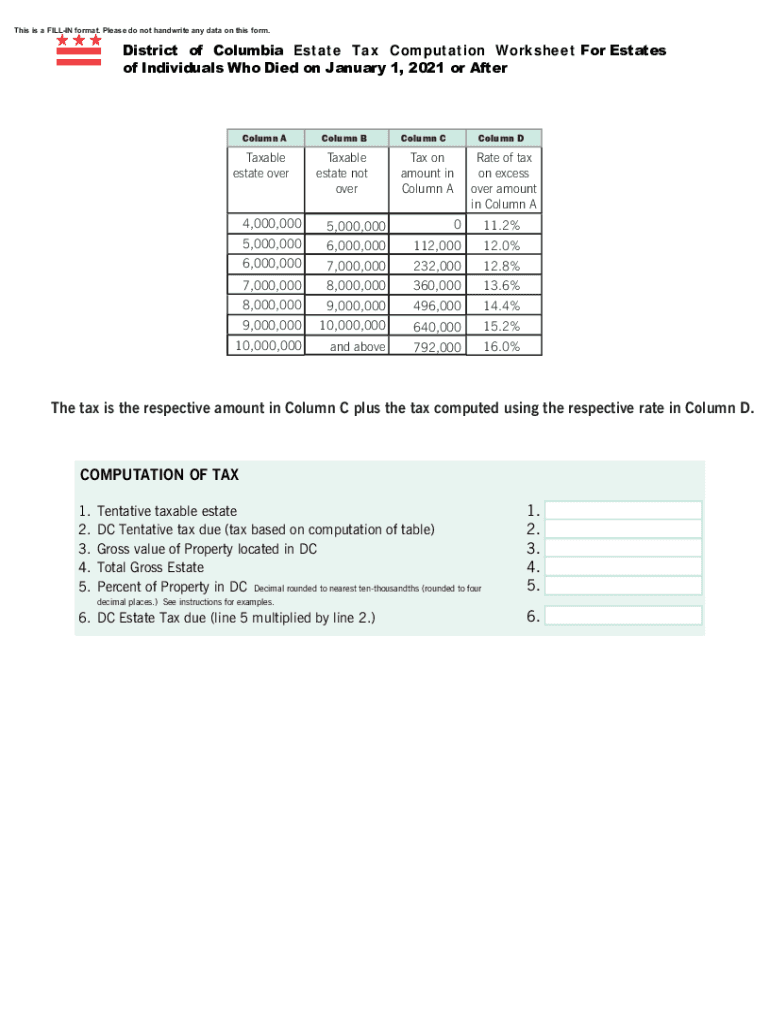

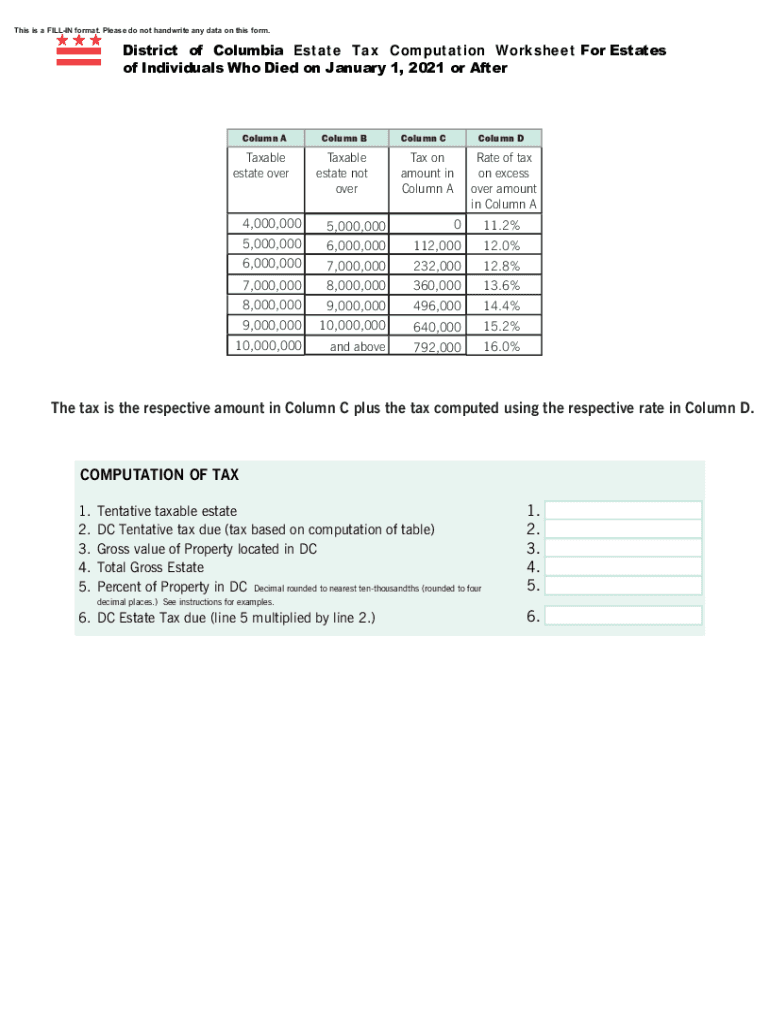

Okay so a little on tax stuff I have to talk about, so I can introduce some of these other things that you do for children right so a state tax right now the federal estate tax limit is five point four three million dollars so if you have a couple you've got ten point eight six million dollars before you pay an estate tax you're less than that no tax if you have more than that it's a forty percent tax rate right you can give an unlimited amount to your spouse so if you have ten billion dollars you can give it all to your spouse no tax but then if your spouse doesn't get remarried just somebody younger than they're going to pay attacks when they die right so not many people paying estate tax these days because the limit is so high at this point it's set to go up a little with inflation each year, so it's 10.34 million last year this year's 10.4 three million so again not a lot of people have to pay that what's included in the taxable estate now this is a little catch right so all the stuff you owned at your death is included that makes sense you know my bank account my car or whatever it was my name but for tax purposes they also look at the value of your life insurance the jointly owned property the house you and your spouse own even if your spouse gets the whole thing automatically on your death they're going to consider half the value of that for tax purposes your retirement accounts anything you have a power of appointment over the ability to direct where it goes annuities that you might own, so your taxable estate might be a lot larger than the cash value of what you have now if you catch everything out I've got a lot of life insurance with for little kids and so does my wife, and it's something happened to both of us, and you solve all of our other stuff we know we be getting closer to that estate tax limit right so if you've got a lot of life insurance or a lot of other assets then the state tax can be a consideration the other thing is if you do move to DC or Maryland they have their own state estate taxes Maryland is in the process of phasing there's out, but DC's is still sixteen percent on anything over a million dollars, so I've got clients in DC who go wow we have a house in a retirement account and all of a sudden that's more than a million dollars and that can be a big bite out of their estate Virginia's a little more friendly than all those places which is probably why you're all living here in Virginia okay so gift tax now if you thought about it if there was no gift tax then everybody would just give away all their stuff shortly before they die send me know when you're going to die so that you don't have to pay an estate tax right, so the gift tax backstops the estate tax system, and basically you have a limit on what you can give without having a tax that's incurred, so there's a unified credit that's 5.4 three million dollars that we talked about is a unified credit between estate tax and gift tax and so if you make a large...

People Also Ask about

How long to file 706 after death?

Does the District of Columbia have an estate tax?

Who has to file an estate tax return 706?

Where to pick up DC tax forms?

What is estate Form 706?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send DC OTR D-76 to be eSigned by others?

How can I get DC OTR D-76?

Can I sign the DC OTR D-76 electronically in Chrome?

What is DC OTR D-76?

Who is required to file DC OTR D-76?

How to fill out DC OTR D-76?

What is the purpose of DC OTR D-76?

What information must be reported on DC OTR D-76?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.