Get the free Mills Act Property Tax ReductionDevelopment Services

Show details

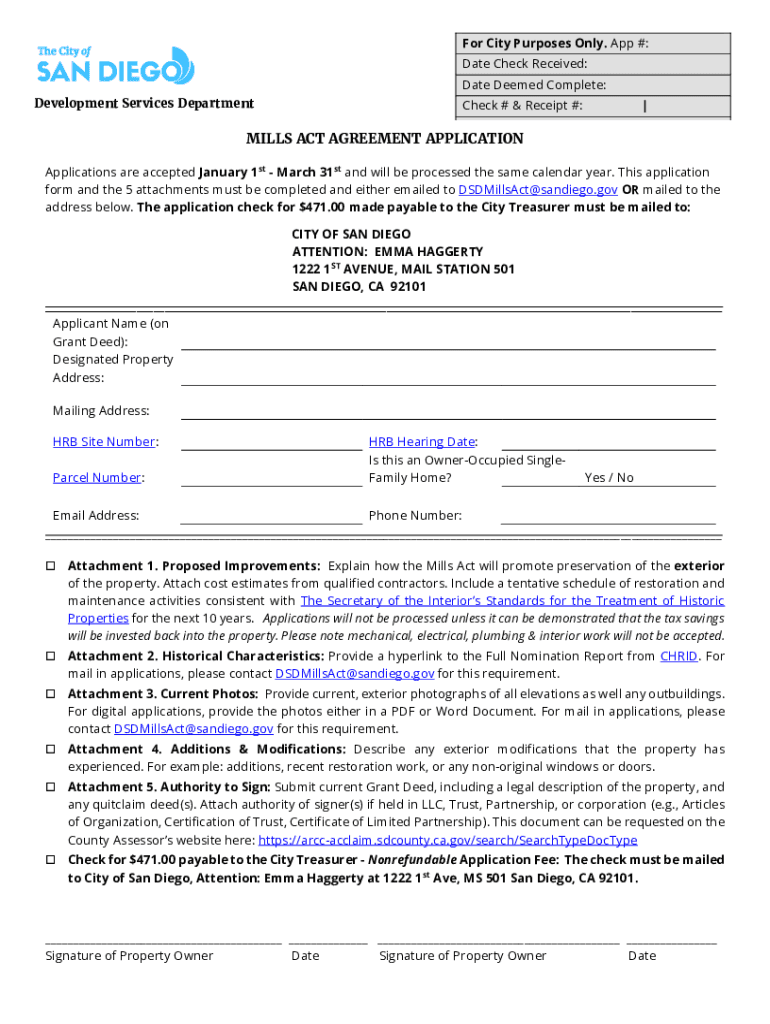

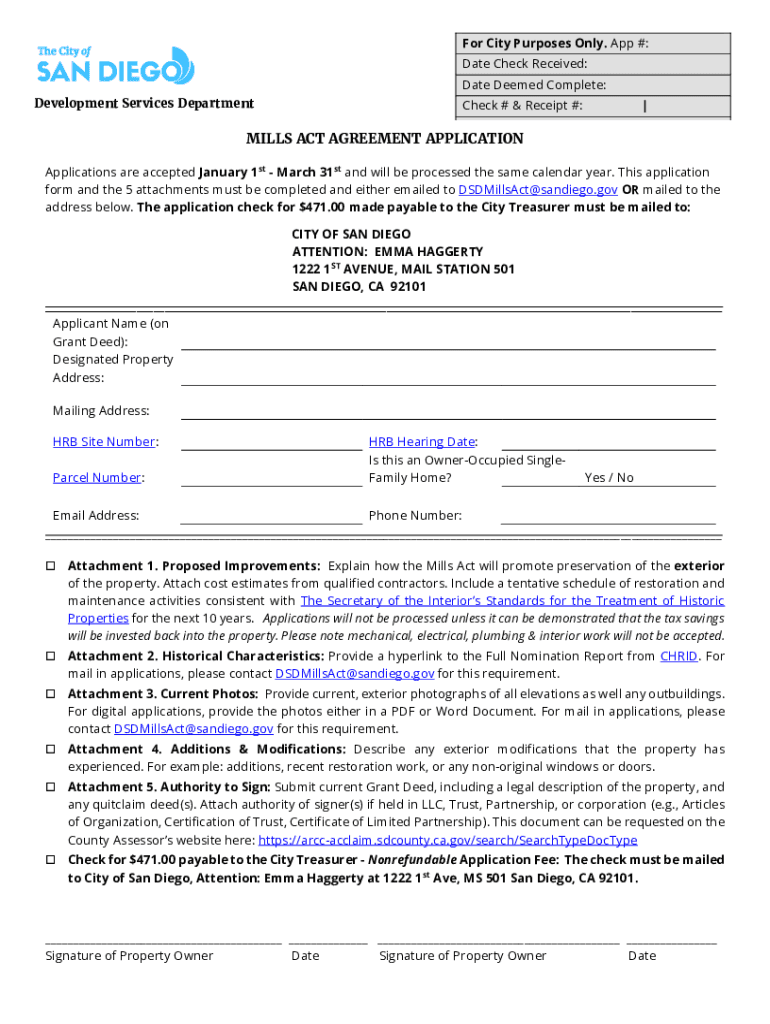

For City Purposes Only. App #: Date Check Received: Date Deemed Complete: Development Services DepartmentCheck # & Receipt #: MILLS ACT AGREEMENT APPLICATION Applications are accepted January 1st

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mills act property tax

Edit your mills act property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mills act property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mills act property tax online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mills act property tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mills act property tax

How to fill out mills act property tax

01

To fill out Mills Act property tax, follow these steps:

02

Obtain the application form from the local government office or website.

03

Provide accurate information about the property, including its address, owner details, and historical significance.

04

Include any relevant supporting documents, such as photographs, historical documents, or architectural plans.

05

Complete the financial analysis section, which may require information on rehabilitation costs or projected property value.

06

Submit the filled-out application form and supporting documents to the designated government office.

07

Pay any applicable fees or processing charges as specified by the local government.

08

Wait for the evaluation process to be completed.

09

If approved, comply with any stipulated requirements for the duration of the Mills Act contract, such as maintenance and preservation obligations.

10

Enjoy the benefits of reduced property taxes as provided by the Mills Act.

Who needs mills act property tax?

01

Various parties may benefit from the Mills Act property tax, including:

02

- Historic property owners who wish to receive property tax reductions in exchange for preserving and maintaining their historically significant properties.

03

- Local governments that aim to encourage property owners to invest in historical preservation and maintain the distinct character of their communities.

04

- Communities and neighborhoods that value the preservation of historical architecture and cultural heritage.

05

- Real estate developers or investors interested in rehabilitating and restoring historical properties for potential financial gain.

06

- Tourism boards and entities that promote heritage tourism, as the Mills Act can contribute to preserving and showcasing historically significant sites.

07

- Historians, researchers, and enthusiasts who appreciate the documentation and conservation of historical landmarks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mills act property tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the mills act property tax in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in mills act property tax?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mills act property tax and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit mills act property tax on an Android device?

You can edit, sign, and distribute mills act property tax on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is mills act property tax?

Mills Act property tax is a property tax reduction program for historic properties.

Who is required to file mills act property tax?

Property owners of designated historic properties are required to file for Mills Act property tax.

How to fill out mills act property tax?

To fill out Mills Act property tax, property owners must submit the application form along with required documentation to the local assessor's office.

What is the purpose of mills act property tax?

The purpose of Mills Act property tax is to provide financial incentives for property owners to preserve and maintain historic properties.

What information must be reported on mills act property tax?

Property owners must report the historical significance of the property, proposed preservation plan, and estimated costs of preservation.

Fill out your mills act property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mills Act Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.