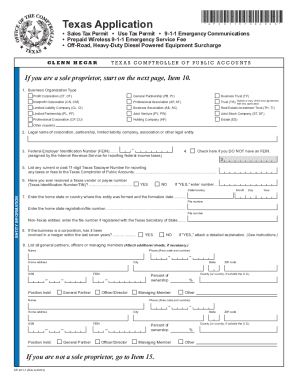

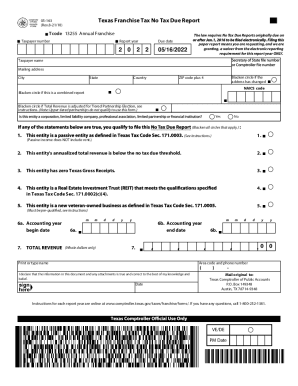

TX Comptroller AP-201 2021 free printable template

Get, Create, Make and Sign TX Comptroller AP-201

How to edit TX Comptroller AP-201 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller AP-201 Form Versions

How to fill out TX Comptroller AP-201

How to fill out TX Comptroller AP-201

Who needs TX Comptroller AP-201?

Instructions and Help about TX Comptroller AP-201

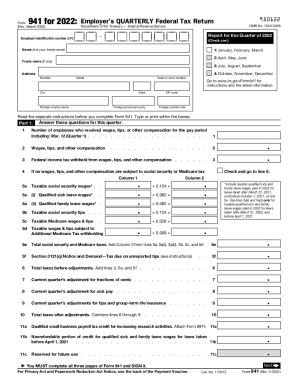

Hi there I'm Lizzy from tax jar, and I'm going to show you how you can file your sales tax return for Texas in minutes using our tax star reports if you've ever filed a sales tax return to Texas before this screen will look familiar if you haven't you might be in for a surprise Texas can be one of the most difficult and frustrating state returns to file for many e-commerce sellers due to the level of detail the state requires you to report your sales Texas wants to know what city county jurisdiction transportation authority and special district rate each of your sales correspond to as a new seller this can be pretty daunting but if you're a tax jar subscriber you can breeze through your Texas filings with our simple tax jar reports once you get to the Texas website you can find the web file log in here now that you're here for the returning user log in you need to use your user ID and password to access your account if you don't have a username or password, yet you'll want to follow the instructions for first-time user and click Sign Up come back to this video once you've completed that and follow along I'm going to log in now after you've logged in you'll want to click on web file pay taxes and fees under the electronic filing and paying section the next screen will take you to a list of your taxpayer accounts in this example we only have one account under tax to our videos so to continue I will click on the taxpayer number in the light blue to the left to proceed the next screen is where you'll be asked which return that you'd like to work on for this example I'll be showing you how to file an original return if you need help with filing previous years returns or getting information to file your back taxes you can also use tax try to complete these filings please reach out to support at tax or calm with any questions about how to do so after I've selected file original return hit continue to move to the next screen next you'll be taken to a screen that asks you to select the filing period for this return since you pay sales tax after the return window has closed I'll choose the second option for the period ending in September since it's now October, and I'm ready to file you wouldn't want to choose the top date as this period has not closed yet, so I'm still going to be collecting sales and sales tax throughout the end of the year hit continue to move to the next screen the next screen asks you a few personal questions about if you are taking credits for your business I cannot give you information on how to fill this out, so please file this out on your own according to your specific business situation for this example I will select now to move forward please hit continue to the next screen the next screen will take you to the locations view if you have multiple locations for your business it will list them all here you must enter the information for your sales tax returns per location so make sure and note this if you are operating multiple...

People Also Ask about

How do I get a Texas sales tax exemption certificate?

How do I get a Texas sales and use tax exemption certificate?

Do I need a Texas sales tax permit?

How do you get a seller's permit in Texas?

What is the difference between a sellers permit and a resale certificate in Texas?

Do I need an EIN or a sales tax permit in Texas?

How much is a sales tax permit in Texas?

What is the difference between Texas sales and use tax resale certificate and Texas sales and use tax exemption certification?

Is a sales and use tax permit the same as a resale certificate in Texas?

How do I get a copy of my Texas sales and use tax permit?

How do I fill out a Texas sales and use tax exemption certificate?

How do I use my Texas sales tax permit?

Is Texas taxpayer number the same as sales tax permit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX Comptroller AP-201 without leaving Google Drive?

How can I send TX Comptroller AP-201 to be eSigned by others?

Where do I find TX Comptroller AP-201?

What is TX Comptroller AP-201?

Who is required to file TX Comptroller AP-201?

How to fill out TX Comptroller AP-201?

What is the purpose of TX Comptroller AP-201?

What information must be reported on TX Comptroller AP-201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.