Get the free support.oracle.comknowledgeOracle E-BusinessR12: Ebtax: Implementing and Using Tax R...

Show details

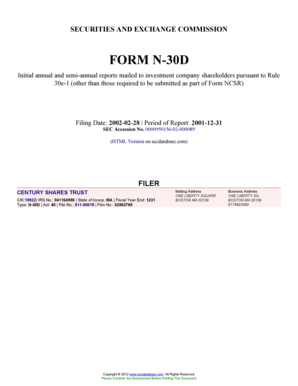

Oracle Business Tax Reporting Guide Release 12.2 Part No. E4875203September 2015Oracle Business Tax Reporting Guide, Release 12.2 Part No. E4875203 Copyright 2011, 2015, Oracle and/or its affiliates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supportoraclecomknowledgeoracle e-businessr12 ebtax implementing

Edit your supportoraclecomknowledgeoracle e-businessr12 ebtax implementing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supportoraclecomknowledgeoracle e-businessr12 ebtax implementing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supportoraclecomknowledgeoracle e-businessr12 ebtax implementing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit supportoraclecomknowledgeoracle e-businessr12 ebtax implementing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supportoraclecomknowledgeoracle e-businessr12 ebtax implementing

How to fill out supportoraclecomknowledgeoracle e-businessr12 ebtax implementing

01

To fill out support.oracle.com knowledge for Oracle E-Business Suite R12 E-Business Tax implementation, follow the steps below:

02

Visit the support.oracle.com website and log in with your account credentials.

03

Navigate to the Knowledge section and search for 'Oracle E-Business Suite R12 E-Business Tax implementation'.

04

Review the available articles, whitepapers, and documentation related to E-Business Tax implementation in R12.

05

Read through the materials and gather information about the best practices, considerations, and guidelines for implementation.

06

Use the gathered information to plan and execute the implementation process for Oracle E-Business Suite R12 E-Business Tax.

07

If you encounter any issues or need further assistance, you can also post a question or seek support from the Oracle community forum within support.oracle.com.

08

Continuously refer to and update your knowledge by exploring the support.oracle.com portal for any new updates or resources related to E-Business Tax implementation.

09

Follow these steps to effectively fill out support.oracle.com knowledge for Oracle E-Business Suite R12 E-Business Tax implementation.

Who needs supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

01

People or organizations that are involved in implementing Oracle E-Business Suite R12 E-Business Tax may need support.oracle.com knowledge. This includes:

02

- Implementation consultants who are responsible for configuring and setting up E-Business Tax in R12 for their clients.

03

- IT professionals or administrators who are tasked with maintaining and managing E-Business Tax in R12 for their organization.

04

- Accountants or financial personnel who need to understand the tax setup and reporting functionalities in E-Business Suite R12.

05

- Business owners or managers who want to ensure compliance with tax regulations and optimize tax-related processes in E-Business Suite R12.

06

Anyone involved in implementing, configuring, maintaining, or using Oracle E-Business Suite R12 E-Business Tax can benefit from support.oracle.com knowledge for effective implementation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my supportoraclecomknowledgeoracle e-businessr12 ebtax implementing directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your supportoraclecomknowledgeoracle e-businessr12 ebtax implementing and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the supportoraclecomknowledgeoracle e-businessr12 ebtax implementing in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I edit supportoraclecomknowledgeoracle e-businessr12 ebtax implementing on an Android device?

You can edit, sign, and distribute supportoraclecomknowledgeoracle e-businessr12 ebtax implementing on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

supportoraclecomknowledgeoracle e-businessr12 ebtax is implementing tax functionality for Oracle E-Business Suite Release 12.

Who is required to file supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

Any organization or individual using Oracle E-Business Suite Release 12 and utilizing the eBTax functionality may be required to file supportoraclecomknowledgeoracle e-businessr12 ebtax implementing.

How to fill out supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

You can fill out supportoraclecomknowledgeoracle e-businessr12 ebtax implementing by following the guidance provided in the Oracle E-Business Suite documentation and consulting with tax experts.

What is the purpose of supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

The purpose of supportoraclecomknowledgeoracle e-businessr12 ebtax implementing is to ensure accurate tax calculations, reporting, and compliance within Oracle E-Business Suite Release 12.

What information must be reported on supportoraclecomknowledgeoracle e-businessr12 ebtax implementing?

The information to be reported on supportoraclecomknowledgeoracle e-businessr12 ebtax implementing includes tax rates, tax rules, tax jurisdictions, tax exemptions, and tax registrations.

Fill out your supportoraclecomknowledgeoracle e-businessr12 ebtax implementing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supportoraclecomknowledgeoracle E-businessr12 Ebtax Implementing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.