VA DoT AST-3 2021-2025 free printable template

Show details

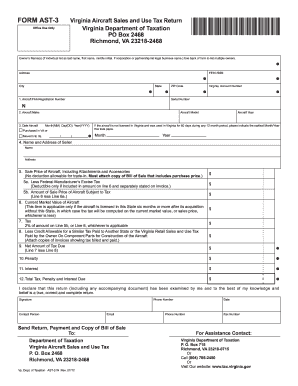

FORM AST3Virginia Aircraft Sales and Use Tax Return

Virginia Department of Taxation

P.O. Box 2468

Richmond, VA 232182468Office Use Only×VAAST3121888×Owners Name(s) (If individual list as last name,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign virginia aircraft tax form

Edit your virginia form ast 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ast 3 2021-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ast 3 2021-2025 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form ast 3 2021-2025. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT AST-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ast 3 2021-2025

How to fill out VA DoT AST-3

01

Obtain the VA DoT AST-3 form from the official VA website or your local VA office.

02

Carefully read the instructions provided with the form to ensure understanding of what information is required.

03

Fill out your personal information in the designated sections, including name, address, and contact details.

04

Provide details regarding your military service, including service dates and branch.

05

Answer any specific questions related to your eligibility or the purpose of the form.

06

Review all entries for accuracy and completeness before submitting.

07

Sign and date the form as required by the instructions.

Who needs VA DoT AST-3?

01

Veterans seeking assistance with their transportation needs.

02

Individuals applying for benefits through the VA that require documentation of transportation services.

03

Caregivers of veterans who need to access transportation resources or support.

Video instructions and help with filling out and completing form ast 3

Instructions and Help about form ast 3 2021-2025

Fill

form

: Try Risk Free

People Also Ask about

Who do I write the check to for Virginia state taxes?

Attach check or money order payable to Virginia Department of Taxation. Include your Social Security number and the tax period for the payment on the check. If your financial institution does not honor your payment to us, we may impose a $35 fee (Code of Virginia § 2.2-614.1).

How much is federal and state tax in Virginia?

Your Income Taxes Breakdown TaxMarginal Tax Rate2021 Taxes*Federal22.00%$9,600FICA7.65%$5,777State5.97%$3,795Local3.88%$2,4924 more rows • 23-Dec-2021

Can you live tax free on a boat?

Declaring your main home. The IRS allows taxpayers to designate one residence only as a main home at any one time. Your main home is the one where you ordinarily live most of the year. This can be a boat or RV even if it doesn't have a permanent location.

Why did I get a check from the Virginia Department of Taxation?

You will receive a check if: Your refund was reduced because we withheld part of your refund to pay authorized debts as explained above. We adjusted your refund amount. We will send you a letter explaining why the refund was adjusted.

Why would the Virginia Department of Taxation send me a letter?

This letter tells you that the Virginia Department of Taxation received an individual income tax return with your name and/or social security number and needs additional information to verify the amount of withholding claimed on your return.

Who is eligible for Virginia tax rebate 2022?

Those who filed individually could be eligible for up to $250 and those who filed jointly could be eligible for up to $500. Here's a breakdown of what Virginia taxpayers can expect regarding the tax rebate: Taxpayers must file taxes by Nov. 1, 2022 to qualify.

Why do I owe VA state taxes?

Generally, you have to file a Virginia state income tax return if: You're a resident, part-year resident or nonresident, and. You're required to file a federal tax return, and. You have Virginia adjusted gross income, or VAGI, above $11,950 (single, or married filing separately) or $23,900 (married and filing jointly).

What is the personal property tax for boats in Virginia?

Tax rate: 2% of the purchase price of the watercraft; or. 2% of the current market value of the watercraft, if it was purchased 6 months or more before it was required to be titled for use in Virginia; or. 2% of the gross receipts from leasing, chartering or other compensatory use.

Does Virginia have personal property tax on vehicles?

Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

What is Virginia state tax?

Virginia Sales Tax 5.3% state levy, which includes a 1% tax allocated to local governments. Some local governments also impose additional taxes of up to 1.7%, making the average combined state and local rate 5.75%, ing to the Tax Foundation.

Do I have to pay Virginia state taxes electronically?

Check - If you do not want to pay electronically, you may e-file your return and mail a paper check for your payment. Online Services - Virginia Tax's Online Services for Individuals is a free online tax payment system that allows you to make payments directly from your checking or savings accounts.

What is the state income tax in Virginia?

Virginia state income tax rates are 2%, 3%, 5% and 5.75%. Virginia state income tax brackets and income tax rates depend on taxable income and residency status.

What is the last day to pay Virginia state taxes?

1, 2022. RICHMOND, Va. – Virginia Tax wants to remind taxpayers if you haven't yet filed your individual income taxes for 2021 in Virginia, the automatic, six-month filing extension deadline is just days away.

Does Virginia require electronic payment for taxes?

You must submit all of your income tax payments electronically if: Any installment payment of estimated tax exceeds $1,500 or. Any payment made for an extension of time to file exceeds $1,500 or. The total income tax liability for the year exceeds $6,000.

Is Virginia a high tax state?

However, sales tax rates in the state are lower than in most other states. Virginia's average combined state and local rate of 5.75% is the 11th-lowest in the nation. Clothing and groceries (reduced rate) are taxable, though. The statewide median property tax rate is below average, too.

How is personal property tax calculated in Virginia?

The amount of personal property tax due is determined by multiplying the property's assessed value by the tax rate [(X/$100) x 4.13].

What do I do if I owe Virginia state taxes?

If you have an unpaid tax bill, you should pay it in full immediately to avoid accruing additional penalties and interest. If you can't pay in full, you may be able to set up a payment plan. If you do not resolve your tax bills on time, we may proceed with collections actions, such as wage liens and bank liens.

Is there personal property tax on boats in Virginia?

Boat, boat motors, and personal watercraft are liable for personal property tax as stated in 58.1-3503 of the Virginia State Code.

What is the sales tax in Virginia 2022?

The sales tax rate for most locations in Virginia is 5.3%.

Is Virginia getting a rebate check 2022?

What You Need to Know About the 2022 One-Time Tax Rebate. Starting in the fall, eligible taxpayers will receive a one-time rebate of up to $250 for individuals and up to $500 for joint filers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form ast 3 2021-2025 in Chrome?

Install the pdfFiller Google Chrome Extension to edit form ast 3 2021-2025 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my form ast 3 2021-2025 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your form ast 3 2021-2025 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit form ast 3 2021-2025 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing form ast 3 2021-2025.

What is VA DoT AST-3?

VA DoT AST-3 is a form used to report information about aboveground storage tanks in Virginia.

Who is required to file VA DoT AST-3?

Owners and operators of aboveground storage tanks that meet certain capacity thresholds must file VA DoT AST-3.

How to fill out VA DoT AST-3?

To fill out VA DoT AST-3, provide accurate information regarding the storage tanks, including location, capacity, contents, and ownership details as outlined in the form instructions.

What is the purpose of VA DoT AST-3?

The purpose of VA DoT AST-3 is to ensure compliance with environmental regulations and to monitor the safety of aboveground storage tanks.

What information must be reported on VA DoT AST-3?

Information that must be reported includes the tank's location, capacity, type of product stored, ownership, and any relevant operational details.

Fill out your form ast 3 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ast 3 2021-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.