MI UIA 4101 2018 free printable template

Show details

UIA 4101

(Rev. 1018)Reset FormGRETCHEN WHITMER

GOVERNORATE OF MICHIGANDEPARTMENT OF LABOR AND ECONOMIC OPPORTUNITY

UNEMPLOYMENT INSURANCE AGENCYAuthorized by

MCL 421.1 et seq.

SUSAN R.COORDINATING

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI UIA 4101

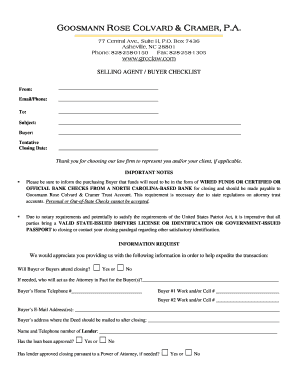

Edit your MI UIA 4101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI UIA 4101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI UIA 4101 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI UIA 4101. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI UIA 4101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI UIA 4101

How to fill out MI UIA 4101

01

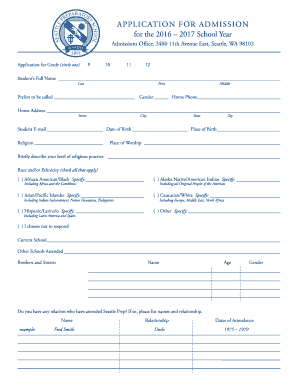

Begin by obtaining the MI UIA 4101 form from the Michigan Unemployment Insurance Agency website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the reason for filing, such as job loss or reduced hours due to a qualifying event.

04

Provide details about your previous employer, including the company's name, address, and your job title.

05

Complete the sections regarding your employment history, ensuring that you list all the relevant jobs you held in the past 18 months.

06

Carefully read and answer any questions about your availability and willingness to work.

07

Attach any required documentation or evidence that supports your claim, such as pay stubs or termination letters.

08

Review the entire form for accuracy and completeness before submitting.

09

Submit the form according to the instructions provided, either online, by mail, or via fax.

Who needs MI UIA 4101?

01

Individuals who have lost their job or had their work hours reduced due to layoffs, company closures, or other qualifying circumstances.

02

People seeking unemployment benefits in Michigan to support themselves during periods of unemployment.

03

Workers who have been previously employed and meet the eligibility requirements for unemployment assistance.

Fill

form

: Try Risk Free

People Also Ask about

How do I file a new UIA claim in Michigan?

Michigan. Michigan's 2023 SUTA rates range from 0.6% to 10.3%, with the wage base holding at $9,500.

Is Michigan waiving unemployment overpayment?

The agency began the waiver process for overpayments it caused by using unauthorized criteria in June 2021, asking nearly 650,000 PUA claimants to requalify and/or recertify for benefits, using the specific federal criteria only.

What is the Michigan Obligation Assessment Rate for 2023?

You submit a protest through your MIWAM account: Click on the PUA claim ID to view the details. Click on "Determination Status", and then on "file a protest" or "file appeal" for the issue you wish to protest.

How do I appeal an unemployment overpayment in Michigan?

If you believe you are eligible for benefits and the UIA made a mistake, you can ask for a waiver due to agency error. There is not an application for this on MiWAM, but you can ask for the waiver by going to your main account page and finding the link "Send Unemployment a Message".

How do I apply for a work waiver on MiWAM?

You will be notified at the time of the request whether a waiver of the requirement is granted. Claimants may apply for a waiver beginning May 30, 2021, either in MiWAM by clicking “Request a COVID-19 Work Search Waiver” or by calling the UIA customer service line at 1-866-500-0017.

Is a termination letter required in Michigan?

Michigan. Form IA 1711 must be provided to an employee upon separation unless an employer is filing claims on behalf of the employee.

What does seeking work waiver mean for Michigan unemployment?

The Registration and Seeking Work (RSW) waiver allows a worker to collect benefits during a short-term layoff period while not being required to register and seek work. The Criteria for establishing a waiver are: 1. The separation must be a lay off for lack of work. 2.

What is the UI rate in Michigan 2023?

Michigan's 2023 SUTA rates range from 0.6% to 10.3%, with the wage base holding at $9,500.

What is Michigan UIA register for work waiver?

Waivers can be requested through the Michigan Web Account Manager (MiWAM). Login to your MIWAM account. Under Accounts tab select UI Tax. Select Account Services tab. Scroll down, under Benefit Services submenu, select Seeking Work Waiver.

How many job searches are required for unemployment in Michigan?

You are required to actively search for work every week you receive unemployment benefits. This includes making at least two job contacts each week and keeping a record of your searches.

How do I file a new UIA claim in Michigan?

0:05 5:01 How to File a Claim - YouTube YouTube Start of suggested clip End of suggested clip And your dates of employment. From all your employers for the last 18. Months in addition you willMoreAnd your dates of employment. From all your employers for the last 18. Months in addition you will need your most recent employers federal employer identification number or fein.

How much money do you have to make to file for unemployment in Michigan?

Wage Requirements The four calendar quarters in a year are: January – March; April – June; July – September; and October – December. You must have at least one quarter in which you earned a minimum of $3,830.00. You must have wages in at least two calendar quarters in the base period.

Do Michigan employers have to pay unemployment?

All employing units that are determined to be employers and therefore liable under the Michigan Employment Security Act, are responsible for paying state unemployment taxes to the Unemploy- ment Insurance Agency (UIA). Most employers are contributing employers and the taxes they pay the UIA are called contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI UIA 4101 to be eSigned by others?

To distribute your MI UIA 4101, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit MI UIA 4101 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign MI UIA 4101. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit MI UIA 4101 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MI UIA 4101 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

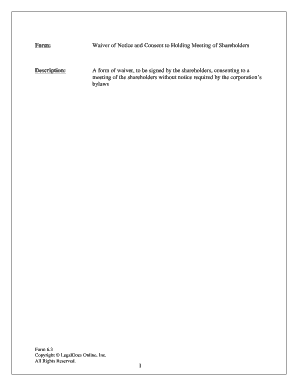

What is MI UIA 4101?

MI UIA 4101 is a form used by employers in Michigan to report unemployment tax information and wage details to the Michigan Unemployment Insurance Agency.

Who is required to file MI UIA 4101?

Employers in Michigan who are subject to unemployment insurance laws are required to file MI UIA 4101.

How to fill out MI UIA 4101?

To fill out MI UIA 4101, employers should provide accurate employee wage information, employer identification, and report the specified period for which they are filing.

What is the purpose of MI UIA 4101?

The purpose of MI UIA 4101 is to ensure compliance with the Michigan unemployment insurance laws by collecting necessary data on employee wages and taxes.

What information must be reported on MI UIA 4101?

Information that must be reported on MI UIA 4101 includes employee names, social security numbers, wages paid during the reporting period, and the employer's identification details.

Fill out your MI UIA 4101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI UIA 4101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.