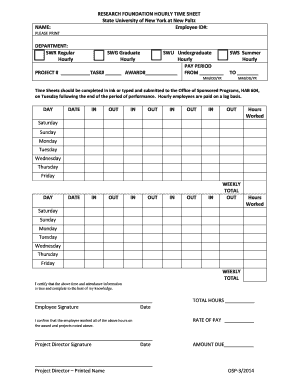

MI 632 2022 free printable template

Show details

Reset Form

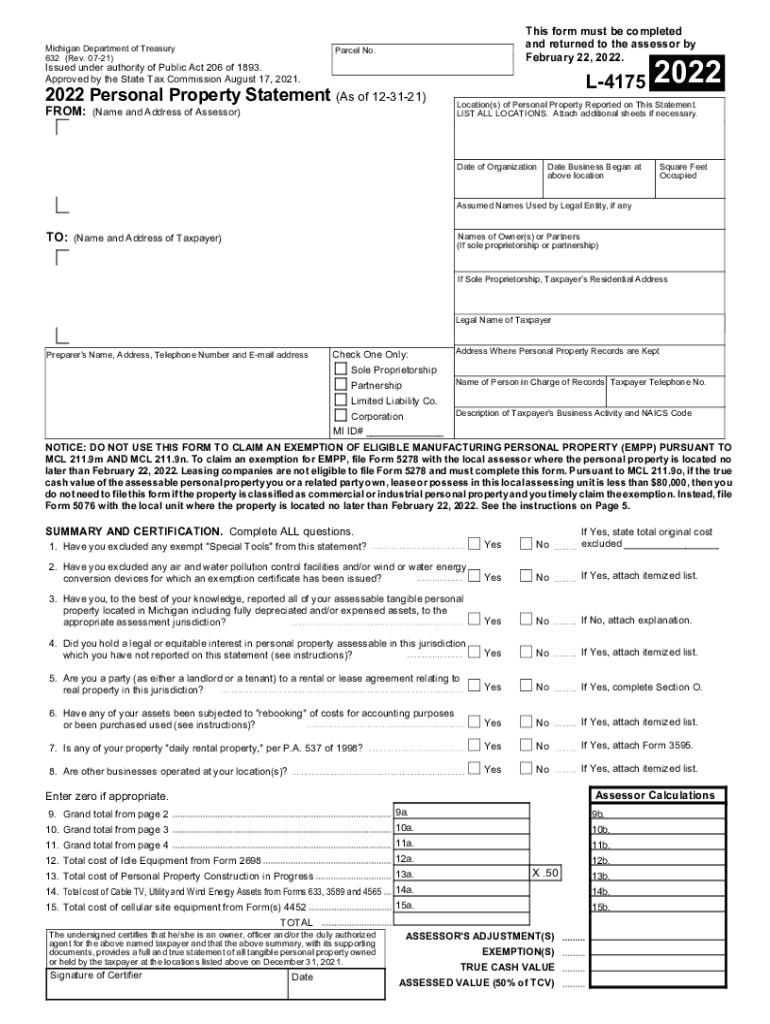

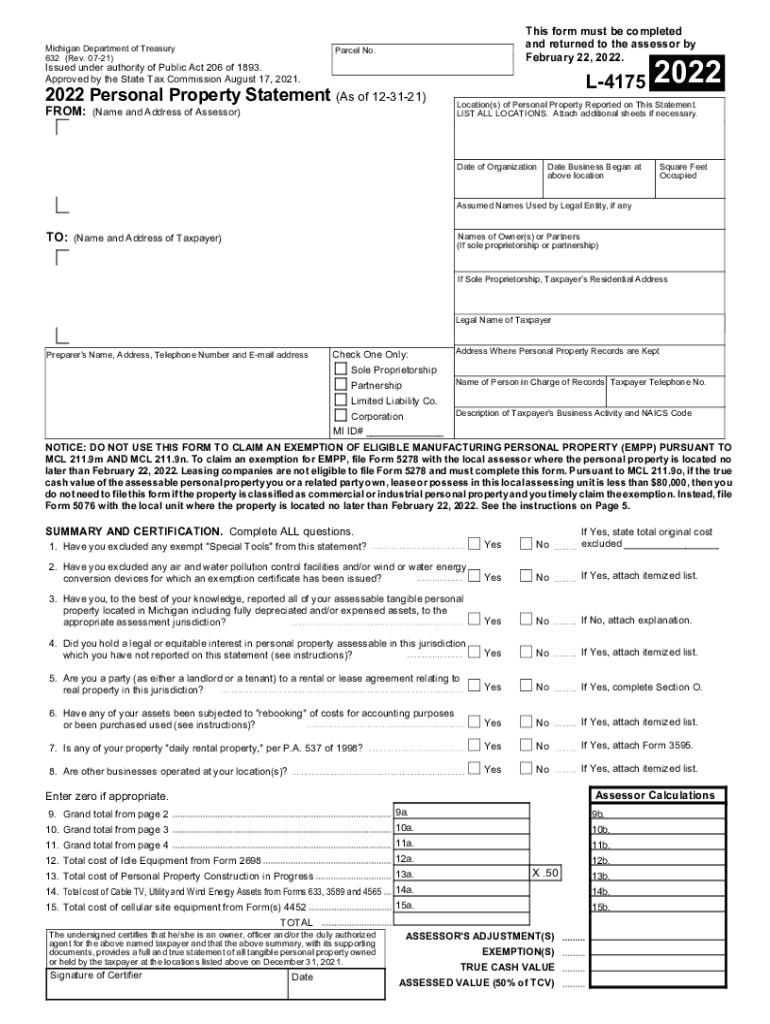

Michigan Department of Treasury

632 (Rev. 0721)This form must be completed

and returned to the assessor by

February 22, 2022. Parcel No. Issued under authority of Public Act 206 of 1893.

Approved

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 632

Edit your MI 632 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 632 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI 632 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI 632. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 632 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 632

How to fill out MI 632

01

Obtain the MI 632 form from the appropriate government website or office.

02

Fill in your personal information, including your name, address, phone number, and email.

03

Provide details relevant to the purpose of the MI 632 form.

04

Review the instructions on the form carefully to ensure all sections are completed correctly.

05

Attach any required supporting documents as indicated in the instructions.

06

Sign and date the form where indicated.

07

Submit the completed form by the method specified (mail, in-person, online, etc.).

Who needs MI 632?

01

Individuals applying for a specific license or permit.

02

Businesses needing to report information to regulatory agencies.

03

Anyone required to submit documentation to comply with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

Is there a new W4 form for 2022?

The 2022 Form W-4, Employee's Withholding Certificate, has not yet been released by the IRS. As soon as a new form is released we will notify you. Until then, you may use the 2021 W-4 version to make any changes to your withholdings.

Has the w4 form changed?

Allowances are no longer used for the redesigned Form W-4. This change is meant to increase transparency, simplicity, and accuracy of the form. In the past, the value of a withholding allowance was tied to the amount of the personal exemption.

What are the new W-4 changes?

How the W-4 form changed. The Form W-4 is now a full page instead of a half page, and yet it's still easier to understand. For starters, a lot of the basics have stayed the same. You still have to provide your name, address, filing status and Social Security number.

How do I claim 1 on the new 2022 w4?

Should I claim 1 or 0 on my W-4 Form? You can no longer claim allowances like 1 or 0 on your W-4 since the IRS redesigned the form. However, you can claim an exemption from withholding if you owed no income tax last year and don't expect to owe anything in the current year.

What tax forms do I need for 2022?

IRS Tax Forms 2022: What are the most common tax forms? Form 1040, Individual Income Tax Return. Form 1040-SR, U.S. Tax Return for Seniors. Form W-2, Wage and Tax Statement. Form W-4, Employee's Withholding Certificate. Form W-4P, Withholding Certificate for Pension or Annuity Payments. Form 1099-MISC, Miscellaneous Income.

Are 2022 w4s available?

Final versions of the 2022 Form W-4, Employee's Withholding Certificate, Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments, and Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, were released by the IRS.

When can you file Michigan taxes 2022?

The Internal Revenue Service (IRS) will open the IIT 2021 e-file season on January 24, 2022. Michigan will retrieve and acknowledge IIT e-file returns on the same day the IRS opens for e-file. E-filing and choosing Direct Deposit is the fastest way to receive your Michigan refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MI 632 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing MI 632 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the MI 632 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your MI 632 in minutes.

Can I edit MI 632 on an Android device?

You can make any changes to PDF files, like MI 632, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is MI 632?

MI 632 is a form used by the Michigan Department of Treasury for reporting certain tax information.

Who is required to file MI 632?

Individuals or businesses that engage in specific transactions that necessitate reporting to the Michigan Department of Treasury are required to file MI 632.

How to fill out MI 632?

To fill out MI 632, you need to provide your personal or business information, details of the transactions being reported, and any necessary documentation as required by the form's instructions.

What is the purpose of MI 632?

The purpose of MI 632 is to ensure compliance with state tax regulations by reporting financial information to the Michigan Department of Treasury.

What information must be reported on MI 632?

Information such as the type of transaction, amounts involved, and relevant dates must be reported on MI 632.

Fill out your MI 632 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 632 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.