Get the free GIFT-IN-KIND FORM - University of New Brunswick UNB

Show details

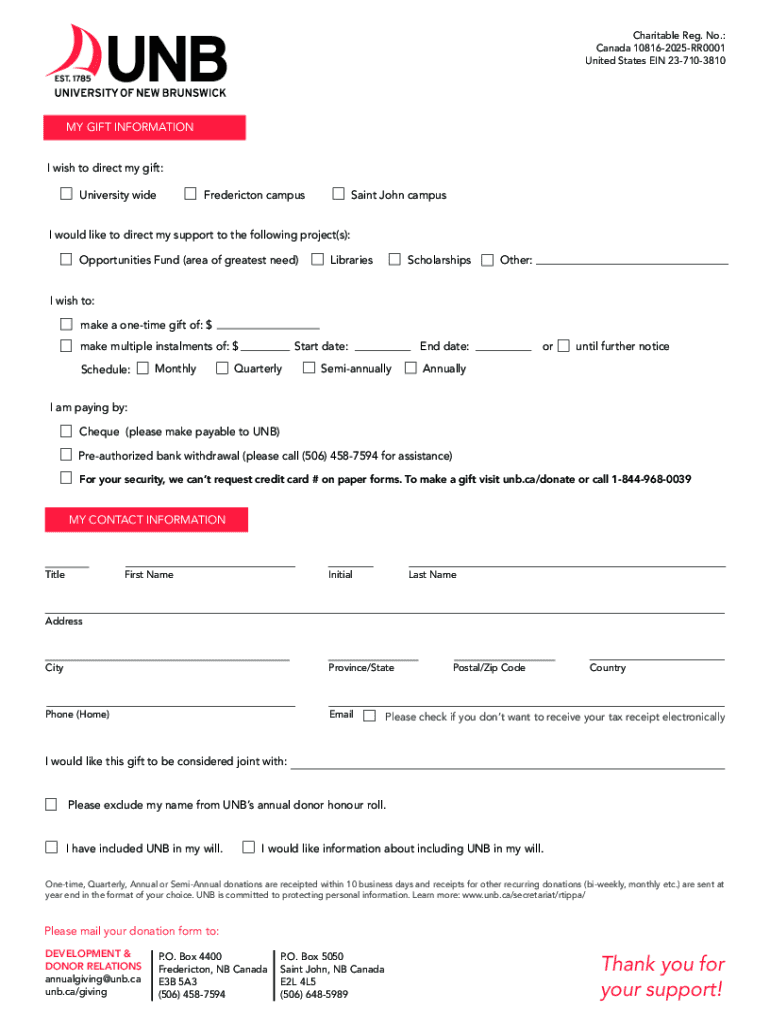

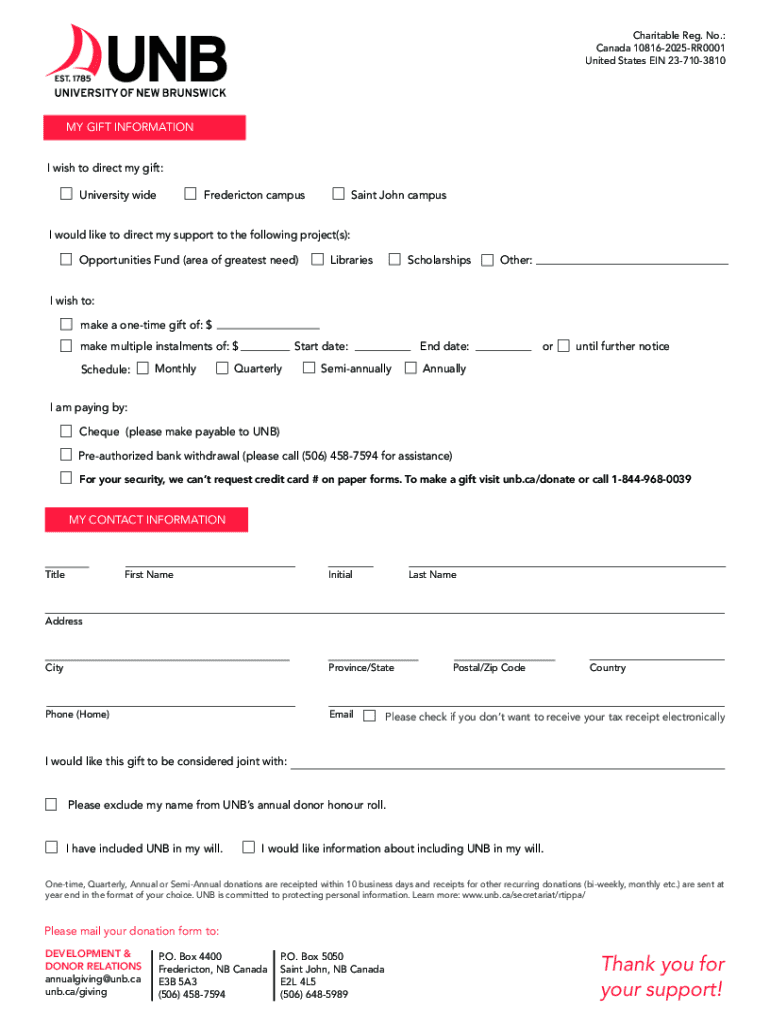

Charitable Reg. No.: Canada 108162025RR0001 United States EIN 237103810MY GIFT INFORMATION I wish to direct my gift: University wide Fredericton campusSaint John campus would like to direct my support

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift-in-kind form - university

Edit your gift-in-kind form - university form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift-in-kind form - university form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift-in-kind form - university online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift-in-kind form - university. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift-in-kind form - university

How to fill out gift-in-kind form - university

01

Start by downloading the gift-in-kind form from the university's website or obtain a physical copy from the relevant department.

02

Fill out your personal information, including your full name, contact details, and any other required identification details.

03

Provide a detailed description of the gift you intend to donate, including its nature, value, and any special characteristics.

04

Indicate whether the gift is an individual donation or a collective contribution from an organization or group.

05

If applicable, specify any restrictions or conditions attached to the gift, such as limitations on its use or intended beneficiaries.

06

If there are any tax implications related to the gift, ensure that you mention it on the form and provide any necessary supporting documents.

07

Review the completed form to ensure accuracy and completeness.

08

Submit the gift-in-kind form to the university's designated department or office either in person or through the provided submission channels.

09

Keep a copy of the submitted form for your records.

10

Wait for confirmation or further instructions from the university regarding the acceptance and process of your gift-in-kind.

Who needs gift-in-kind form - university?

01

Anyone who wishes to make a non-monetary donation to a university may need to fill out a gift-in-kind form.

02

This includes individuals, organizations, or groups who want to contribute valuable items, materials, equipment, or other assets to the university.

03

The gift-in-kind form ensures proper documentation and legal compliance for both the donor and the university.

04

For tax purposes, individuals or organizations seeking tax benefits for their donation may also be required to fill out the gift-in-kind form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find gift-in-kind form - university?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific gift-in-kind form - university and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in gift-in-kind form - university without leaving Chrome?

gift-in-kind form - university can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out gift-in-kind form - university on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your gift-in-kind form - university, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is gift-in-kind form - university?

The gift-in-kind form for a university is a document used to report donations of goods or services instead of cash.

Who is required to file gift-in-kind form - university?

The university or its representatives are required to file the gift-in-kind form.

How to fill out gift-in-kind form - university?

The gift-in-kind form for a university can typically be filled out online or in paper form, providing details about the donation and donor.

What is the purpose of gift-in-kind form - university?

The purpose of the gift-in-kind form for a university is to accurately report non-monetary gifts received by the institution.

What information must be reported on gift-in-kind form - university?

The gift-in-kind form for a university must include details such as the description of the gift, its estimated value, donor information, and date of donation.

Fill out your gift-in-kind form - university online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift-In-Kind Form - University is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.