Get the free life insurance beneficiary trust - Bing

Show details

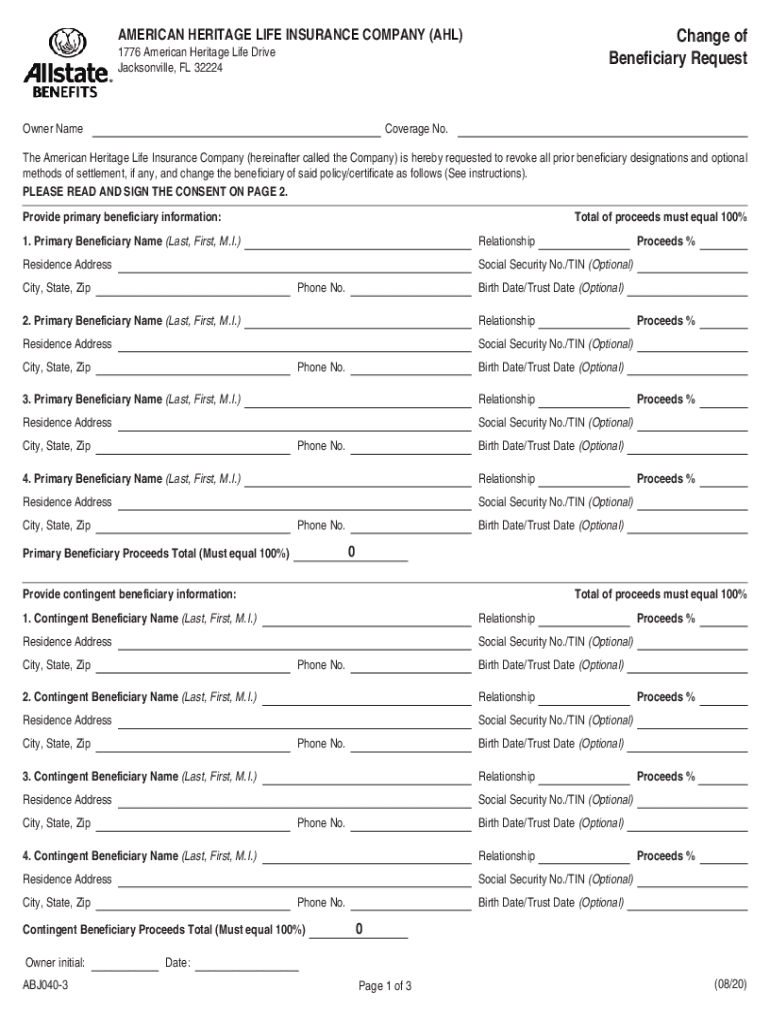

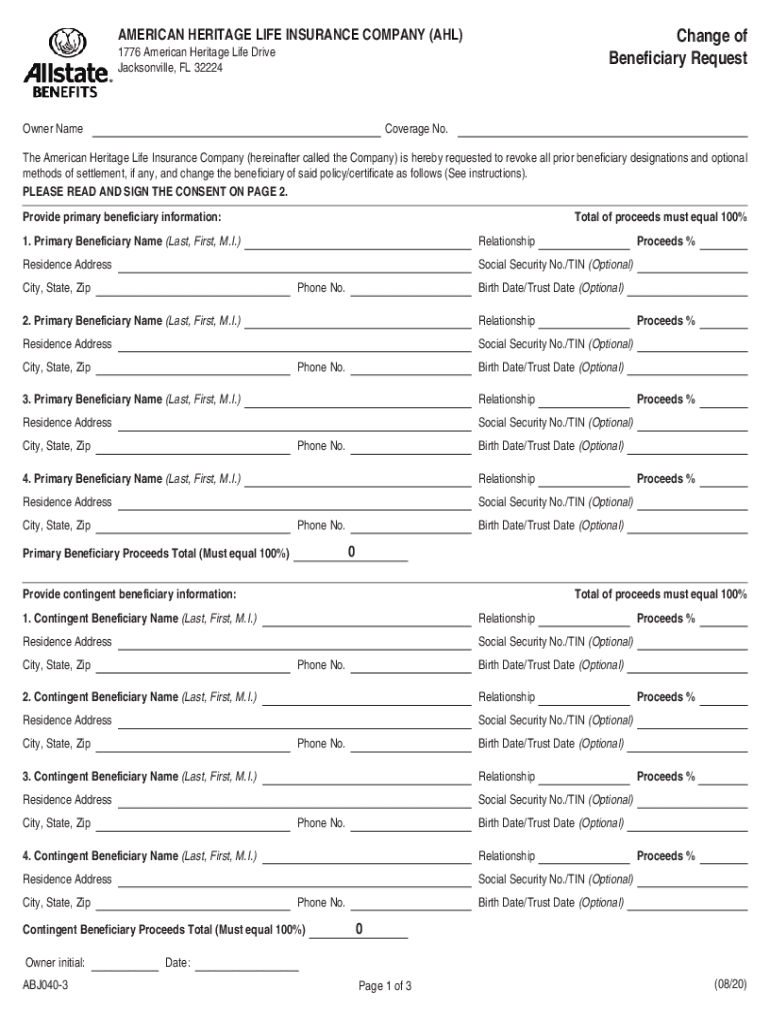

Change of Beneficiary RequestAMERICAN HERITAGE LIFE INSURANCE COMPANY (AHL) 1776 American Heritage Life Drive Jacksonville, FL 32224Owner NameCoverage No. The American Heritage Life Insurance Company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance beneficiary trust

Edit your life insurance beneficiary trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance beneficiary trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance beneficiary trust online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life insurance beneficiary trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance beneficiary trust

How to fill out life insurance beneficiary trust

01

To fill out a life insurance beneficiary trust, follow these steps:

02

Gather all necessary information about the life insurance policy, including the policy number, the policyholder's name, and the beneficiary's information.

03

Consult with an attorney or a financial advisor experienced in estate planning to ensure that a beneficiary trust is the right option for you.

04

Create the trust document, which should include the trust's name, the trustee's name, and the beneficiaries' names.

05

Specify the terms and conditions of the trust, such as how the trust assets will be managed and distributed.

06

Name a successor trustee who will take over the management of the trust in case the original trustee becomes unable or unwilling to fulfill their duties.

07

Sign the trust document in the presence of a notary public to make it legally binding.

08

Notify the life insurance company about the existence of the beneficiary trust and provide them with a copy of the trust document.

09

Review and update the beneficiary trust regularly to ensure it aligns with your current wishes and circumstances.

10

Consider working with an attorney or financial advisor throughout the process to ensure compliance with legal requirements and maximize the benefits of the beneficiary trust.

Who needs life insurance beneficiary trust?

01

Life insurance beneficiary trust is generally relevant for individuals who:

02

- Have substantial life insurance policies with significant benefit amounts.

03

- Desire to control how the life insurance proceeds are distributed after their death.

04

- Want to protect the insurance proceeds from potential creditors or legal claims.

05

- Have minor children or beneficiaries with special needs who may require ongoing financial management.

06

- Wish to minimize potential estate taxes by utilizing various trust strategies.

07

- Seek to keep the life insurance proceeds out of the probate process, ensuring a faster and more private distribution.

08

- Have concerns about the financial responsibility or management capabilities of their chosen beneficiaries.

09

As everyone's situation is unique, it is advisable to consult with an attorney or financial advisor familiar with estate planning to determine if a life insurance beneficiary trust is suitable for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send life insurance beneficiary trust to be eSigned by others?

Once you are ready to share your life insurance beneficiary trust, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit life insurance beneficiary trust in Chrome?

Install the pdfFiller Google Chrome Extension to edit life insurance beneficiary trust and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit life insurance beneficiary trust on an Android device?

You can make any changes to PDF files, like life insurance beneficiary trust, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is life insurance beneficiary trust?

A life insurance beneficiary trust is a legal entity created to receive the proceeds of a life insurance policy and distribute them according to the terms set forth in the trust agreement.

Who is required to file life insurance beneficiary trust?

The trustee of the life insurance beneficiary trust is responsible for filing the necessary paperwork and managing the trust assets.

How to fill out life insurance beneficiary trust?

To fill out a life insurance beneficiary trust, you will need to gather information about the beneficiaries, the policy details, and the terms of the trust agreement. You may also need to consult with an attorney to ensure the trust is properly structured.

What is the purpose of life insurance beneficiary trust?

The purpose of a life insurance beneficiary trust is to provide for the distribution of life insurance proceeds in a tax-efficient and controlled manner, according to the wishes of the policyholder.

What information must be reported on life insurance beneficiary trust?

The information that must be reported on a life insurance beneficiary trust includes the names and contact information of the beneficiaries, the policy details, and the terms of the trust agreement.

Fill out your life insurance beneficiary trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Beneficiary Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.