Get the free Record a returned or bounced check using an expense

Show details

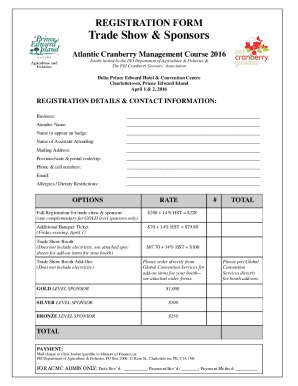

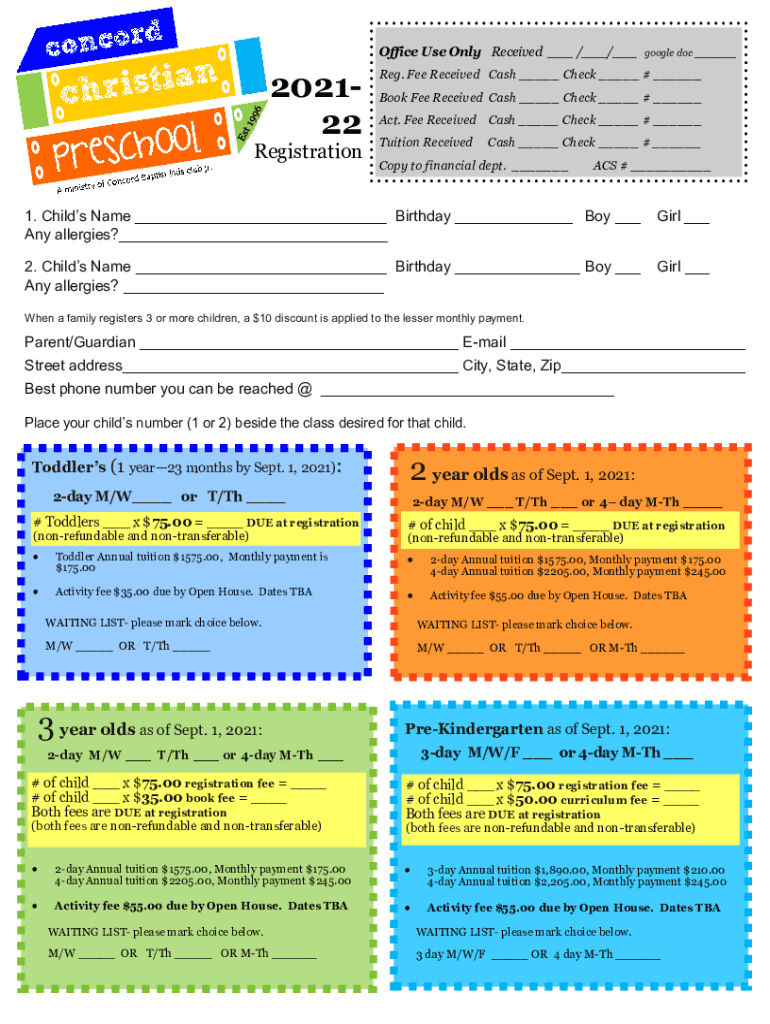

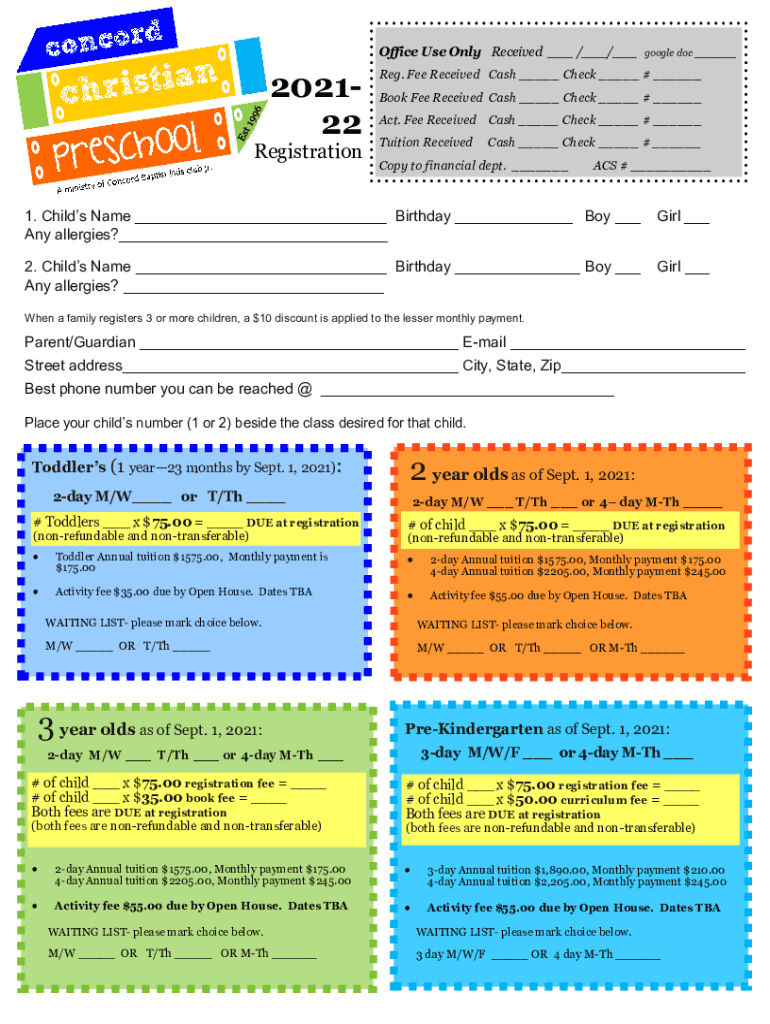

Office Use Only Received / / 202122Registrationgoogle doc Reg. Fee Received Cash Check # Book Fee Received Cash Check # Act. Fee Received Cash Check # Tuition Received Cash Check # Copy to financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign record a returned or

Edit your record a returned or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your record a returned or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit record a returned or online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit record a returned or. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out record a returned or

How to fill out record a returned or

01

To fill out and record a returned order, follow these steps:

02

Start by identifying the reason for the return. Is it due to a defect, wrong item, or simply a customer change of mind?

03

Ensure that you have the necessary information for the return, such as the order number, customer name, and date of purchase.

04

Prepare the return package by securely packaging the item and including any relevant documentation, such as return labels or receipts.

05

Label the package clearly with the return address, recipient's name, and any other instructions provided by the company.

06

Choose a suitable shipping method for the return and ensure that it has tracking capabilities to monitor the package's progress.

07

Send the package back to the company using the chosen shipping method.

08

Once the company receives the returned item, they will typically inspect it for any damages or signs of use.

09

If the return is approved, the company may issue a refund or offer a replacement, depending on their return policy.

10

Finally, update your records accordingly by noting the return date, refund details, and any other relevant information.

11

It's always recommended to communicate with the customer throughout the return process, providing updates and ensuring their satisfaction.

Who needs record a returned or?

01

Record a returned order is required by:

02

- E-commerce companies that sell products online and offer a return policy to their customers.

03

- Brick-and-mortar stores that have a return policy and need to keep track of returned items for accounting and inventory purposes.

04

- Customer service departments that handle returns and need to document the details of each returned item for future reference.

05

- Shipping and logistics companies that handle returned packages and need to record the relevant information for tracking and processing purposes.

06

- Online marketplaces that facilitate returns between buyers and sellers and require a record of returned items for dispute resolution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my record a returned or directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your record a returned or and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify record a returned or without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like record a returned or, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in record a returned or?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your record a returned or to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is record a returned or?

Record a returned or is a document that shows the details of returns made by a taxpayer.

Who is required to file record a returned or?

Any individual or entity that has made returns and needs to keep a record of them for tax purposes is required to file record a returned or.

How to fill out record a returned or?

Record a returned or can be filled out by providing details such as date of return, type of return, reason for return, and any other relevant information.

What is the purpose of record a returned or?

The purpose of record a returned or is to maintain a record of returns made by a taxpayer for tax compliance and auditing purposes.

What information must be reported on record a returned or?

Information such as date of return, type of return, reason for return, and any other relevant details must be reported on record a returned or.

Fill out your record a returned or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Record A Returned Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.