Get the free Information on Donating Gifts of Publicly Traded ...

Show details

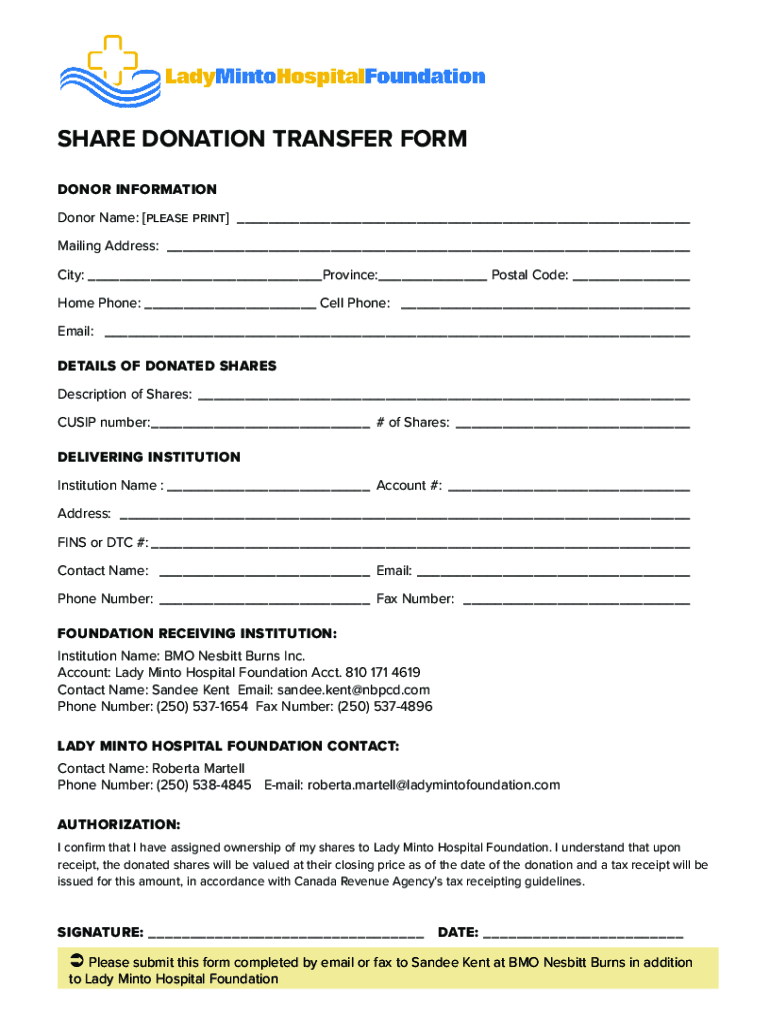

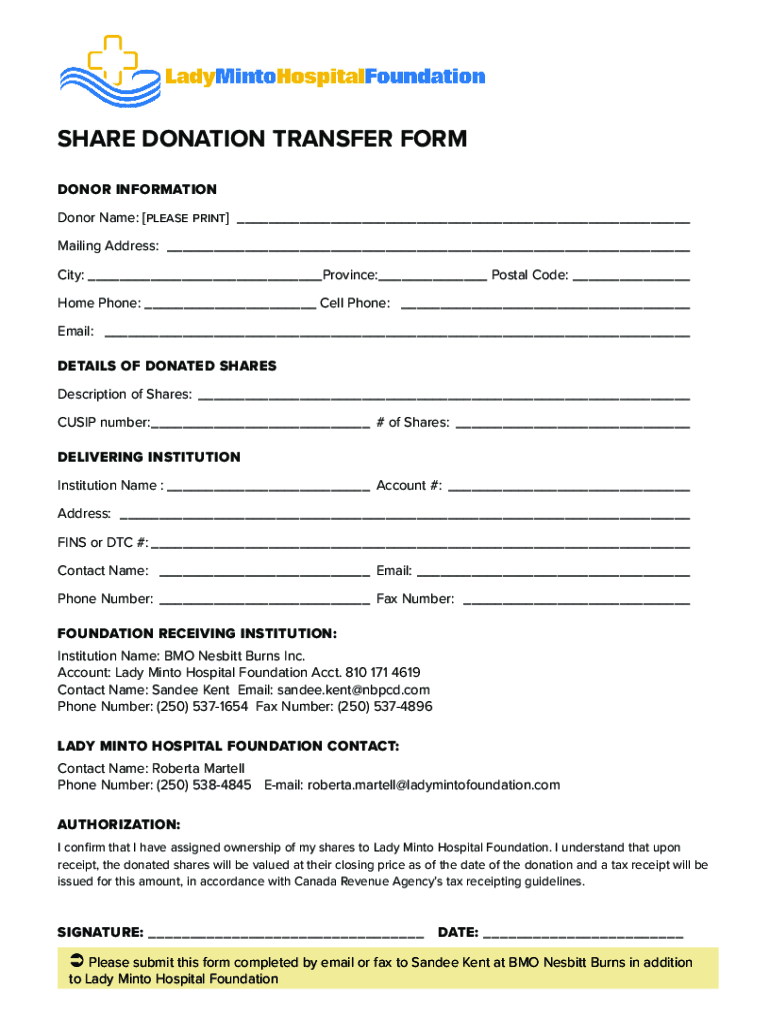

SHARE DONATION TRANSFER FORM DONOR INFORMATION Donor Name: please print Mailing Address: City: Province: Postal Code: Home Phone: Cell Phone: Email: DETAILS OF DONATED SHARES Description of Shares:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information on donating gifts

Edit your information on donating gifts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information on donating gifts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing information on donating gifts online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit information on donating gifts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out information on donating gifts

How to fill out information on donating gifts

01

Start by gathering all the necessary information about the gift you want to donate, including its description, condition, and any special instructions or restrictions.

02

Find a reputable organization or charity that accepts gift donations. You can search online or ask for recommendations from friends or family.

03

Contact the organization or charity to inquire about their specific donation process. Some may have online forms or paperwork to fill out, while others may require a phone call or in-person visit.

04

Follow the instructions provided by the organization to accurately and completely fill out the information about your gift. Be sure to provide any requested documentation or proof of ownership if necessary.

05

Double-check all the information you have filled out to ensure its accuracy. Make sure you have included all relevant details about the gift to avoid any confusion or misunderstandings.

06

Submit the completed information and any required documentation to the organization. Follow their instructions for delivery or drop-off of the physical gift if applicable.

07

Keep a record of your donation and any receipts or acknowledgments provided by the organization. This can be useful for tax purposes or future reference.

08

If you have any questions or concerns during the donation process, don't hesitate to reach out to the organization for clarification or assistance.

Who needs information on donating gifts?

01

Anyone who is interested in donating gifts to organizations or charities would benefit from information on how to fill out the necessary information. This includes individuals, businesses, or groups who want to contribute to a cause or help those in need through gift donations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my information on donating gifts in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign information on donating gifts and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send information on donating gifts for eSignature?

Once your information on donating gifts is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out information on donating gifts using my mobile device?

Use the pdfFiller mobile app to fill out and sign information on donating gifts. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is information on donating gifts?

Information on donating gifts includes details about gifts given to individuals or organizations, including the value of the gift and the recipient.

Who is required to file information on donating gifts?

Individuals or organizations who have given gifts valued above a certain threshold are required to file information on donating gifts.

How to fill out information on donating gifts?

Information on donating gifts can be filled out using a specific form provided by the relevant tax authority, including details about the gift, its value, and the recipient.

What is the purpose of information on donating gifts?

The purpose of information on donating gifts is to track and report gifts given for tax purposes, ensuring transparency and compliance with tax laws.

What information must be reported on information on donating gifts?

Information on donating gifts must include the value of the gift, the recipient's details, and any relevant dates associated with the gift.

Fill out your information on donating gifts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information On Donating Gifts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.