Get the free TAX INCREMENT FINANCING PROJECT PLAN APPLICATION

Show details

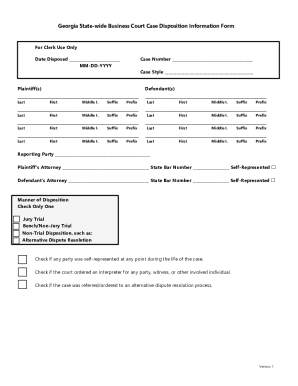

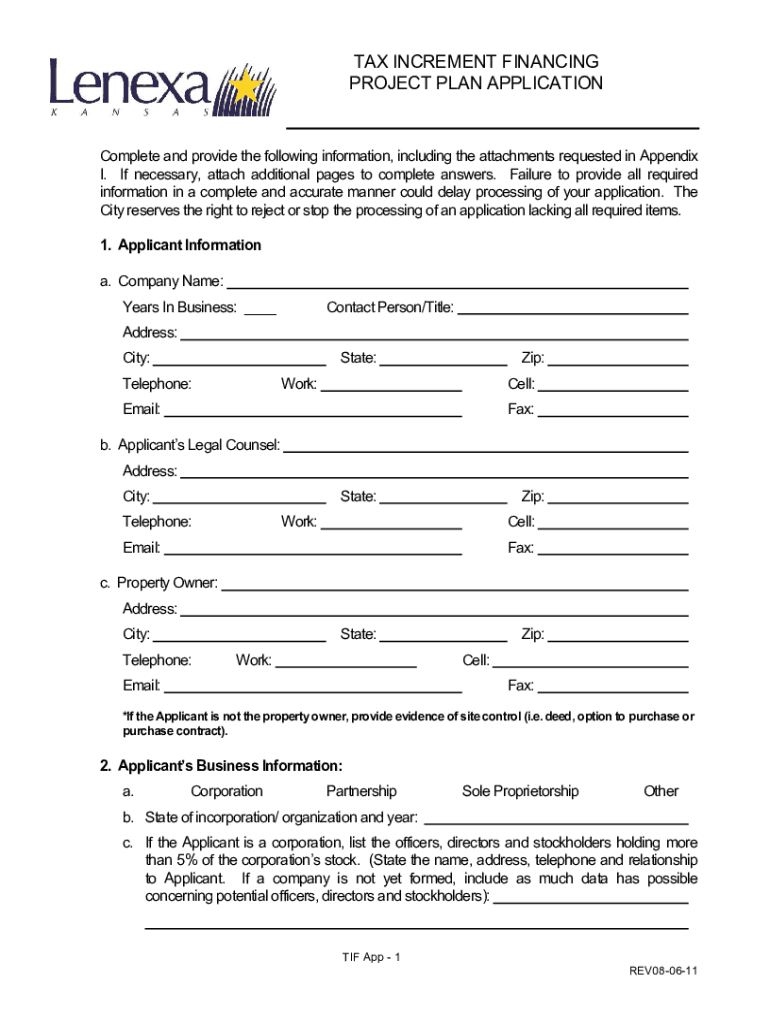

TAX INCREMENT FINANCING PROJECT PLAN APPLICATIONComplete and provide the following information, including the attachments requested in Appendix I. If necessary, attach additional pages to complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing project

Edit your tax increment financing project form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing project form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax increment financing project online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax increment financing project. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing project

How to fill out tax increment financing project

01

To fill out a tax increment financing project, follow these steps:

02

Gather the necessary financial and project information, including estimates of the project costs, anticipated property value increases, and potential revenue sources.

03

Identify the eligible project area or district where you intend to implement the tax increment financing project.

04

Determine the baseline property values in the project area. This will serve as the starting point for calculating future property value increments and tax revenue increases.

05

Calculate the tax increment, which is the difference between the actual property tax revenue generated within the project area and the baseline property tax revenue.

06

Develop a financing plan that outlines how the tax increment funds will be utilized to support the project. This may include infrastructure improvements, redevelopment efforts, or other eligible expenses.

07

Consult with relevant stakeholders, such as local government officials, community members, and potential private partners, to gather input and support for the tax increment financing project.

08

Prepare the necessary documentation, including a comprehensive project plan, budget, and analysis of the anticipated economic and community benefits.

09

Submit the tax increment financing project proposal to the appropriate governing body or regulatory agency for review and approval.

10

If approved, implement the project according to the established financing plan and continuously monitor and report on the progress and outcomes.

11

Regularly assess and adjust the tax increment financing project as needed to ensure its effectiveness and alignment with the intended goals and objectives.

Who needs tax increment financing project?

01

Tax increment financing projects can be beneficial for various entities, including:

02

- Local governments: They can use tax increment financing to spur economic development, revitalize blighted areas, and attract private investment.

03

- Developers: Tax increment financing can provide developers with additional funding sources and incentives to undertake projects that may have been financially infeasible without the additional support.

04

- Business owners: Tax increment financing projects can create opportunities for business growth and expansion, enhance infrastructure and amenities, and increase property values within a designated area.

05

- Community organizations: Tax increment financing projects can contribute to improved quality of life, increased job opportunities, and enhanced community facilities and services.

06

- Residents: Tax increment financing can lead to improved living conditions, increased employment opportunities, and a more vibrant and prosperous local economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax increment financing project from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax increment financing project into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get tax increment financing project?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the tax increment financing project in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out tax increment financing project on an Android device?

Complete tax increment financing project and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is tax increment financing project?

Tax increment financing project is a public financing tool used to stimulate economic development in a designated area by capturing the increase in property tax revenue.

Who is required to file tax increment financing project?

The local government or municipality is typically required to file for tax increment financing project.

How to fill out tax increment financing project?

To fill out a tax increment financing project, the local government must provide detailed information about the designated area, proposed development projects, and projected increase in property tax revenue.

What is the purpose of tax increment financing project?

The purpose of tax increment financing project is to promote economic development, improve infrastructure, and revitalize underdeveloped areas.

What information must be reported on tax increment financing project?

Information such as the boundaries of the designated area, proposed development projects, and projected increase in property tax revenue must be reported on tax increment financing project.

Fill out your tax increment financing project online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing Project is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.