Get the free FAIR MARKET VALUATION Wainwright Dr. Boise, ID 83713 FORM ...

Show details

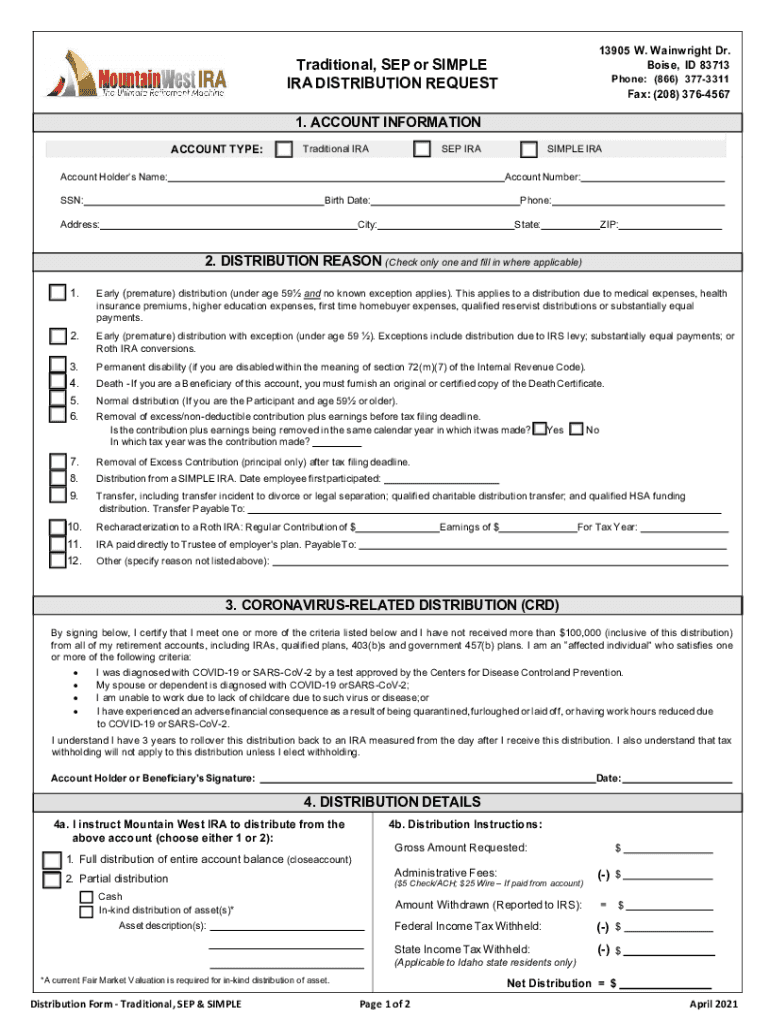

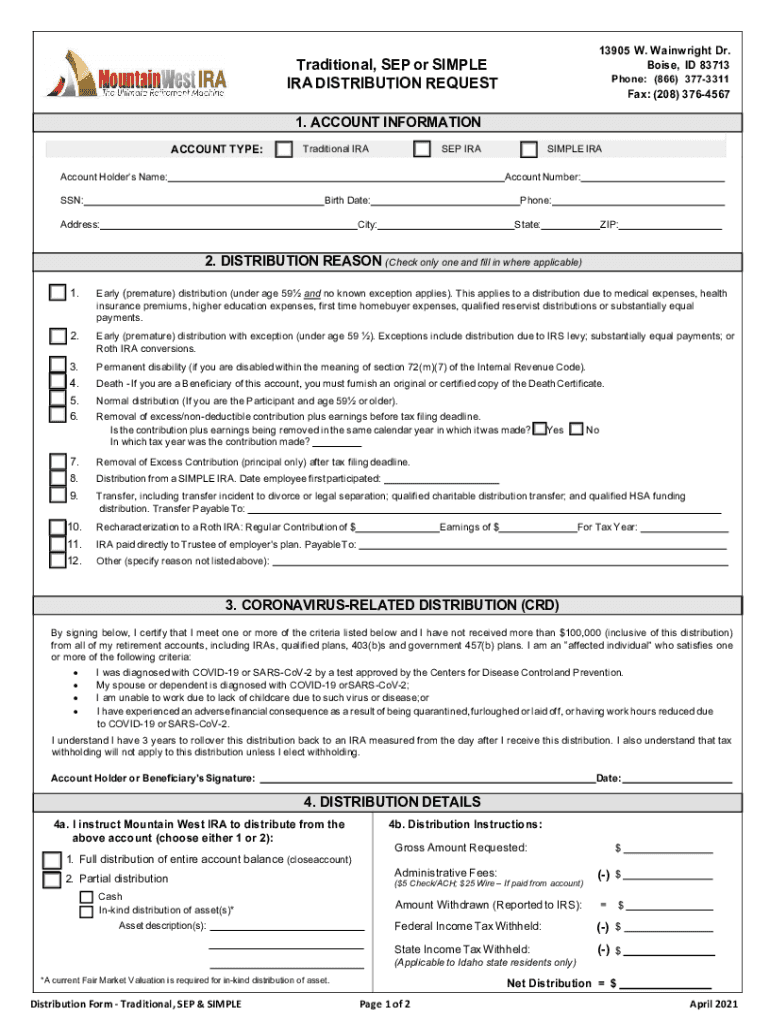

13905 W. Wainwright Dr. Boise, ID 83713Traditional, SEP or SIMPLE IRA DISTRIBUTION REQUESTPhone: (866) 3773311Fax: (208) 37645671. ACCOUNT INFORMATION ACCOUNT TYPE:Traditional IRA SEP Account Holders

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair market valuation wainwright

Edit your fair market valuation wainwright form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair market valuation wainwright form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fair market valuation wainwright online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fair market valuation wainwright. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair market valuation wainwright

How to fill out fair market valuation wainwright

01

To fill out the fair market valuation for Wainwright, follow these steps:

02

Start by gathering all the necessary information about the property you want to value.

03

Determine the purpose of the valuation. Is it for insurance, taxation, or other financial purposes?

04

Identify the appropriate valuation approach. Common methods include the market approach, income approach, and cost approach.

05

Research the local real estate market to understand the current trends and prices of similar properties.

06

Assess the property's condition, features, and any improvements made to determine its value.

07

Calculate the fair market value based on the chosen valuation approach and the gathered information.

08

Document the valuation process, including the data used, calculations made, and any assumptions or qualifications.

09

Double-check the completed fair market valuation form for accuracy and completeness.

10

Submit the filled-out fair market valuation form to the relevant party or authority.

11

Keep a copy of the valuation for your records.

12

Remember to consult with a professional appraiser or seek legal advice if needed.

Who needs fair market valuation wainwright?

01

Fair market valuation Wainwright is needed by various individuals and organizations, including:

02

- Property owners who want to determine the fair value of their property for selling, renting, or refinancing purposes.

03

- Investors who want to assess the potential value and return on investment of a property.

04

- Insurance companies that require accurate property valuations for insurance coverage purposes.

05

- Banks and financial institutions that need property valuations for mortgage or loan underwriting.

06

- Government authorities or tax agencies that require property valuations for taxation or assessment purposes.

07

- Legal professionals involved in property disputes, estate settlements, or divorce cases.

08

- Individuals or businesses involved in property transactions, such as buying or selling real estate.

09

- Financial advisors who provide guidance on property investments or portfolio management.

10

- Appraisal firms or professionals who offer valuation services.

11

- Anyone with an interest in understanding the fair market value of a property in Wainwright.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fair market valuation wainwright?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific fair market valuation wainwright and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit fair market valuation wainwright online?

The editing procedure is simple with pdfFiller. Open your fair market valuation wainwright in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my fair market valuation wainwright in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your fair market valuation wainwright directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is fair market valuation wainwright?

Fair market valuation Wainwright refers to the process of determining the market value of property or assets within the jurisdiction of Wainwright, often for taxation and financial reporting purposes.

Who is required to file fair market valuation wainwright?

Individuals or entities holding property or assets within Wainwright that need to declare their fair market value for tax assessment purposes are required to file fair market valuation.

How to fill out fair market valuation wainwright?

To fill out the fair market valuation Wainwright, one must complete the designated form by providing accurate information about the property or assets, including their current market value, location, and any relevant details specified by local regulations.

What is the purpose of fair market valuation wainwright?

The purpose of fair market valuation Wainwright is to assess the value of properties and assets for taxation, ensuring that property taxes are levied fairly and equitably based on their true market value.

What information must be reported on fair market valuation wainwright?

The information that must be reported includes property type, location, current market value, ownership details, and any relevant exemptions or assessments as required by local authorities.

Fill out your fair market valuation wainwright online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Market Valuation Wainwright is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.