NY IT-255 2021 free printable template

Show details

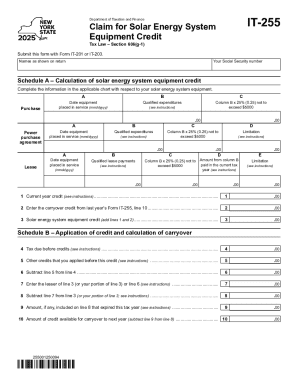

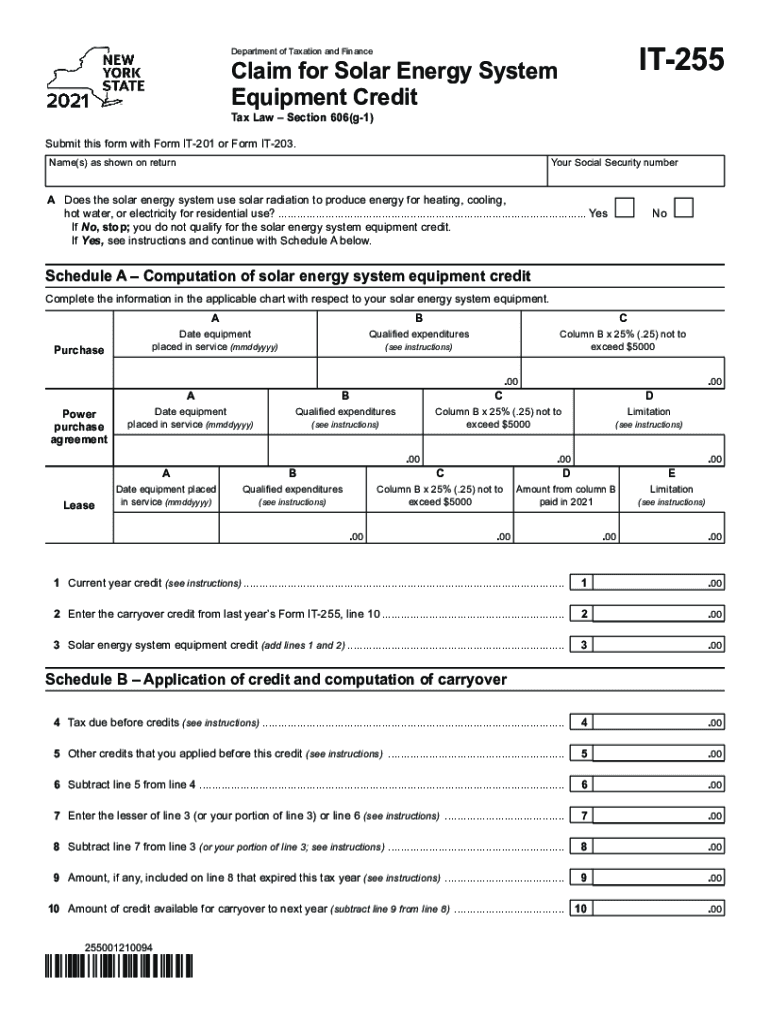

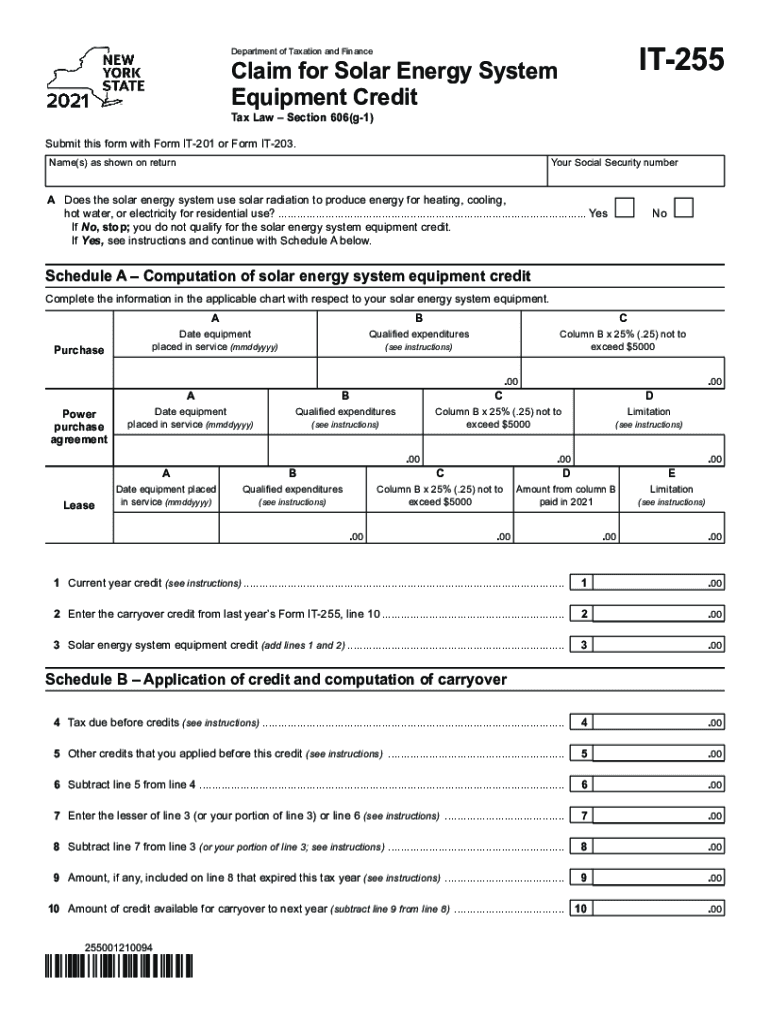

IT255Department of Taxation and FinanceClaim for Solar Energy System Equipment Credit Tax Law Section 606(g1) Submit this form with Form IT201 or Form IT203. Name(s) as shown on returner Social Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-255

Edit your NY IT-255 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-255 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY IT-255 online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY IT-255. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-255 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-255

How to fill out NY IT-255

01

Obtain the NY IT-255 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information, including your name, address, and Social Security number at the top of the form.

03

Indicate if you are filing as an individual or a corporation.

04

Follow the instructions to calculate your New York State income allocation percentages.

05

Enter the total amounts on the appropriate lines as per your calculations.

06

Review the eligibility criteria for the credit and ensure you meet them.

07

Sign and date the form at the bottom.

08

Submit the completed form along with your tax return.

Who needs NY IT-255?

01

Individuals or businesses that have incurred specific expenses for research and development in New York State may need to file NY IT-255.

02

Taxpayers seeking to claim the New York State investment tax credit or the disability income credit should also use this form.

03

Those who have partners or members in a partnership or LLC that qualify for the credits may be required to complete and submit NY IT-255.

Fill

form

: Try Risk Free

People Also Ask about

How does the NYS solar tax credit work?

New York State solar tax credit. The NY State Solar Energy System Equipment Tax Credit is a mouthful, but it's also one of the best state solar tax credits in the country. The tax credit is worth 25% of the installed cost of your system or $5,000 – whichever is less.

Can you write off solar panels on taxes?

When you purchase solar equipment for your home and have tax liability, you generally can claim a solar tax credit to lower your tax bill. The Residential Clean Energy Credit is non-refundable meaning that it can offset your income tax liability dollar-for-dollar, but any excess credit won't be refunded.

Can you claim the solar tax credit more than once?

How Many Times Can You Claim Solar Tax Credit? You can claim the solar tax credit only once. However, you may be able to claim it more times in case you have more than one solar-powered property.

What is the NYS solar tax credit for 2023?

You can claim 30% of your solar installation costs as a tax credit, and the benefit remains available through 2034. ing to the March 2023 Solar Market Insight Report, U.S. homeowners can expect to pay $3.30 per watt of solar capacity installed.

What is the solar property tax credit in NYC?

The Solar Electric Generating Systems Tax Abatement program provides a four-year tax abatement of 5% of eligible expenditures. The maximum abatement is $62,500 per year for 4 years or the building's annual tax liability (whichever is less). Contact the Department of Buildings for more information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY IT-255 online?

pdfFiller has made it simple to fill out and eSign NY IT-255. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out the NY IT-255 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY IT-255 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit NY IT-255 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign NY IT-255. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is NY IT-255?

NY IT-255 is a tax form used in New York for claiming a credit for certain eligible expenses related to college tuition, student loans, and other qualifying educational expenses.

Who is required to file NY IT-255?

Individuals who are eligible to claim the educational credit associated with qualified tuition and educational expenses must file NY IT-255.

How to fill out NY IT-255?

To fill out NY IT-255, taxpayers must provide their personal information, details of eligible expenses, and calculations for the credits they are claiming.

What is the purpose of NY IT-255?

The purpose of NY IT-255 is to allow taxpayers to report and claim credits for educational expenses incurred by themselves or their dependents.

What information must be reported on NY IT-255?

The information that must be reported includes taxpayer identification details, type and amount of expenses, and any other necessary documentation to support the claim.

Fill out your NY IT-255 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-255 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.