IRS Instructions 8962 2021 free printable template

Get, Create, Make and Sign IRS Instructions 8962

How to edit IRS Instructions 8962 online

Uncompromising security for your PDF editing and eSignature needs

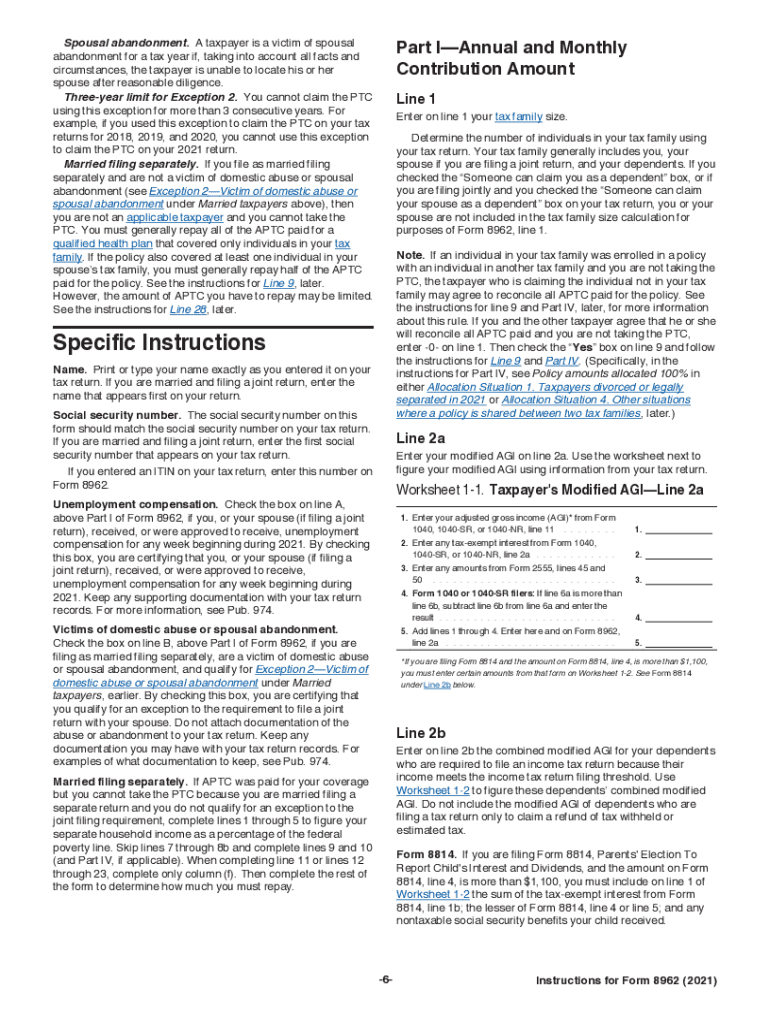

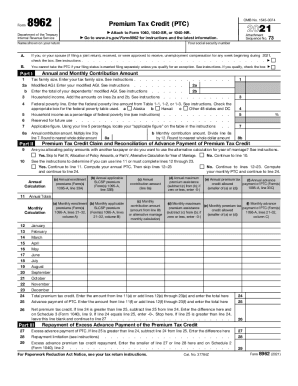

IRS Instructions 8962 Form Versions

How to fill out IRS Instructions 8962

How to fill out IRS Instructions 8962

Who needs IRS Instructions 8962?

Instructions and Help about IRS Instructions 8962

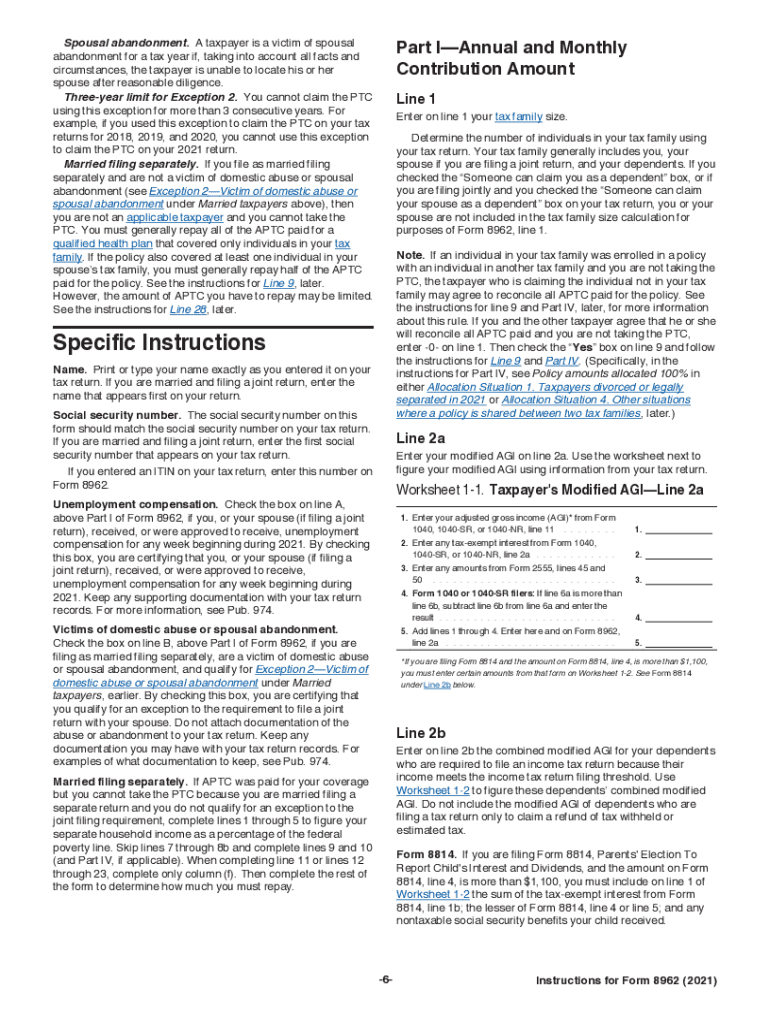

In this video I want to work through an example of filling out form 8962 for the premium tax credit this is going to be a relatively simple example I'm going to be filling it out for a single person who had uniform coverage throughout the entire course of the tax year so if you have a more complicated scenario or if you're married if you have dependents if you change coverage throughout the year you change jobs all these sorts of different variations that you can have that can affect this form I will link some helpful information down in the video description from the IRS that goes through examples of all these different types of scenarios, so again it can be helpful information, and I'll link it down in the video description, but I just want to run through this example here of a single person so starting off here at the top line the name that's shown on your tax return we're going to write John Doe with our social security number and then moving on since this is a single person we don't need to check this box that says you cannot take the premium tax credit...

People Also Ask about

What is form 8962 used to calculate?

What does the e file database indicates that Form 8962?

Why is the IRS asking me for form 8962?

Where do I put 8962 on my 1040?

What is Form 8862?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the IRS Instructions 8962 in Gmail?

How do I fill out the IRS Instructions 8962 form on my smartphone?

Can I edit IRS Instructions 8962 on an Android device?

What is IRS Instructions 8962?

Who is required to file IRS Instructions 8962?

How to fill out IRS Instructions 8962?

What is the purpose of IRS Instructions 8962?

What information must be reported on IRS Instructions 8962?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.