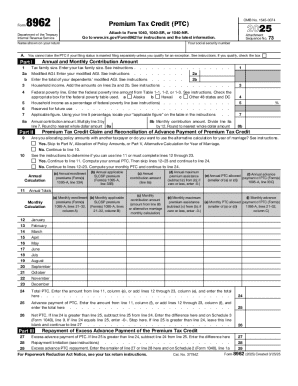

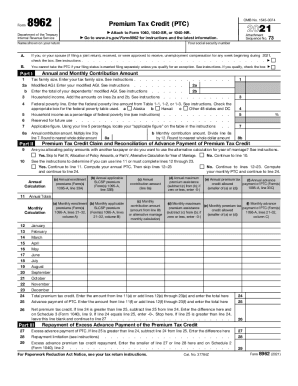

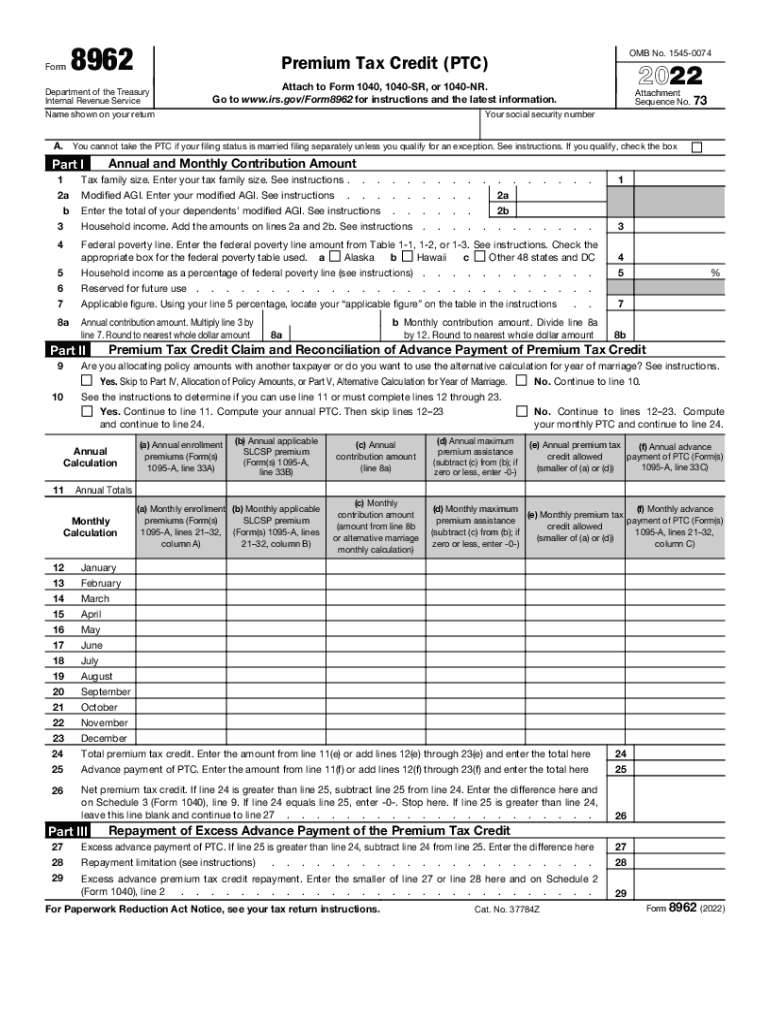

IRS 8962 2022 free printable template

Instructions and Help about IRS 8962

How to edit IRS 8962

How to fill out IRS 8962

About IRS 8 previous version

What is IRS 8962?

Who needs the form?

Components of the form

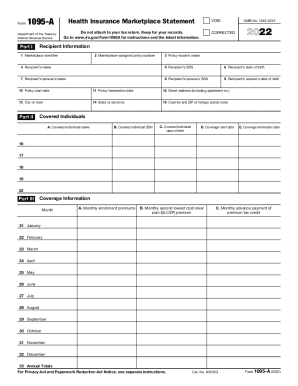

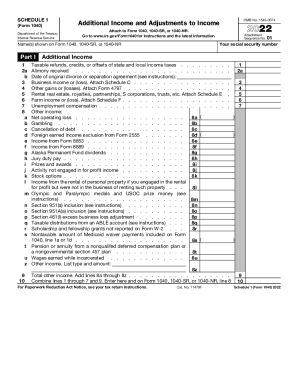

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8962

What should I do if I discover mistakes after submitting IRS 8962?

If you notice errors on your submitted IRS 8962, you can file an amended return using Form 1040-X. Ensure that you include a corrected version of the IRS 8962 to accurately reflect any changes. It's essential to keep documentation supporting your corrections for future reference.

How can I track the status of my IRS 8962 submission?

To track your IRS 8962, you can use the IRS 'Where's My Amended Return?' tool or the e-file status tracking feature if you filed electronically. This tool allows you to verify receipt and processing status, helping you stay informed about any potential issues.

What common mistakes should I be aware of to avoid issues with my IRS 8962?

Common errors include incorrect taxpayer identification numbers and discrepancies in income reporting. Ensuring that your figures match other submitted documents and double-checking to confirm that all relevant information is included can help prevent these mistakes.

Is electronic filing of IRS 8962 secure, and are e-signatures accepted?

Yes, electronic filing of IRS 8962 is secure, provided you use the IRS-approved software. E-signatures are accepted for this form, but you must ensure that your chosen e-filing platform complies with IRS security standards to protect your sensitive information.

What should I do if I receive a notice regarding my submitted IRS 8962?

Upon receiving a notice related to your IRS 8962, carefully read the instructions provided. Prepare to respond with any required documentation, and consider seeking assistance from a tax professional to ensure compliance and a proper resolution of the issue.

See what our users say