IRS 8938 2021-2025 free printable template

Show details

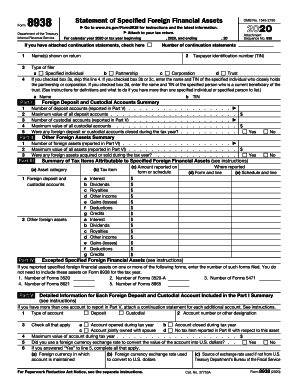

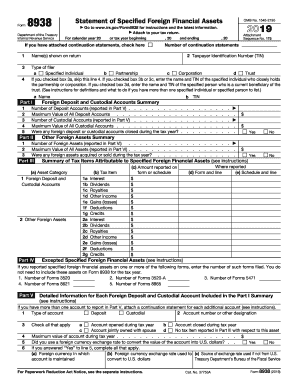

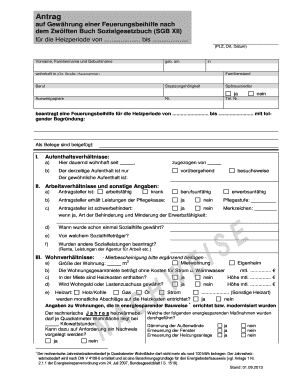

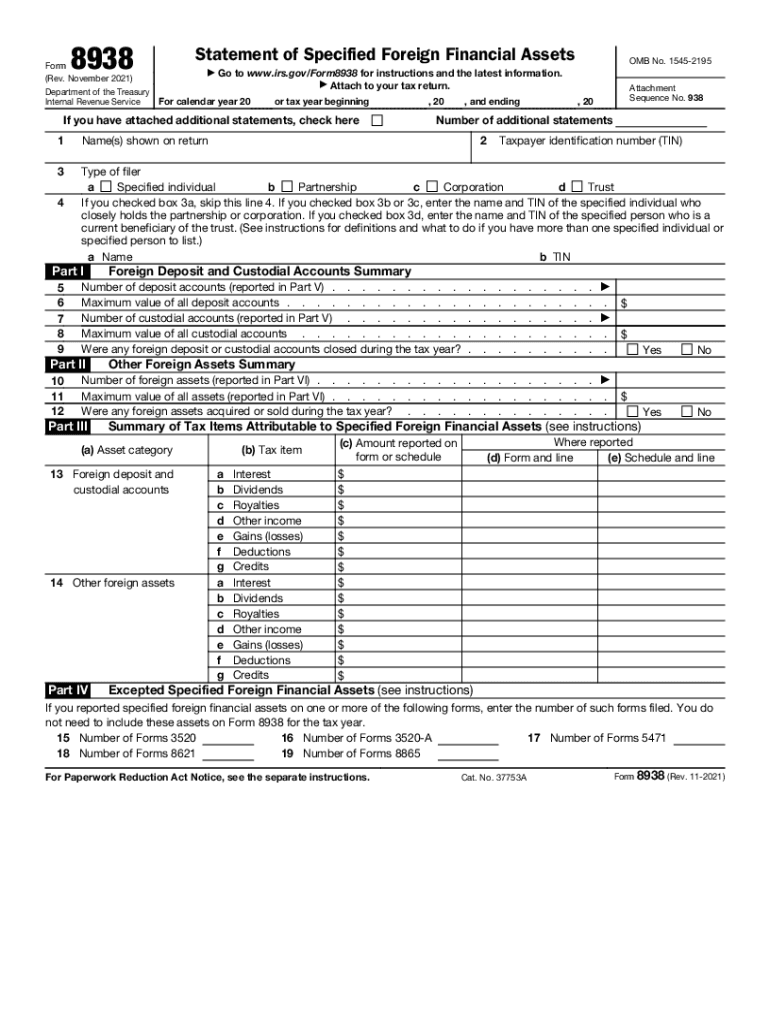

15 Number of Forms 3520 For Paperwork Reduction Act Notice see the separate instructions. Cat. No. 37753A Form 8938 Rev. 11-2021 Page 2 Part V Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part I Summary see instructions If you have more than one account to report in Part V attach a separate statement for each additional account. Number of custodial accounts reported in Part V. b Tax item e f g Interest Dividends Royalties Other income Gains losses...Deductions Credits Where reported d Form and line e Schedule and line c Amount reported on form or schedule Excepted Specified Foreign Financial Assets see instructions If you reported specified foreign financial assets on one or more of the following forms enter the number of such forms filed. You do not need to include these assets on Form 8938 for the tax year. Statement of Specified Foreign Financial Assets Form Go to www*irs*gov/Form8938 for instructions and the latest information* Rev*...November 2021 Attach to your tax return* Department of the Treasury For calendar year 20 or tax year beginning and ending Internal Revenue Service If you have attached additional statements check here OMB No* 1545-2195 Attachment Sequence No* 938 Number of additional statements Name s shown on return Type of filer Specified individual b Partnership c Corporation d Trust a If you checked box 3a skip this line 4. If you checked box 3b or 3c enter the name and TIN of the specified individual who...closely holds the partnership or corporation* If you checked box 3d enter the name and TIN of the specified person who is a current beneficiary of the trust. See instructions for definitions and what to do if you have more than one specified individual or specified person to list. a Name b TIN Part I. Yes No Summary of Tax Items Attributable to Specified Foreign Financial Assets see instructions a Asset category 13 Foreign deposit and custodial accounts 14 Other foreign assets Other Foreign...Assets Summary Number of foreign assets reported in Part Vl. Maximum value of all assets reported in Part Vl. Were any foreign assets acquired or sold during the tax year Taxpayer identification number TIN Foreign Deposit and Custodial Accounts Summary Number of deposit accounts reported in Part V. See instructions. Deposit 21 Account number or other designation Type of account Custodial Account opened during tax year Account closed during tax year Check all that apply Account jointly owned with...spouse No tax item reported in Part III with respect to this asset Did you use a foreign currency exchange rate to convert the value of the account into U*S* dollars. If you answered Yes to line 24 complete all that apply. a Foreign currency in which account is maintained used to convert to U*S* dollars Treasury Department s Bureau of the Fiscal Service b Global Intermediary Identification Number GIIN Optional Mailing address of financial institution in which account is maintained* Number street...and room or suite no.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8938

How to edit IRS 8938

How to fill out IRS 8938

Instructions and Help about IRS 8938

How to edit IRS 8938

To edit IRS Form 8938, you can utilize pdfFiller, which enables users to fill out and modify the form easily. Start by uploading the document to the platform. Once uploaded, you can click on any field to enter or change information. After editing, save your changes to ensure your form is up-to-date and accurate.

How to fill out IRS 8938

Filling out IRS Form 8938 entails providing detailed information about your foreign financial assets. Begin by gathering documentation of all applicable accounts and assets. Use the form’s guidelines to record the value and type of each asset, ensuring you accurately report the required information. Once complete, review the form for accuracy.

Latest updates to IRS 8938

Latest updates to IRS 8938

Check the IRS website regularly for updates related to Form 8938, as requirements and thresholds may change annually. Stay informed about any adjustments in filing thresholds or changes in compliance rules that could affect your filing obligations.

All You Need to Know About IRS 8938

What is IRS 8938?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 8938

What is IRS 8938?

IRS Form 8938, also known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service for certain U.S. taxpayers. It is used to report specified foreign financial assets if the total value exceeds a set threshold. This form aims to ensure compliance with U.S. tax regulations regarding foreign assets.

What is the purpose of this form?

The purpose of IRS Form 8938 is to report the ownership of foreign financial assets by U.S. taxpayers. This reporting is important for tax compliance as it helps the IRS identify unreported foreign income and prevents tax evasion. Failing to file this form when required can lead to significant penalties.

Who needs the form?

You need to file IRS Form 8938 if you are a U.S. citizen or resident alien and have specified foreign financial assets above certain thresholds. This includes accounts held outside the U.S. or foreign trusts and partnerships. The thresholds vary depending on your filing status and whether you reside in the U.S. or abroad.

When am I exempt from filling out this form?

Exemptions from filing IRS Form 8938 apply if your total specified foreign financial assets fall below the reporting thresholds. You may also be exempt if you are not required to file a U.S. tax return, or if you qualify under specific IRS guidelines related to aggregation and types of assets held.

Components of the form

The components of IRS Form 8938 include sections for reporting identification information, a list of specified foreign financial assets, and the total value of these assets. You will also report income generated from these assets. Accuracy in reporting each component is essential to avoid penalties.

Due date

IRS Form 8938 is due on the same date as your federal income tax return, including any extensions. This generally means April 15 for most taxpayers, with an extension available to October 15 if properly filed. Be sure to check current year deadlines as they can vary.

What payments and purchases are reported?

Payments and purchases relevant for IRS Form 8938 include interest, dividends, and capital gains derived from foreign financial assets. Additionally, if you sell or otherwise dispose of any foreign assets, these transactions may need to be reported according to specific IRS guidelines.

How many copies of the form should I complete?

Typically, you need to complete one copy of IRS Form 8938 for filing with your federal tax return. However, retain additional copies for your records. If you have multiple assets to report in different categories, ensure that you provide accurate and complete information in the single submission.

What are the penalties for not issuing the form?

Penalties for not filing IRS Form 8938 can be significant. The IRS imposes a failure-to-file penalty starting at $10,000, with additional penalties accruing for continued failure after notification. Misreporting can also lead to severe fines, increasing based on the amount of unreported assets.

What information do you need when you file the form?

To file IRS Form 8938, you must gather information about your foreign financial accounts, including their locations, account numbers, and maximum values during the tax year. Additionally, you’ll need to report income earned from these assets and any foreign trusts or partnerships you may have.

Is the form accompanied by other forms?

IRS Form 8938 is typically filed in conjunction with your standard federal income tax return forms. Depending on your situation, you may also need to complete additional forms that pertain to foreign income or assets, such as Form 5471 or Form 8865.

Where do I send the form?

You should send IRS Form 8938 along with your federal tax return to the address specified in the form instructions. For those filing electronically, ensure your tax software supports the submission of this particular form.

See what our users say