Get the free Schedule B (Form 5713)

Show details

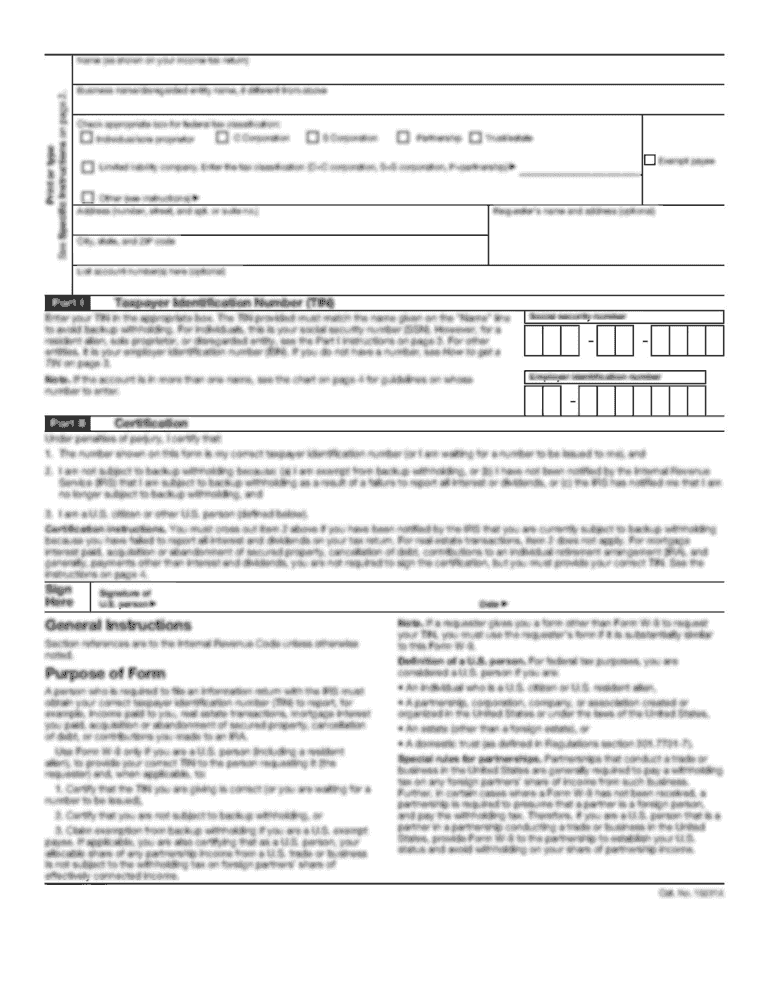

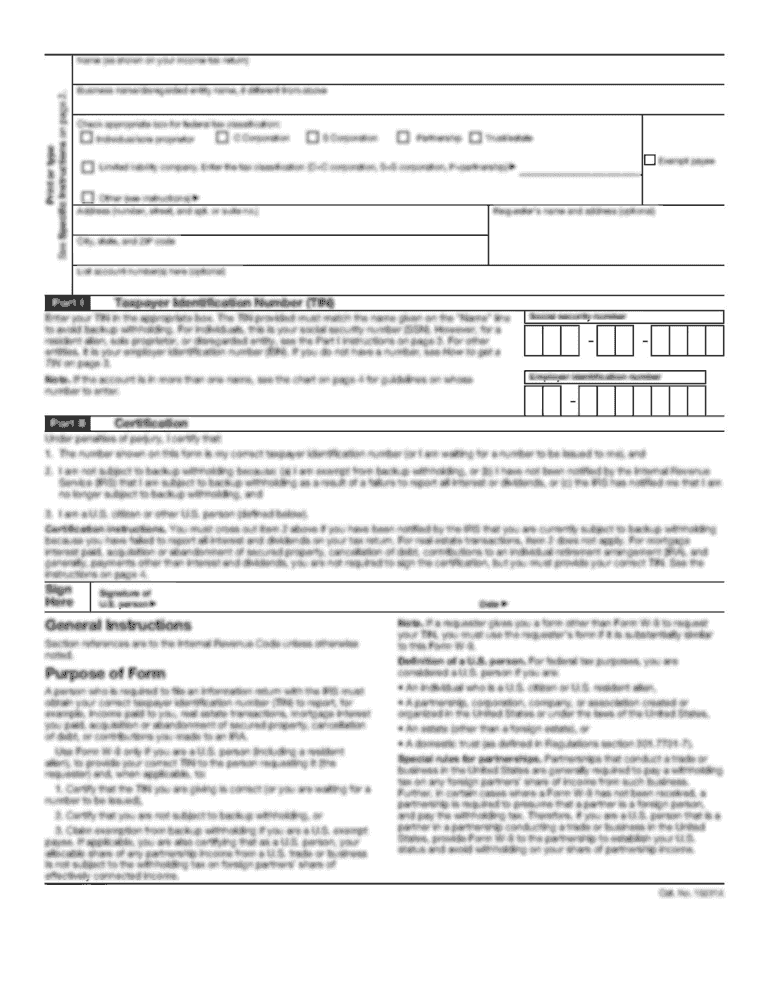

Complete this schedule if you participated in or cooperated with an international boycott and need to compute the specifically attributable taxes and income. Attach it to Form 5713.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule b form 5713

Edit your schedule b form 5713 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule b form 5713 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule b form 5713 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit schedule b form 5713. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule b form 5713

How to fill out Schedule B (Form 5713)

01

Obtain Schedule B (Form 5713) from the IRS website or your tax preparer.

02

Read the instructions carefully to understand the purpose of the form.

03

Begin by filling in your identifying information, including your name, address, and taxpayer identification number.

04

Review each section of the form and gather any necessary documentation or data required for completion.

05

Follow each line item sequentially, entering the requested information such as income from foreign partnerships, corporations, and foreign trusts.

06

Ensure accuracy in your entries to avoid errors in your tax return.

07

Review the completed form for any omissions or mistakes before submission.

08

File Schedule B along with your Form 5713 and your overall tax return by the required deadline.

Who needs Schedule B (Form 5713)?

01

U.S. persons, including citizens and residents, who have interest in foreign corporations, partnerships, or trusts.

02

Taxpayers who are required to report income from foreign entities under U.S. tax law.

03

Individuals or entities that meet the qualifications outlined in IRS instructions for Form 5713.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file form B?

You do not need to include Form 1095-B with your federal or state tax return. But, the IRS and the California State Franchise Tax Board suggest that you save it with your tax records.

What happens if I don't file my 1099-B?

If you receive a Form 1099-B and do not report the transaction on your tax return, the IRS will likely send you a CP2000, Underreported Income notice. This IRS notice will propose additional tax, penalties and interest on this transaction and any other unreported income.

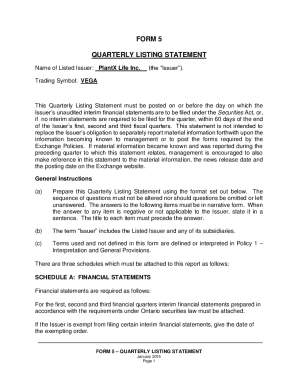

What is form 5713 Schedule B?

Form 5713 (Schedule B) Accessible is used to figure the loss of tax benefits by specifically attributing taxes and income. It is issued by the IRS and is required for individuals or businesses who participated an international boycott.

Do I have to file a schedule B?

For most taxpayers, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

Is Form 1095-B still required?

No. Currently the IRS does not require you to submit Form 1095-B with your federal income tax return, but you will need the information on Part IV in order to report months of coverage for you and your family.

What is a Schedule B tax form used for?

A Schedule B IRS form reports taxable interest and dividend income received during the tax year. Most taxpayers only need to file a Schedule B if they receive more than $1,500 of taxable interest or dividends.

What happens if I don't file my 1095-B?

Form 1095-B is not needed to file your tax return. On the other hand, if you signed up for health insurance through the marketplace, there's more work you'll need to do during tax time. You'll receive Form 1095-A from your marketplace (federal or state).

Does form 5713 need to be signed?

Form 5713 is due when your income tax return is due, including extensions. Attach the original copy of the Form 5713 (and Schedules A, B, and C, if applicable) to your income tax return. Do not sign the copy that is attached to your income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule B (Form 5713)?

Schedule B (Form 5713) is a tax form used by U.S. taxpayers to report their foreign tax credit and any taxes paid or accrued to foreign countries.

Who is required to file Schedule B (Form 5713)?

Taxpayers who claim a foreign tax credit or who have foreign income that is subject to taxation must file Schedule B (Form 5713).

How to fill out Schedule B (Form 5713)?

To fill out Schedule B (Form 5713), gather all relevant information on foreign income and taxes paid, follow the instructions provided with the form, and accurately report the figures in the designated sections.

What is the purpose of Schedule B (Form 5713)?

The purpose of Schedule B (Form 5713) is to calculate and report any foreign tax credits for taxes paid to foreign governments, ensuring taxpayers can reduce their U.S. tax liability on foreign income.

What information must be reported on Schedule B (Form 5713)?

On Schedule B (Form 5713), taxpayers must report details of foreign income, foreign taxes paid or accrued, and any relevant credits or deductions related to those taxes.

Fill out your schedule b form 5713 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule B Form 5713 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.