Get the free 2021-2022 Non-Tax Filer Form - Student

Show details

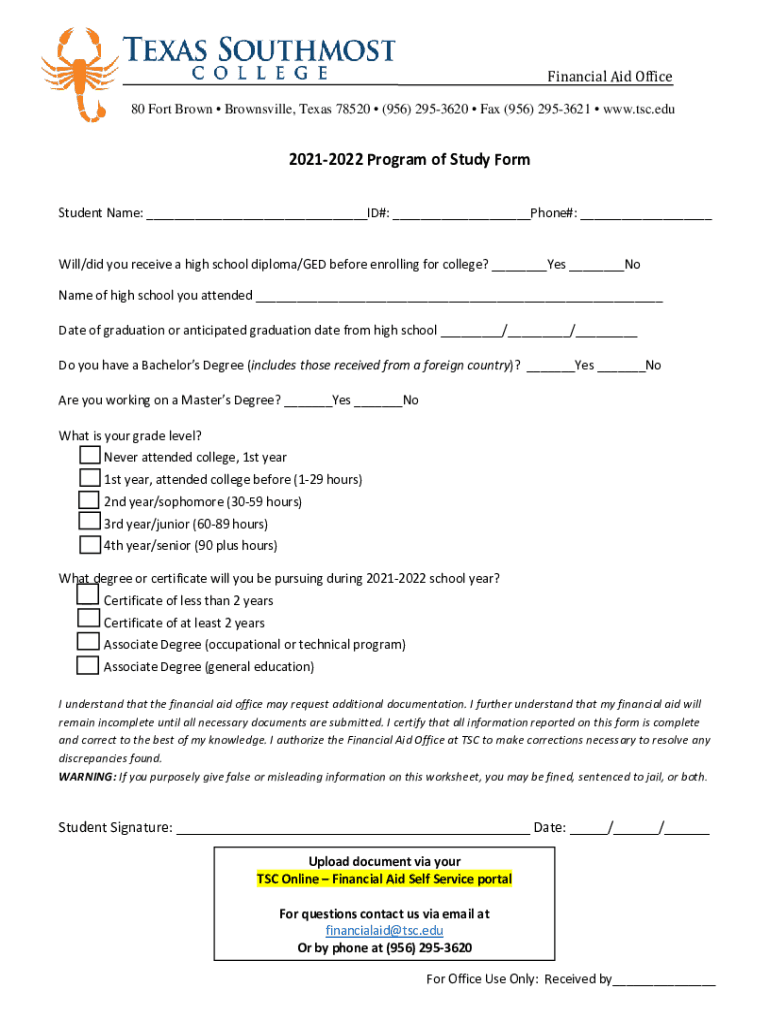

Financial Aid Office80 Fort Brown Brownsville, Texas 78520 (956) 2953620 Fax (956) 2953621 www.tsc.edu20212022 Program of Study Form Student Name: ID#: Phone#: Will/did you receive a high school diploma/GED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2021-2022 non-tax filer form

Edit your 2021-2022 non-tax filer form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2021-2022 non-tax filer form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2021-2022 non-tax filer form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2021-2022 non-tax filer form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2021-2022 non-tax filer form

How to fill out 2021-2022 non-tax filer form

01

To fill out the 2021-2022 non-tax filer form, follow these steps:

02

Gather your personal information, such as your full name, social security number, date of birth, and contact information.

03

Obtain the necessary forms. You can typically find the non-tax filer form on the official website of the organization or institution that requires it.

04

Carefully read the instructions provided on the form. Make sure to understand the requirements and provide accurate information.

05

Fill in your personal information in the designated fields of the form. Double-check for any errors or missing information before proceeding.

06

Provide any supporting documentation, if required. This may include proof of income or non-filing status, such as a statement from the IRS.

07

Review the completed form to ensure all information is accurate and legible.

08

Sign and date the form as indicated.

09

Submit the form as instructed. This could involve mailing it to the appropriate address or submitting it online through a secure portal.

10

Keep a copy of the form and any supporting documentation for your records.

11

It is always recommended to consult the specific instructions provided by the organization or institution to ensure you fulfill all requirements and complete the form correctly.

Who needs 2021-2022 non-tax filer form?

01

The 2021-2022 non-tax filer form is typically required by individuals who did not file a tax return for the specified tax year and need to provide proof of non-filing status.

02

Some common scenarios where this form may be needed include:

03

- Students or parents applying for financial aid or scholarships

04

- Individuals applying for certain government benefits or assistance programs

05

- Renters or tenants applying for housing assistance or low-income housing

06

- Individuals applying for certain types of loans or grants

07

- Non-residents or individuals with no income subject to federal tax

08

It is important to note that the specific requirements for who needs to submit the non-tax filer form may vary depending on the organization or institution requesting it. It is recommended to check the specific instructions or requirements provided by the entity requiring the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2021-2022 non-tax filer form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2021-2022 non-tax filer form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for signing my 2021-2022 non-tax filer form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 2021-2022 non-tax filer form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit 2021-2022 non-tax filer form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 2021-2022 non-tax filer form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is non-tax filer form?

Non-tax filer form is a form that individuals can fill out to declare that they did not file a tax return for a specific year.

Who is required to file non-tax filer form?

Individuals who did not earn enough income to be required to file a tax return are typically required to file a non-tax filer form.

How to fill out non-tax filer form?

Non-tax filer forms can usually be filled out online or through paper forms provided by the relevant tax authority. The form will require basic personal information and an explanation of why a tax return was not filed.

What is the purpose of non-tax filer form?

The purpose of the non-tax filer form is to inform the tax authority that an individual is not required to file a tax return for a specific year.

What information must be reported on non-tax filer form?

The non-tax filer form typically requires personal information such as name, address, social security number, and an explanation of why a tax return was not filed.

Fill out your 2021-2022 non-tax filer form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2021-2022 Non-Tax Filer Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.