Get the free GIFTS OF STOCK, BONDS, AND OTHER SECURITIES

Show details

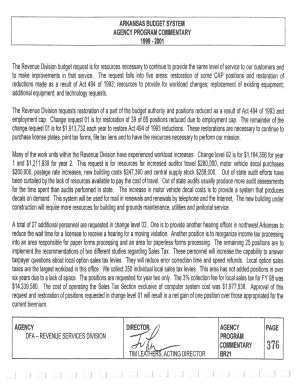

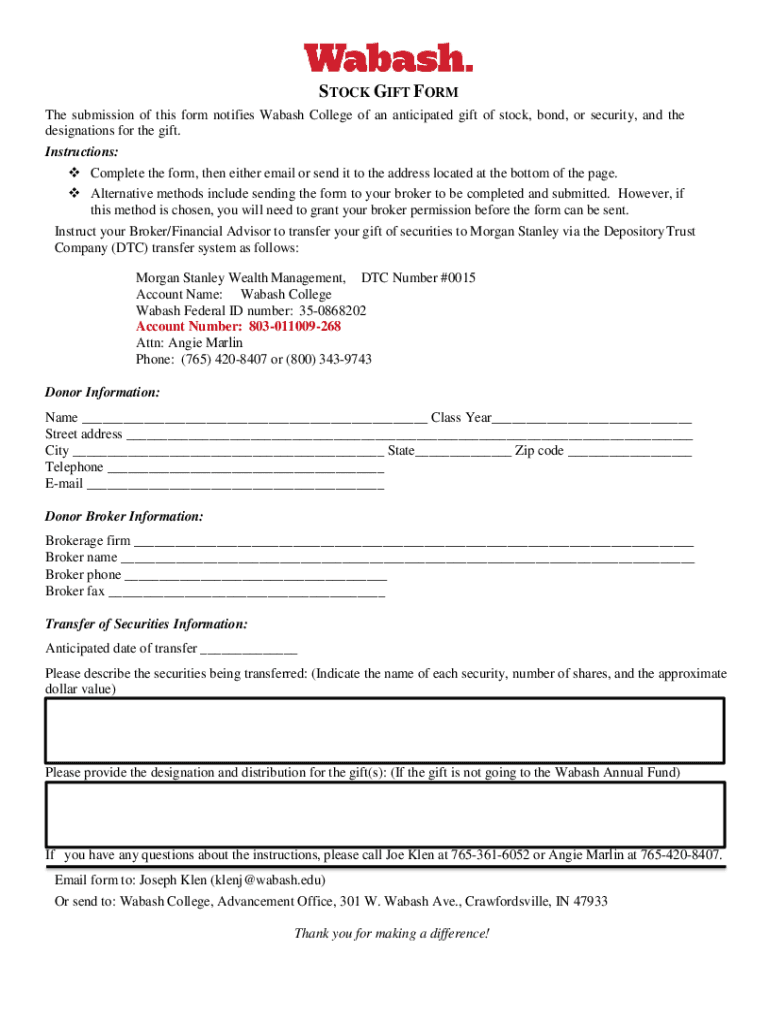

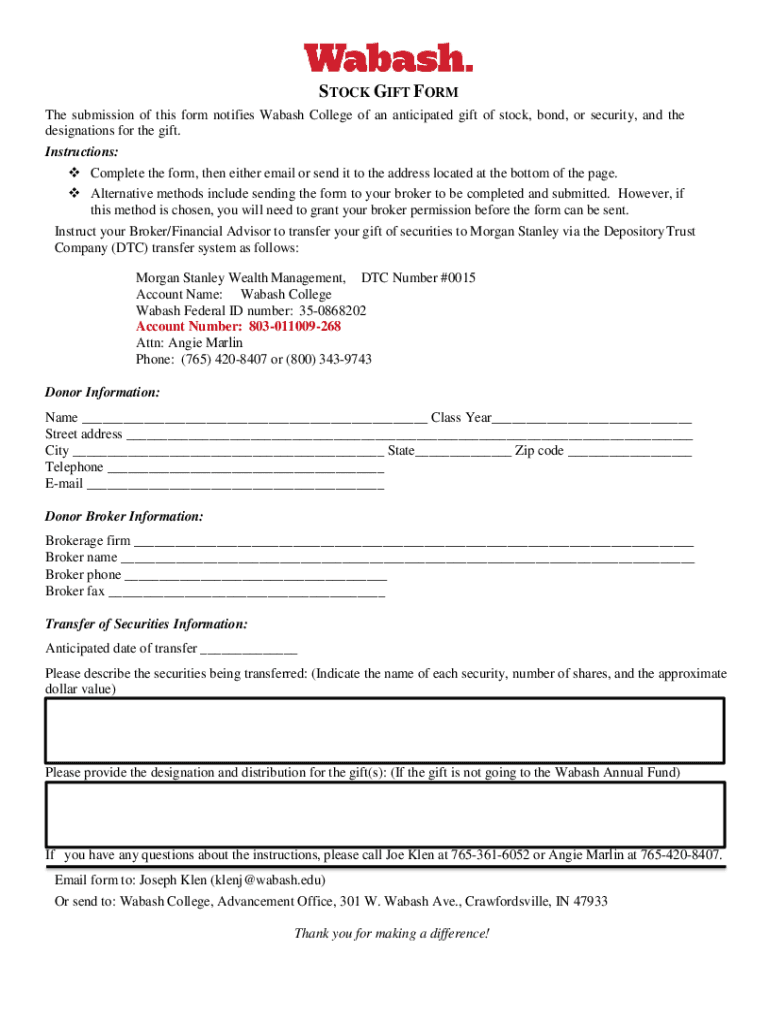

STOCK GIFT From The submission of this form notifies Wabash College of an anticipated gift of stock, bond, or security, and the designations for the gift. Instructions: Complete the form, then either

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts of stock bonds

Edit your gifts of stock bonds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts of stock bonds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gifts of stock bonds online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gifts of stock bonds. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts of stock bonds

How to fill out gifts of stock bonds

01

Step 1: Gather all the necessary information and documents related to the stock bonds you want to gift.

02

Step 2: Determine how you want to transfer the stock bonds - whether it's through a physical certificate or electronically through a brokerage account.

03

Step 3: If transferring through a physical certificate, fill out the necessary transfer forms provided by the company or institution that issued the stock bonds.

04

Step 4: Provide all required information, including the recipient's name and contact details, the number of stock bonds being gifted, and any other relevant information.

05

Step 5: Sign and date the transfer forms, ensuring all required fields are properly filled out.

06

Step 6: Submit the completed transfer forms and any supporting documents to the appropriate company or institution as instructed.

07

Step 7: If transferring electronically, contact your brokerage firm and inform them of your intention to gift the stock bonds.

08

Step 8: Follow the brokerage firm's instructions for initiating the transfer, which may involve entering the recipient's account details and the quantity of stock bonds being gifted.

09

Step 9: Review and verify all the information before submitting the transfer request.

10

Step 10: Confirm that the transfer of the stock bonds has been completed successfully and provide any necessary documentation to the recipient.

Who needs gifts of stock bonds?

01

Individuals or organizations who wish to make charitable contributions or provide financial support to others may choose to gift stock bonds.

02

Investors who hold appreciated stock bonds and want to avoid capital gains taxes may also opt to gift them.

03

Family members who want to pass on their stock bonds to their loved ones as part of estate planning or inheritance might also consider gifting the bonds.

04

Additionally, some individuals or organizations may use gifts of stock bonds as a means of fulfilling certain legal or financial obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gifts of stock bonds to be eSigned by others?

To distribute your gifts of stock bonds, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete gifts of stock bonds online?

With pdfFiller, you may easily complete and sign gifts of stock bonds online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in gifts of stock bonds without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your gifts of stock bonds, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is gifts of stock bonds?

Gifts of stock bonds refer to the transfer of ownership of stocks or bonds from one party to another as a gift.

Who is required to file gifts of stock bonds?

Individuals who receive gifts of stock bonds that exceed a certain value threshold may be required to report this gift to the IRS.

How to fill out gifts of stock bonds?

To fill out gifts of stock bonds, individuals must include details of the gift such as the value of the stocks or bonds, the date of the gift, and the relationship between the giver and recipient.

What is the purpose of gifts of stock bonds?

The purpose of gifts of stock bonds is to ensure that the IRS is aware of any significant transfers of wealth, and to prevent tax evasion through the gifting of assets.

What information must be reported on gifts of stock bonds?

The information that must be reported on gifts of stock bonds includes the value of the stocks or bonds at the time of the gift, the date of the gift, and the identity of the giver and recipient.

Fill out your gifts of stock bonds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts Of Stock Bonds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.