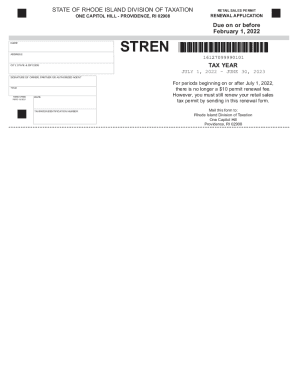

RI Retail Sales Permit Renewal Application 2020 free printable template

Get, Create, Make and Sign RI Retail Sales Permit Renewal Application

Editing RI Retail Sales Permit Renewal Application online

Uncompromising security for your PDF editing and eSignature needs

RI Retail Sales Permit Renewal Application Form Versions

How to fill out RI Retail Sales Permit Renewal Application

How to fill out RI Retail Sales Permit Renewal Application

Who needs RI Retail Sales Permit Renewal Application?

Instructions and Help about RI Retail Sales Permit Renewal Application

— So, we've talked about one policy response to pollution, the idea of a Nigerian tax. And we've talked about the idea that perhaps, sometimes due to the Case theorem, people will be able to solve their environmental problems on their own. But let me now go ahead and talk about tradable permit systems. So, one way of dealing with an externality problem, say a negative externality problem, is to tax people. And that's a great solution when the marginal external cost is flat and known. Because then we can go ahead and put the tax on there, and that's basically great. But, on the other hand, there's lots of things, as I said, where the marginal external tax maybe-- or the marginal external cost maybe goes something like this. So, in that case, we're really worried about keeping the amount of pollution under control more. So we really need to keep it from getting into this really high region here. So in this case-- and let's suppose we have the marginal benefit of pollution here. So we might know that, say for instance, we need to keep carbon dioxide emissions below a certain amount here. Well, then what we do here is we issue a certain number of permits. Now you'll notice that if we issue this amount of permits, we get to the efficient outcome. And we can see that the permits will trade for this amount here. Because remember, this curve here, the marginal benefit of pollution curve, tells us the gains from trade that can be omitted-- can be gained from omitting that amount of pollution. And if you can get $30.00 of gains from trade from omitting that amount of pollution, then you're going to be willing to spend up to $30.00 to get that permit. So that's one way of thinking about it. And notice, Nigerian taxes and tradable permits can be made equivalent, or at least mostly equivalent. There is a slight difference here. With Nigerian taxes, we create a situation where the price of pollution is fixed. And so in that case, we know that there will always be some deterrent to pollute, but that deterrent to pollute won't get higher if pollution rises. So, there's a known deterrent, known and constant deterrent to pollute. Tradable permits, the quantity of pollution is fixed. Thou shall not pollute more than the permit amount. So, known and constant quantity, maximum quantity of pollution. But it may be that, in this case, we have an unknown-- or it will be the case, that here, if we have the Nigerian tax, we will have an unknown quantity of pollution. Because, say for instance, if this marginal benefit curve shifts out, or if we're thinking about a supply demand diagram, it may be true that the Nigerian tax causes the supply curve to shift from S1 to S2. And so it does reduce the quantity of the activity. But then if there's an increase in a demand for the final product, then we get back out to here. So, again, known and constant price, but unknown quantity here. If we have tradable permits, we have a known and constant quantity, but we have an unknown...

People Also Ask about

How do I renew my retail sales permit in RI?

How to apply for a sales tax permit in RI?

How do I pay my Rhode Island sales tax?

How do I pay my state taxes in Rhode Island?

Where do I send my RI tax payment?

How do I pay my RI sales tax online?

How do I pay my sales tax online in Rhode Island?

What is a retail sales permit in Rhode Island?

What is a retail sales permit for RI?

How do I get a tax ID number in RI?

Do I need a sellers permit to sell online in Rhode Island?

How can I pay my tax online from home?

How do tax sales work in Rhode Island?

Who needs a business license in Rhode Island?

How do I get a seller's permit in Rhode Island?

Does Rhode Island have online sales tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit RI Retail Sales Permit Renewal Application in Chrome?

How do I edit RI Retail Sales Permit Renewal Application on an iOS device?

How do I complete RI Retail Sales Permit Renewal Application on an Android device?

What is RI Retail Sales Permit Renewal Application?

Who is required to file RI Retail Sales Permit Renewal Application?

How to fill out RI Retail Sales Permit Renewal Application?

What is the purpose of RI Retail Sales Permit Renewal Application?

What information must be reported on RI Retail Sales Permit Renewal Application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.