Get the free www.citizensinformation.ieenhousingMortgage Arrears Resolution Process (MARP) - Citi...

Show details

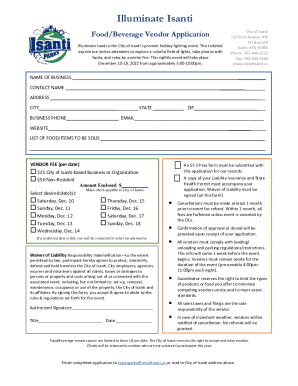

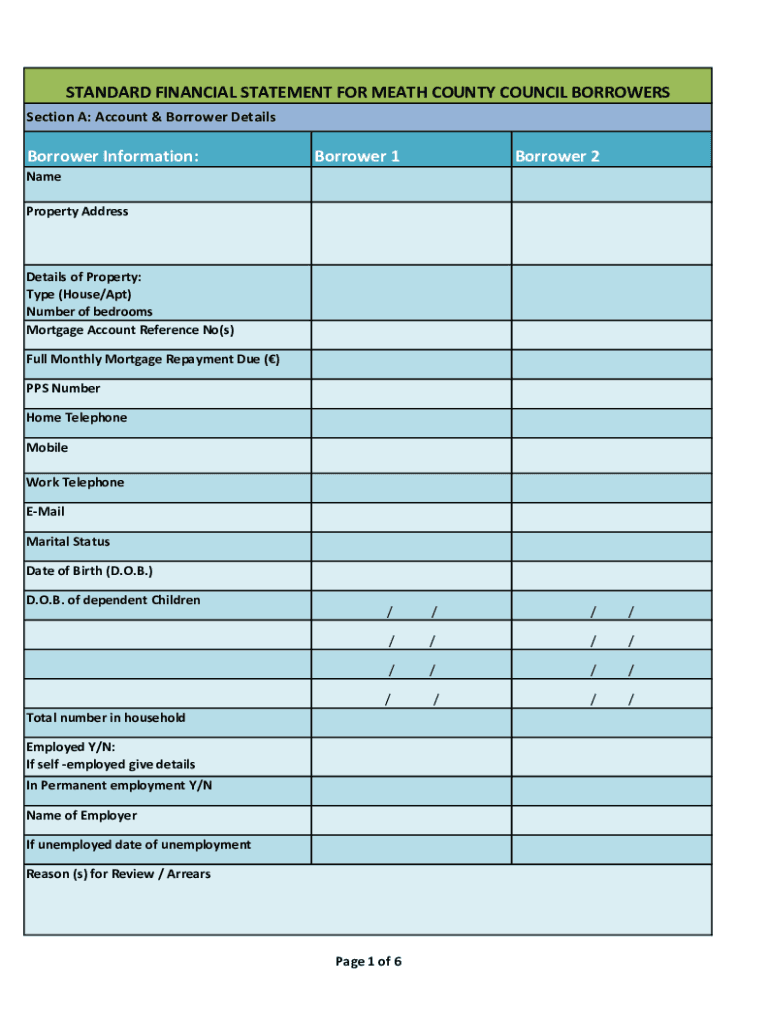

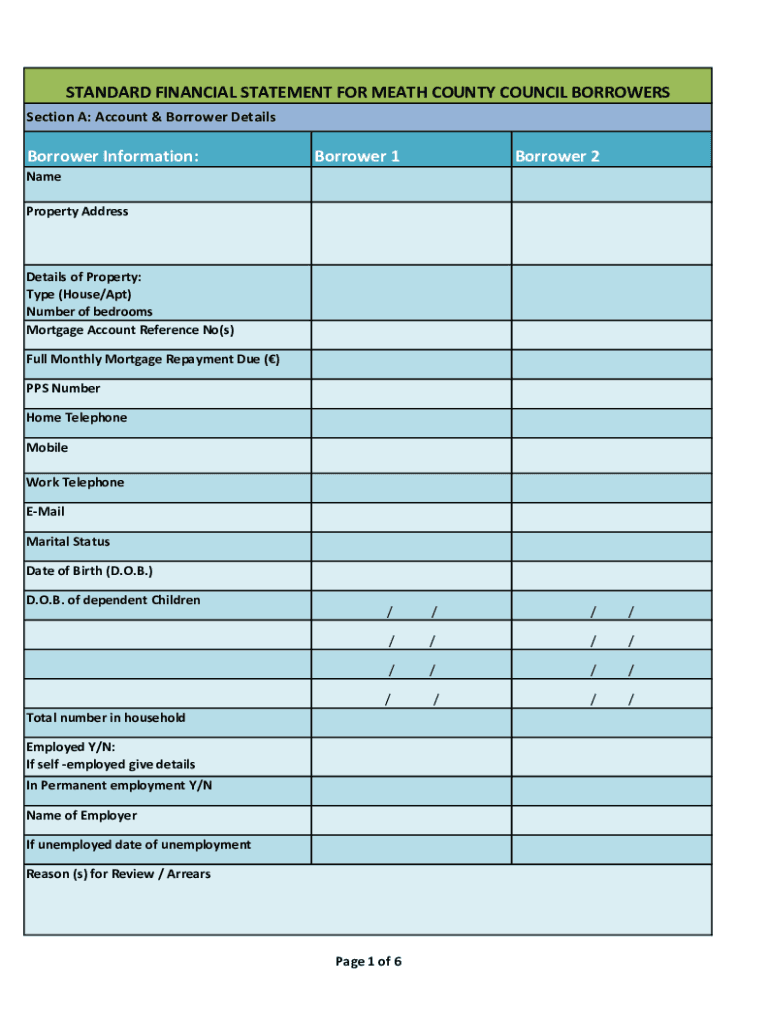

STANDARD FINANCIAL STATEMENT FOR DEATH COUNTY COUNCIL BORROWERS Section A: Account & Borrower DetailsBorrower Information:Borrower 1Borrower 2Name Property AddressDetails of Property: Type (House/Apt)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwcitizensinformationieenhousingmortgage arrears resolution process

Edit your wwwcitizensinformationieenhousingmortgage arrears resolution process form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwcitizensinformationieenhousingmortgage arrears resolution process form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wwwcitizensinformationieenhousingmortgage arrears resolution process online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wwwcitizensinformationieenhousingmortgage arrears resolution process. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwcitizensinformationieenhousingmortgage arrears resolution process

How to fill out wwwcitizensinformationieenhousingmortgage arrears resolution process

01

Visit the website www.citizensinformation.ie/en/housing/mortgage_arrears_resolution_process

02

Read and understand the information provided on the page about the mortgage arrears resolution process

03

Gather all necessary financial documents, such as mortgage statements, bank statements, and proof of income

04

Contact your mortgage lender to discuss your situation and inform them about your intention to go through the mortgage arrears resolution process

05

Submit the required documents to your mortgage lender

06

Work with your lender to assess your financial situation and explore possible solutions, such as loan modification, mortgage restructuring, or alternative repayment arrangements

07

Follow the guidance provided by your lender and provide any additional information or documentation as needed

08

Review and consider any proposed solutions or offers from your lender

09

Consult with a financial advisor or seek legal advice if necessary

10

Once an agreement is reached, make sure to comply with the agreed-upon terms and meet all financial obligations on time

Who needs wwwcitizensinformationieenhousingmortgage arrears resolution process?

01

Individuals who are facing mortgage arrears and are struggling to make their mortgage payments

02

Homeowners who are at risk of foreclosure or repossession of their property

03

People who want to explore options to resolve their mortgage arrears and find sustainable solutions

04

Borrowers who are looking for assistance and guidance in negotiating with their mortgage lender

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wwwcitizensinformationieenhousingmortgage arrears resolution process to be eSigned by others?

Once your wwwcitizensinformationieenhousingmortgage arrears resolution process is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for signing my wwwcitizensinformationieenhousingmortgage arrears resolution process in Gmail?

Create your eSignature using pdfFiller and then eSign your wwwcitizensinformationieenhousingmortgage arrears resolution process immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out wwwcitizensinformationieenhousingmortgage arrears resolution process on an Android device?

On Android, use the pdfFiller mobile app to finish your wwwcitizensinformationieenhousingmortgage arrears resolution process. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is www.citizensinformation.ie/en/housing/mortgage-arrears resolution process?

The mortgage arrears resolution process is a structured framework aimed at assisting borrowers who are in arrears with their mortgage repayments to find a sustainable solution with their lender.

Who is required to file www.citizensinformation.ie/en/housing/mortgage-arrears resolution process?

Borrowers who are struggling to meet their mortgage repayments and are at risk of arrears are required to engage in the mortgage arrears resolution process.

How to fill out www.citizensinformation.ie/en/housing/mortgage-arrears resolution process?

Borrowers can fill out the mortgage arrears resolution process by proactively engaging with their lender, providing relevant financial information, and exploring potential solutions such as restructuring repayments or alternative arrangements.

What is the purpose of www.citizensinformation.ie/en/housing/mortgage-arrears resolution process?

The purpose of the mortgage arrears resolution process is to help borrowers in financial difficulty to find a sustainable solution with their lender and avoid losing their homes through repossession.

What information must be reported on www.citizensinformation.ie/en/housing/mortgage-arrears resolution process?

Borrowers must report their current financial situation, details of their mortgage contract, any changes in their circumstances, and proposed solutions to address the arrears.

Fill out your wwwcitizensinformationieenhousingmortgage arrears resolution process online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wwwcitizensinformationieenhousingmortgage Arrears Resolution Process is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.