Get the free Maintain Your Enrolled Agent Status - IRS tax forms

Show details

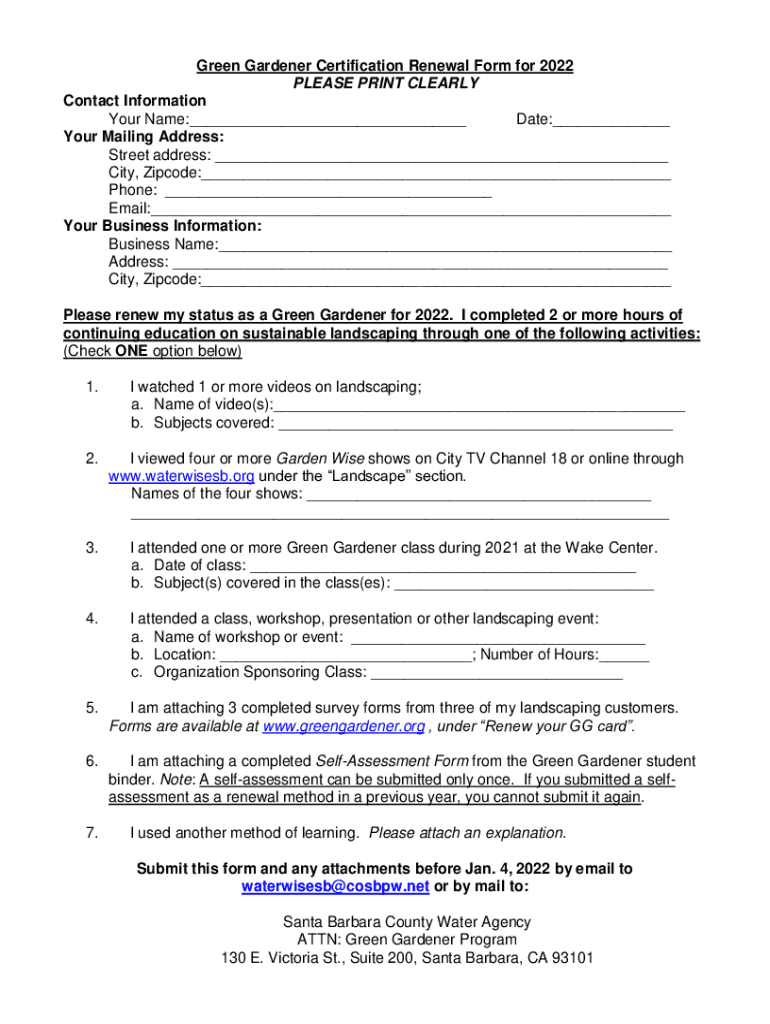

Green Gardener Certification Renewal Form for 2022 PLEASE PRINT CLEARLY Contact Information Your Name: Date: Your Mailing Address: Street address: City, Zip code: Phone: Email: Your Business Information:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maintain your enrolled agent

Edit your maintain your enrolled agent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maintain your enrolled agent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maintain your enrolled agent online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit maintain your enrolled agent. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maintain your enrolled agent

How to fill out maintain your enrolled agent

01

To maintain your enrolled agent status, follow these steps:

02

Fulfill the continuing education requirements: Enrolled agents must complete 72 hours of continuing education every three years, with a minimum of 16 hours per year. This education should be related to federal tax law topics.

03

Renew your Preparer Tax Identification Number (PTIN) annually: Enrolled agents must have a valid PTIN to practice before the Internal Revenue Service (IRS), so make sure to renew it on time.

04

Stay updated with tax law changes: Enrolled agents should continuously keep themselves informed about any updates or changes in federal tax laws and regulations.

05

Abide by the ethical requirements: Enrolled agents are expected to follow the ethical guidelines outlined by the IRS. This includes maintaining client confidentiality, avoiding conflicts of interest, and conducting themselves in a professional manner.

06

Pay any necessary fees: There may be certain fees associated with maintaining your enrolled agent status, such as renewal fees or fees related to continuing education courses.

07

By following these steps, you can successfully maintain your enrolled agent status and continue to practice before the IRS.

Who needs maintain your enrolled agent?

01

Maintaining enrolled agent status is essential for individuals who want to provide tax preparation and representation services before the IRS.

02

Here are some examples of who may need to maintain their enrolled agent status:

03

- Tax professionals who want to offer their services to clients and represent them in front of the IRS.

04

- Individuals who want to start a tax preparation business and serve as enrolled agents.

05

- Accountants or tax consultants who wish to expand their service offerings to include tax preparation and representation.

06

- Employees or partners in accounting firms who want to handle tax matters for their clients.

07

If you fall into any of these categories and want to actively engage in tax preparation and representation activities, maintaining your enrolled agent status is crucial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete maintain your enrolled agent online?

With pdfFiller, you may easily complete and sign maintain your enrolled agent online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit maintain your enrolled agent online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your maintain your enrolled agent and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete maintain your enrolled agent on an Android device?

Use the pdfFiller Android app to finish your maintain your enrolled agent and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is maintain your enrolled agent?

Maintain your enrolled agent refers to keeping your enrolled agent status active and complying with continuing education requirements.

Who is required to file maintain your enrolled agent?

Enrolled agents who want to maintain their status with the IRS are required to file maintain your enrolled agent.

How to fill out maintain your enrolled agent?

To fill out maintain your enrolled agent, enrolled agents must complete the required continuing education courses and report their completion to the IRS.

What is the purpose of maintain your enrolled agent?

The purpose of maintain your enrolled agent is to ensure that enrolled agents stay current with tax laws and regulations.

What information must be reported on maintain your enrolled agent?

Enrolled agents must report the completion of their continuing education courses and any other relevant information requested by the IRS on maintain your enrolled agent.

Fill out your maintain your enrolled agent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maintain Your Enrolled Agent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.