Get the free Housing and Credit Counseling, Inc. - HCCILinkedIn

Show details

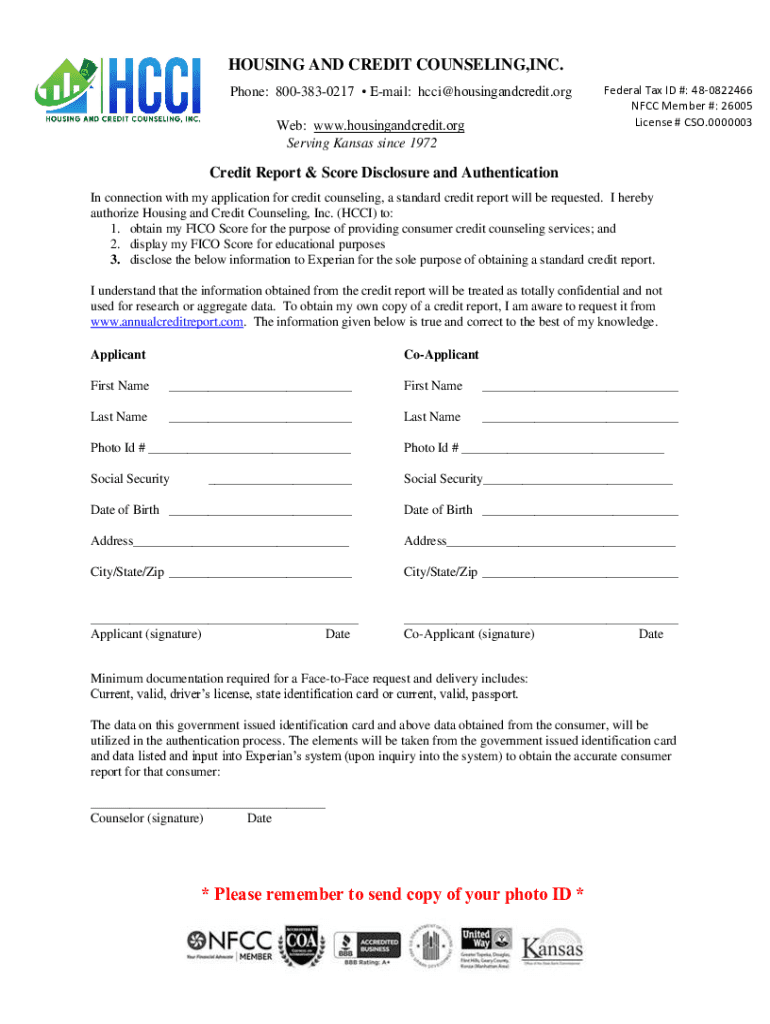

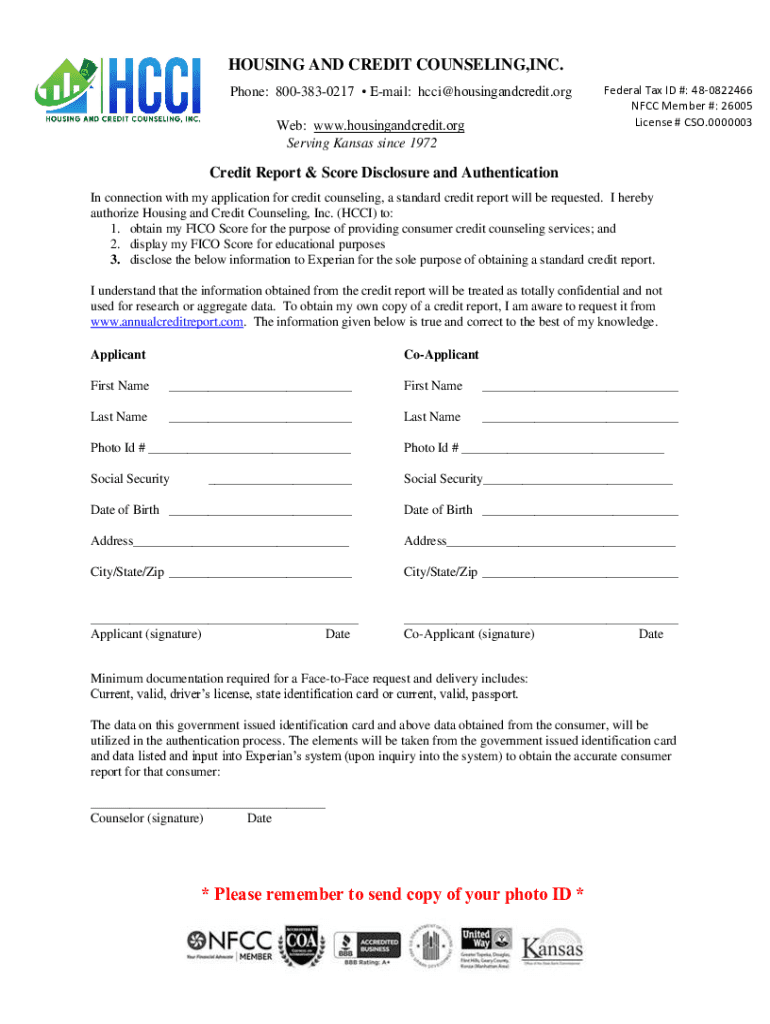

HOUSING AND CREDIT COUNSELING, INC. Phone: 8003830217 Email: CCI housingandcredit.org Web: www.housingandcredit.org Serving Kansas since 1972Federal Tax ID #: 480822466 FCC Member #: 26005 License

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign housing and credit counseling

Edit your housing and credit counseling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your housing and credit counseling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit housing and credit counseling online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit housing and credit counseling. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out housing and credit counseling

How to fill out housing and credit counseling

01

To fill out housing and credit counseling, follow these steps:

02

Start by gathering all your financial documents, including bank statements, pay stubs, and any outstanding loan statements.

03

Research and choose a reputable housing and credit counseling agency or organization.

04

Schedule an appointment with the chosen agency or organization to meet with a housing and credit counselor.

05

During the appointment, the counselor will review your financial situation, including your income, expenses, and debts.

06

The counselor will work with you to create a budget and develop a plan to address your housing and credit needs.

07

Follow the counselor's guidance and recommendations, which may include attending financial education courses or workshops.

08

Ongoing communication with the counselor is important to track progress, address any challenges, and update your plan as needed.

09

Stay committed to the counseling process and implement the strategies discussed to improve your housing and credit situation.

10

Regularly review and monitor your finances to ensure you are on track and making progress towards your goals.

11

Continue to seek guidance and support from the housing and credit counseling agency as needed.

Who needs housing and credit counseling?

01

Housing and credit counseling is beneficial for individuals or families who:

02

- Struggle with managing their finances effectively

03

- Want to improve their credit score or establish credit history

04

- Need assistance in creating a realistic budget and managing their expenses

05

- Are facing foreclosure or eviction

06

- Want to understand their housing and credit rights and options

07

- Need help in navigating the homebuying or rental process

08

- Have significant debt and need guidance on debt repayment strategies

09

- Are interested in financial education and increasing their financial literacy

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my housing and credit counseling in Gmail?

housing and credit counseling and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit housing and credit counseling online?

With pdfFiller, it's easy to make changes. Open your housing and credit counseling in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the housing and credit counseling in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your housing and credit counseling in minutes.

What is housing and credit counseling?

Housing and credit counseling is a type of counseling that helps individuals manage their financial situations in relation to housing matters and credit.

Who is required to file housing and credit counseling?

Individuals who are seeking to purchase a home or secure a loan may be required to participate in housing and credit counseling.

How to fill out housing and credit counseling?

To fill out housing and credit counseling, individuals must attend counseling sessions with a certified counselor and provide relevant financial information.

What is the purpose of housing and credit counseling?

The purpose of housing and credit counseling is to help individuals understand their financial options, create a budget, and make informed decisions about housing and credit.

What information must be reported on housing and credit counseling?

Information such as income, expenses, debt, credit history, and financial goals must be reported during housing and credit counseling.

Fill out your housing and credit counseling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Housing And Credit Counseling is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.