Get the free Charities and giving - Canada.ca

Show details

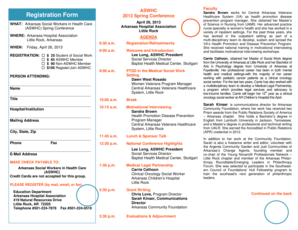

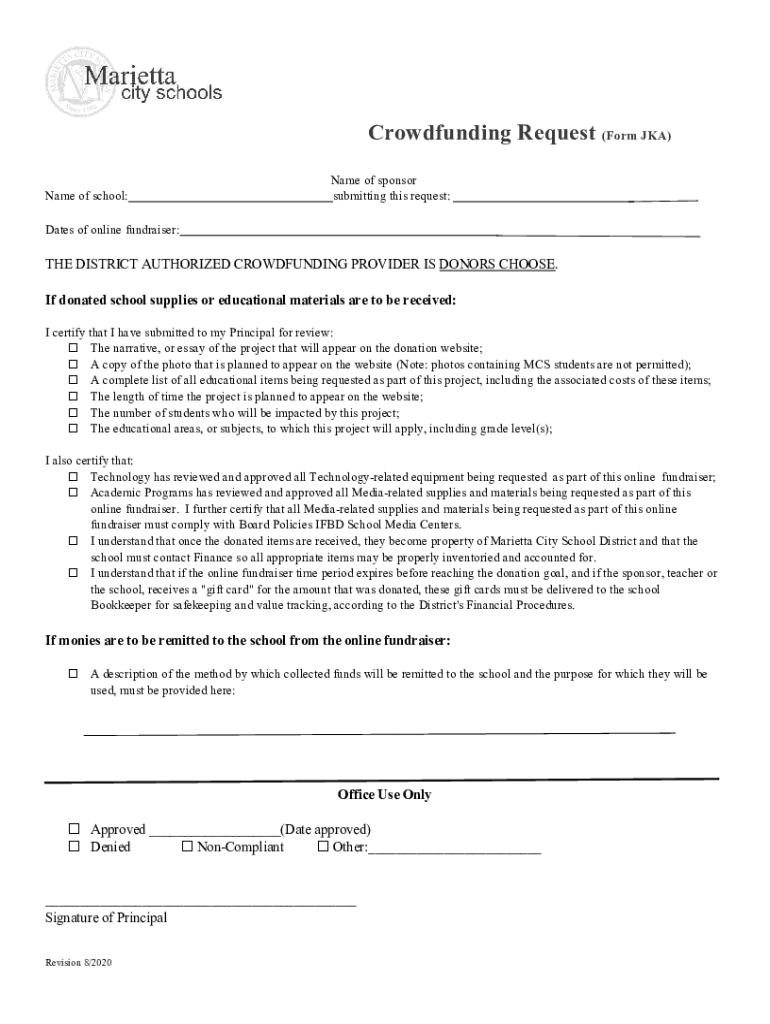

Crowdfunding Request (Form AKA) Name of school:Name of sponsor submitting this request:Dates of online fundraiser:THE DISTRICT AUTHORIZED CROWDFUNDING PROVIDER IS DONORS CHOOSE. If donated school

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charities and giving

Edit your charities and giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charities and giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charities and giving online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charities and giving. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charities and giving

How to fill out charities and giving

01

First, research and identify a charity or organization that aligns with your values and causes you care about.

02

Review their mission, programs, and impact to ensure they are legitimate and effective.

03

Decide how you want to contribute - whether it's through one-time donations, monthly contributions, or volunteering your time.

04

If you choose to donate money, determine your budget and set aside a specific amount you are comfortable giving.

05

Explore different donation options such as online platforms, direct bank transfers, or mailing a check.

06

Follow the specific guidelines provided by the charity on how to donate and fill out the necessary information accurately.

07

If you wish to donate goods or items, get in touch with the charity to understand their requirements and drop-off locations.

08

Complete any forms or paperwork required for tax deductions if applicable.

09

Keep track of your contributions and make a habit of evaluating the impact your donations are making.

10

Consider consulting financial advisors or tax professionals for advice on maximizing the benefits of your charitable giving.

Who needs charities and giving?

01

Charities and giving are crucial for various individuals and groups in society who are in need of assistance.

02

Individuals facing poverty, homelessness, or extreme financial hardships often rely on charities for basic necessities and support.

03

Families struggling to provide for their children may require assistance with food, clothing, education, or healthcare.

04

Disadvantaged communities or marginalized groups benefit from charities that work towards equality, empowerment, and social justice.

05

Nonprofits and charitable organizations also support individuals with disabilities, mental health challenges, or medical conditions.

06

Victims of natural disasters, conflicts, or emergencies often depend on charities for immediate relief and long-term recovery.

07

Charitable giving is essential for funding scientific research, advancing medical breakthroughs, and supporting innovation in various fields.

08

Artists, musicians, and performers frequently rely on charitable donations to fund their projects, events, and creative endeavors.

09

Animal shelters, conservation organizations, and wildlife sanctuaries heavily rely on donations for the care and protection of animals.

10

Moreover, charities play a vital role in addressing social and environmental issues by advocating for change and providing resources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit charities and giving straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing charities and giving, you need to install and log in to the app.

How do I edit charities and giving on an Android device?

You can edit, sign, and distribute charities and giving on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete charities and giving on an Android device?

Use the pdfFiller Android app to finish your charities and giving and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is charities and giving?

Charities and giving refers to the act of donating money, goods, or services to charitable organizations in order to support their causes.

Who is required to file charities and giving?

Nonprofit organizations and individuals who make significant charitable donations may be required to file charities and giving.

How to fill out charities and giving?

Charities and giving can be filled out by providing information on the donations made, the recipient organizations, and any other relevant details requested by the filing requirements.

What is the purpose of charities and giving?

The purpose of charities and giving is to support charitable organizations and causes that provide assistance to those in need or work towards a specific social or environmental goal.

What information must be reported on charities and giving?

Information such as the amount of donations made, the recipient organizations, and any associated tax deductions must be reported on charities and giving forms.

Fill out your charities and giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charities And Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.