Get the free Financial Statements December 31, 2020 No Barriers USA

Show details

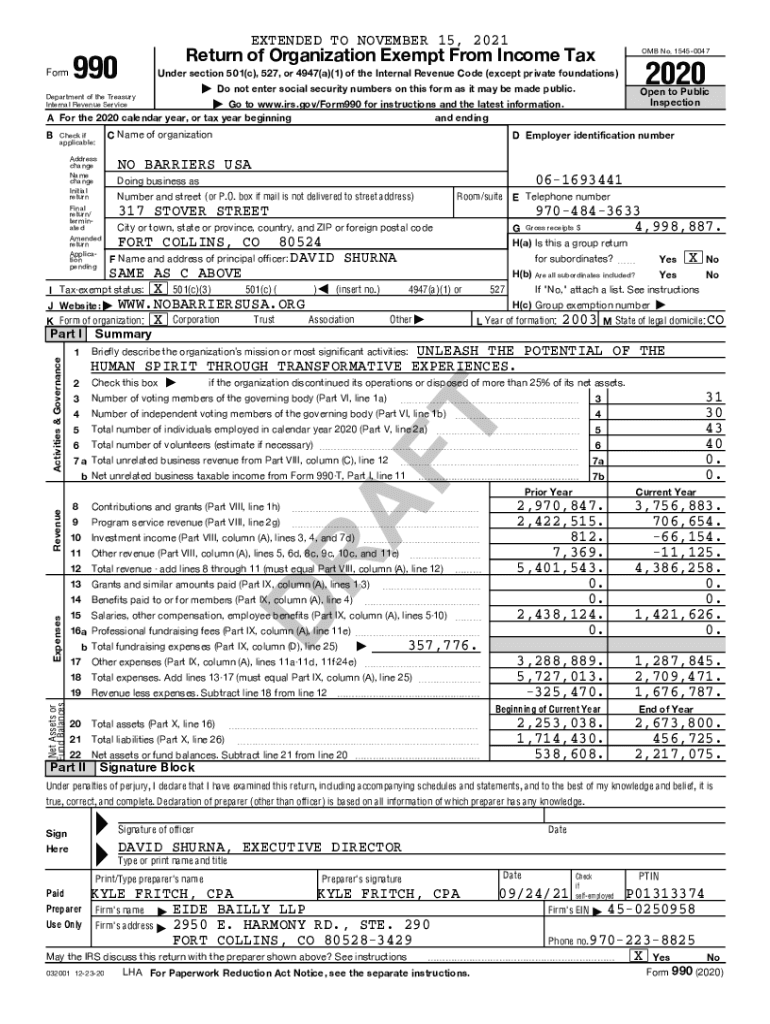

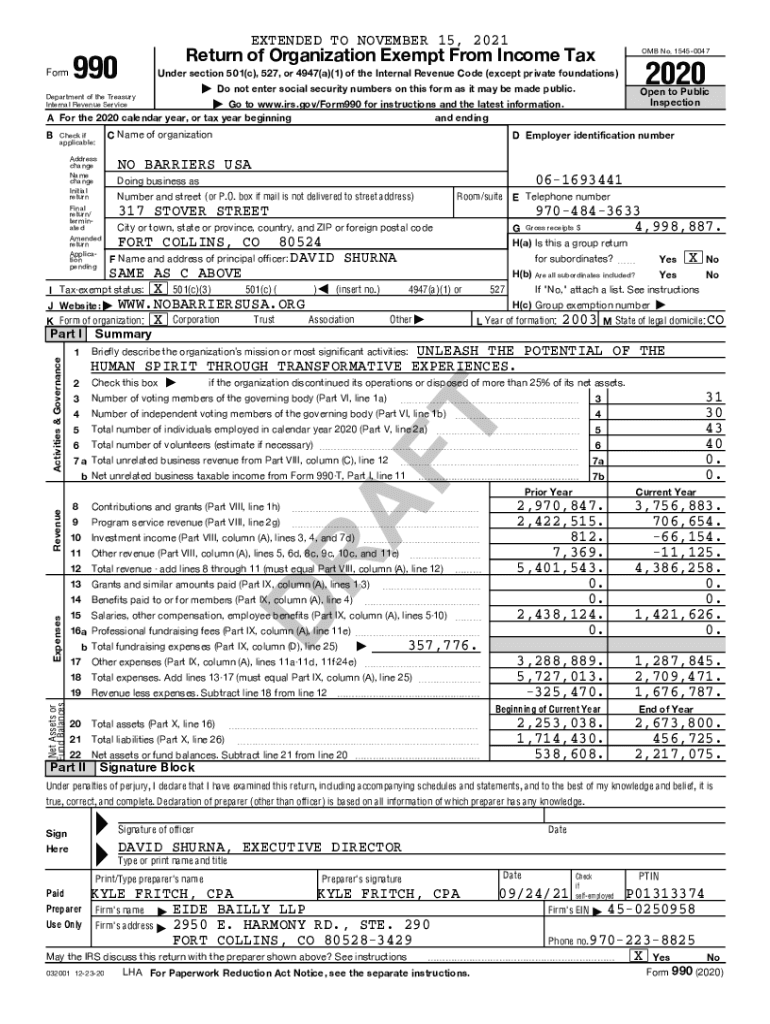

EXTENDED TO NOVEMBER 15, 2021 Form990Return of Organization Exempt From Income Tax OMB No. 15450047 Do not enter social security numbers on this form as it may be made public. Open to Public Inspection2020Under

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements december 31

Edit your financial statements december 31 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements december 31 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial statements december 31 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit financial statements december 31. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements december 31

How to fill out financial statements december 31

01

Step 1: Gather all relevant financial documents and records for the period ending December 31.

02

Step 2: Review the balance sheet, income statement, and cash flow statement templates provided by your accounting software or consultant.

03

Step 3: Start with the balance sheet. Fill in the assets section first, including cash, accounts receivable, inventory, and any other assets your company owns.

04

Step 4: Move on to the liabilities section of the balance sheet. Include accounts payable, short-term debt, long-term debt, and any other outstanding obligations your company has.

05

Step 5: Calculate the equity section of the balance sheet by subtracting liabilities from assets.

06

Step 6: Proceed to the income statement. Record all revenue earned during the period, including sales, investments, and other sources of income.

07

Step 7: Deduct all expenses incurred during the period, such as salaries, operating costs, taxes, and interest paid.

08

Step 8: Calculate the net income by subtracting total expenses from total revenue.

09

Step 9: Lastly, prepare the cash flow statement. Record the cash inflows and outflows from operating activities, investing activities, and financing activities during the period.

10

Step 10: Crosscheck all the calculations and ensure that the financial statements are accurate.

11

Step 11: Review the completed financial statements for any errors or inconsistencies.

12

Step 12: Once you are satisfied with the accuracy of the financial statements, save them in a standardized format, such as PDF or Excel, for easy distribution and reference.

Who needs financial statements december 31?

01

Financial statements for December 31 are necessary for various stakeholders including:

02

- Business owners and shareholders who need to monitor the financial health and performance of the company.

03

- Potential investors or lenders who require financial statements to evaluate the viability of investing or lending to the company.

04

- Regulatory bodies and government agencies that may require financial statements for compliance and reporting purposes.

05

- Tax authorities who need financial statements to assess the company's tax liability.

06

- Business consultants and advisors who use financial statements to provide insights and guidance to their clients.

07

- Internal stakeholders such as managers and employees who rely on financial statements for decision-making and budgeting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial statements december 31 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your financial statements december 31 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send financial statements december 31 for eSignature?

Once you are ready to share your financial statements december 31, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit financial statements december 31 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing financial statements december 31, you need to install and log in to the app.

What is financial statements December 31?

Financial statements as of December 31 are formal records of the financial activities and position of a business, organization, or individual at the end of the calendar year. They typically include the balance sheet, income statement, cash flow statement, and statement of changes in equity.

Who is required to file financial statements December 31?

Entities such as publicly traded companies, private companies meeting certain criteria, nonprofits, and government entities are required to file financial statements as of December 31, depending on regulatory requirements.

How to fill out financial statements December 31?

To fill out financial statements for December 31, gather all financial data, including income, expenses, assets, liabilities, and equity. Use accounting principles to prepare the balance sheet, income statement, cash flow statement, and any required disclosures.

What is the purpose of financial statements December 31?

The purpose of financial statements as of December 31 is to provide stakeholders with a clear view of the entity's financial position and performance over the year, aiding in decision-making and promoting transparency.

What information must be reported on financial statements December 31?

Financial statements as of December 31 must report on revenues, expenses, net income, assets, liabilities, equity, cash flows, and any necessary notes or disclosures related to accounting policies and contingent liabilities.

Fill out your financial statements december 31 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements December 31 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.