Get the free Charitable Giving - Three Pillars Senior Living Communities

Show details

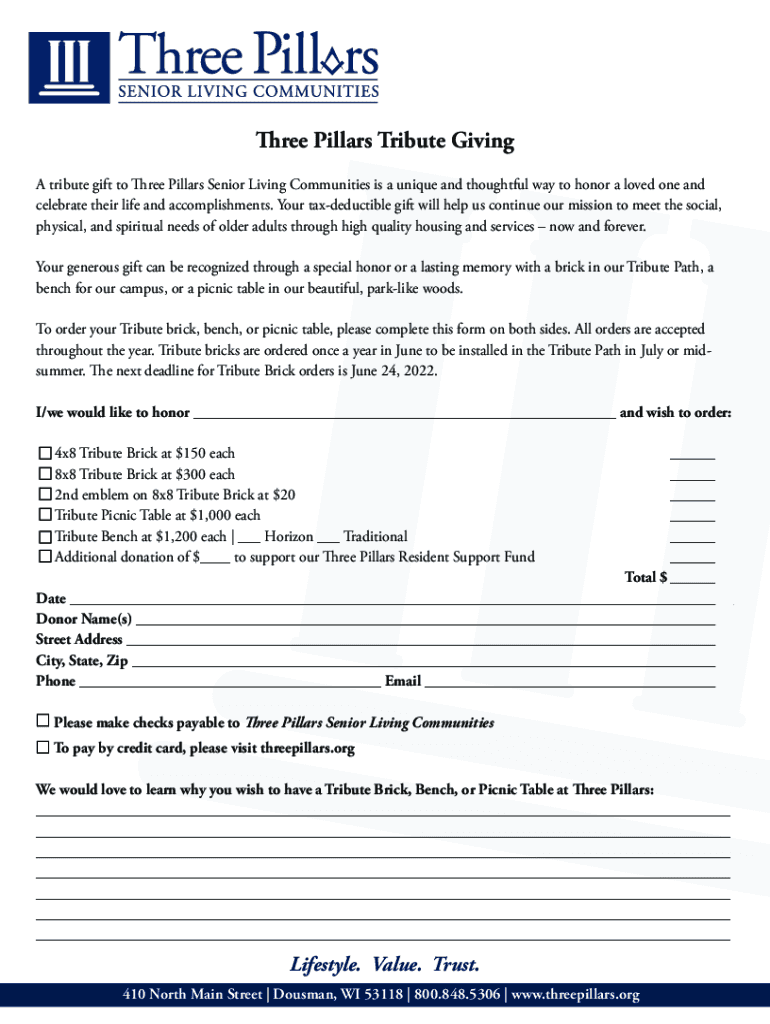

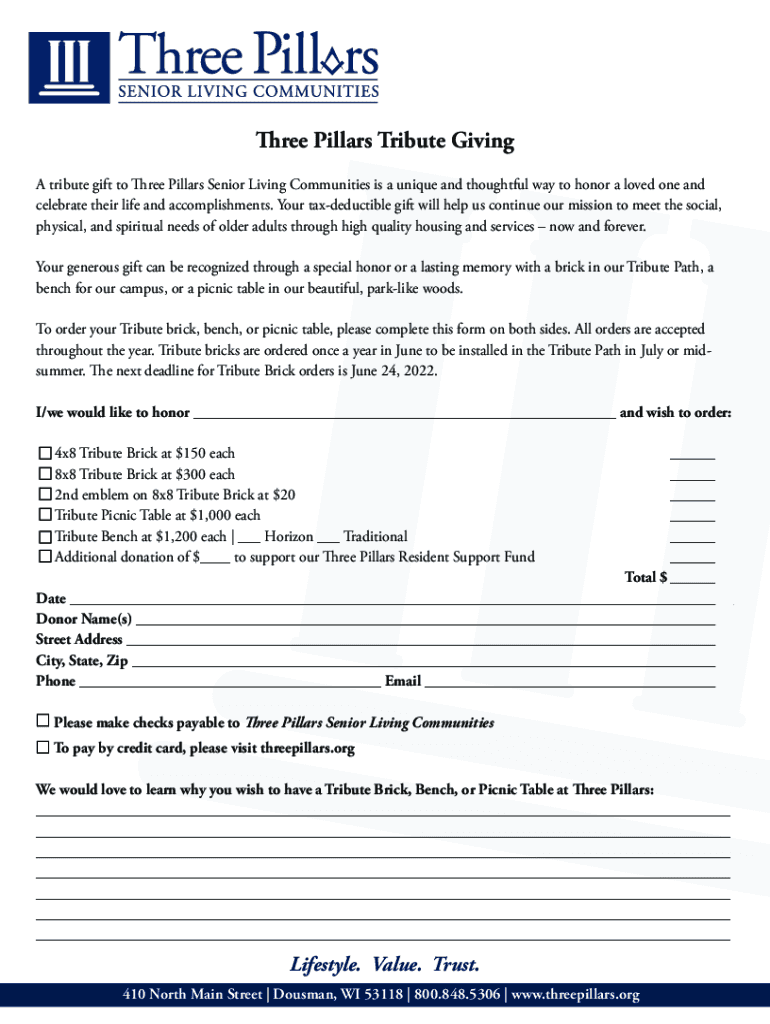

Three Pillars Tribute Giving A tribute gift to Three Pillars Senior Living Communities is a unique and thoughtful way to honor a loved one and celebrate their life and accomplishments. Your tax-deductible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable giving - three

Edit your charitable giving - three form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable giving - three form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable giving - three online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable giving - three. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable giving - three

How to fill out charitable giving - three

01

To fill out charitable giving - three, follow these steps:

02

Begin by gathering your financial information, such as your income, assets, and expenses.

03

Identify the charitable organizations or causes you wish to support through your giving.

04

Research the requirements and guidelines of these organizations to ensure your giving aligns with their mission and objectives.

05

Determine the amount or percentage of your income or assets you are willing to contribute to charitable giving.

06

Consult with a financial advisor or tax professional to understand the tax implications and benefits of your charitable giving.

07

Fill out the necessary forms or paperwork provided by the charitable organizations to document your contributions.

08

Keep records of your charitable giving for tax purposes and to track your contributions over time.

09

Review and update your charitable giving plan periodically to accommodate any changes in your financial situation or charitable interests.

Who needs charitable giving - three?

01

Charitable giving - three can benefit a variety of individuals and organizations, including:

02

- Non-profit organizations that rely on donations to fund their activities and support their missions.

03

- Communities facing social, economic, or environmental challenges that can benefit from financial support.

04

- Individuals or families in need of assistance, such as those affected by natural disasters, poverty, or medical expenses.

05

- Research institutions or universities seeking funding for scientific studies and advancements.

06

- Cultural or arts organizations that promote creativity, expression, and cultural heritage.

07

- Animal shelters or wildlife conservation organizations dedicated to protecting and caring for animals.

08

- Religious or faith-based organizations that use donations to support their religious activities and community programs.

09

- Educational institutions aiming to provide quality education and scholarships to students.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my charitable giving - three directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your charitable giving - three along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get charitable giving - three?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the charitable giving - three in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit charitable giving - three in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your charitable giving - three, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is charitable giving - three?

Charitable giving refers to the act of donating money, goods, or time to organizations in need in order to support their causes and help those in need.

Who is required to file charitable giving - three?

Individuals, businesses, and organizations who make charitable donations and wish to claim tax deductions are required to file charitable giving forms with the appropriate authorities.

How to fill out charitable giving - three?

To fill out charitable giving forms, individuals and entities must provide details of their donations, including the recipient organization, the amount donated, and any supporting documentation required by tax authorities.

What is the purpose of charitable giving - three?

The purpose of charitable giving is to support causes and organizations that address social issues, provide aid to those in need, and contribute to the betterment of society as a whole.

What information must be reported on charitable giving - three?

Information such as the name and address of the recipient organization, the date and amount of the donation, and any accompanying documentation must be reported on charitable giving forms.

Fill out your charitable giving - three online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Giving - Three is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.