Get the free Capital v Revenue Expenditure Toolkit - GOV.UK

Show details

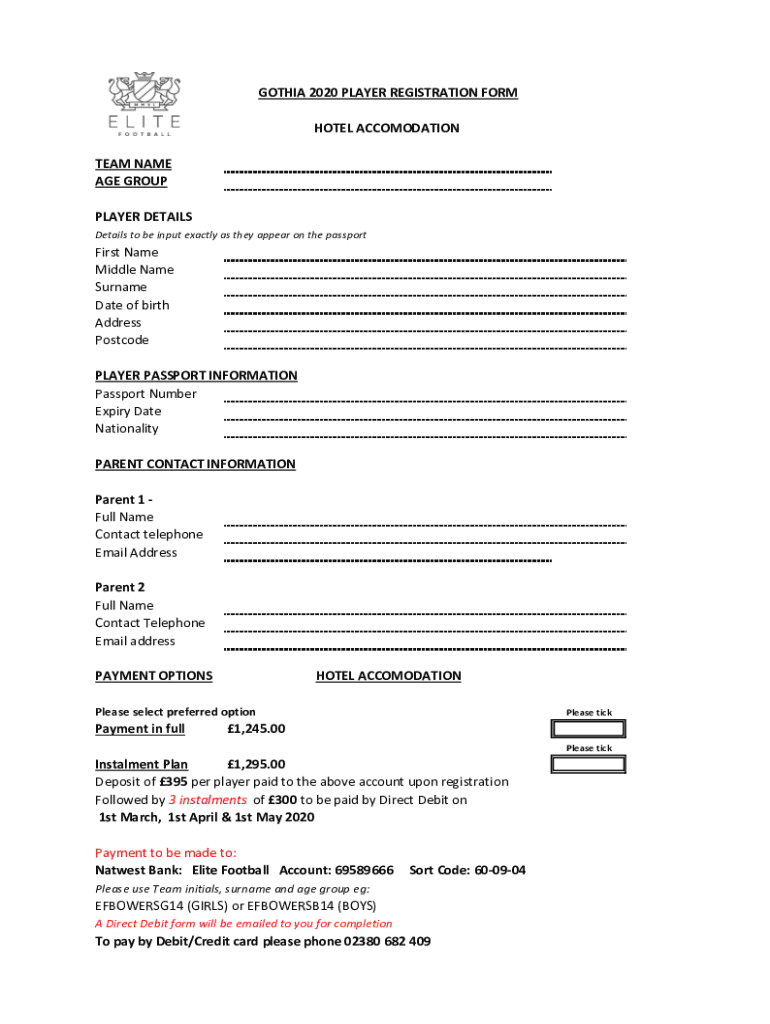

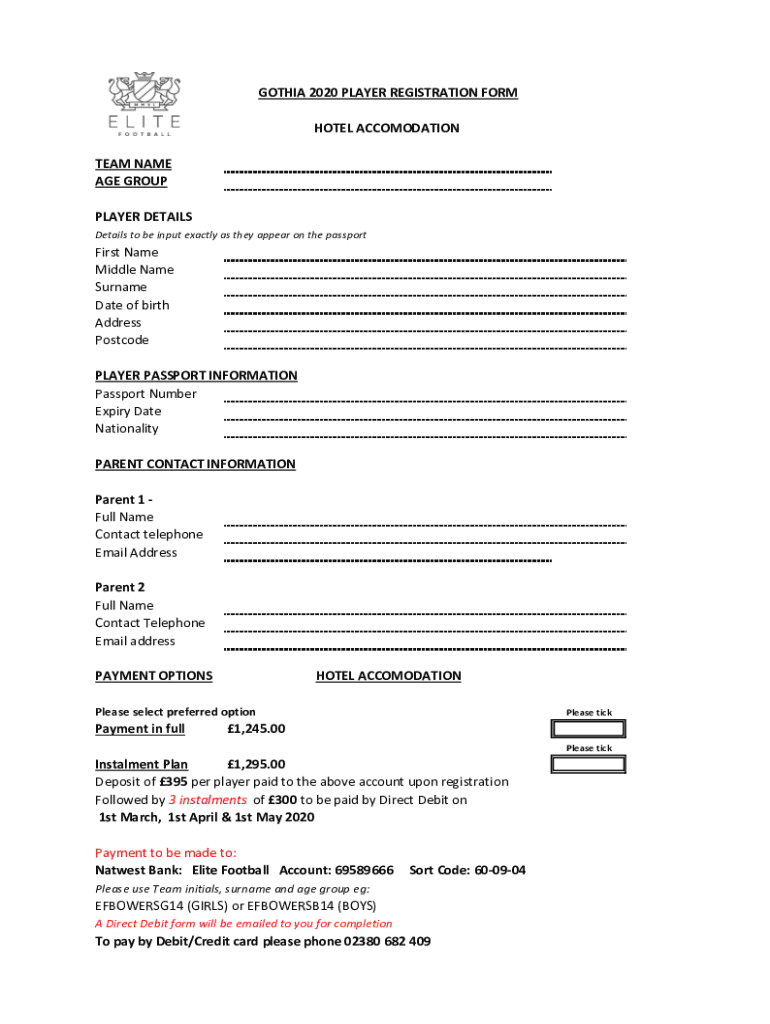

GOTHIC 2020 PLAYER REGISTRATION FORM HOTEL ACCOMMODATION TEAM NAME AGE GROUP PLAYER DETAILS to be input exactly as they appear on the passportFirst Name Middle Name Surname Date of birth Address Postcode

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capital v revenue expenditure

Edit your capital v revenue expenditure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capital v revenue expenditure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing capital v revenue expenditure online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit capital v revenue expenditure. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capital v revenue expenditure

How to fill out capital v revenue expenditure

01

To fill out capital v revenue expenditure, follow these steps:

02

Identify the nature of the expenditure: Determine whether it relates to capital or revenue.

03

Capital Expenditure: If the expenditure is related to the acquisition or improvement of assets or investments that benefit the organization in the long term, categorize it as capital expenditure.

04

Revenue Expenditure: If the expenditure is for the day-to-day operations, maintenance, or immediate consumption of resources, classify it as revenue expenditure.

05

Separate recording: Keep separate records for capital and revenue expenditures to ensure accurate financial reporting.

06

Classification: Classify each expenditure item into the appropriate category based on its nature and intended purpose.

07

Documentation: Maintain proper documentation and supporting evidence for each expenditure to substantiate its classification.

08

Review and Approval: Ensure all capital and revenue expenditures are reviewed and authorized according to the organization's financial policies and procedures.

09

Regular Review: Regularly review and update the classification of expenditures to reflect any changes in their nature or purpose.

10

Consult Experts: Seek guidance from financial professionals or accountants if unsure about the classification of certain expenditures.

11

Keep up-to-date: Stay informed about accounting standards and regulations regarding capital v revenue expenditure to ensure compliance and accurate financial reporting.

Who needs capital v revenue expenditure?

01

Capital v revenue expenditure is required by individuals and organizations involved in financial management and accounting.

02

Businesses: All types of businesses, whether small or large, need to distinguish between capital and revenue expenditure to accurately assess their financial health, plan budgets, and make informed investment decisions.

03

Government Agencies: Government agencies, such as departments, ministries, or local authorities, need to differentiate between capital and revenue expenditure for effective budgeting and resource allocation.

04

Non-profit Organizations: Non-profit organizations, including charities and educational institutions, must track capital and revenue expenditure to comply with financial regulations, report on their financial activities, and ensure proper allocation of funds.

05

Individuals: Individuals who manage their personal finances or investments need to understand the difference between capital and revenue expenditure to make wise spending decisions and evaluate the long-term impact of their financial choices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit capital v revenue expenditure from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your capital v revenue expenditure into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the capital v revenue expenditure in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the capital v revenue expenditure form on my smartphone?

Use the pdfFiller mobile app to fill out and sign capital v revenue expenditure on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is capital v revenue expenditure?

Capital expenditure refers to spending on acquiring or improving fixed assets, while revenue expenditure is the cost of running the day-to-day operations of a business.

Who is required to file capital v revenue expenditure?

Companies and businesses are required to file capital and revenue expenditure as part of their financial reporting.

How to fill out capital v revenue expenditure?

To fill out capital and revenue expenditure, one must accurately classify expenses as either capital or revenue and report them accordingly in financial statements.

What is the purpose of capital v revenue expenditure?

The purpose of distinguishing between capital and revenue expenditure is to accurately reflect the financial performance and position of a company.

What information must be reported on capital v revenue expenditure?

Information such as types of expenses, amounts spent, classification as capital or revenue, and impact on financial statements must be reported on capital and revenue expenditure.

Fill out your capital v revenue expenditure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capital V Revenue Expenditure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.