Get the free letter abatement penalty irs

Show details

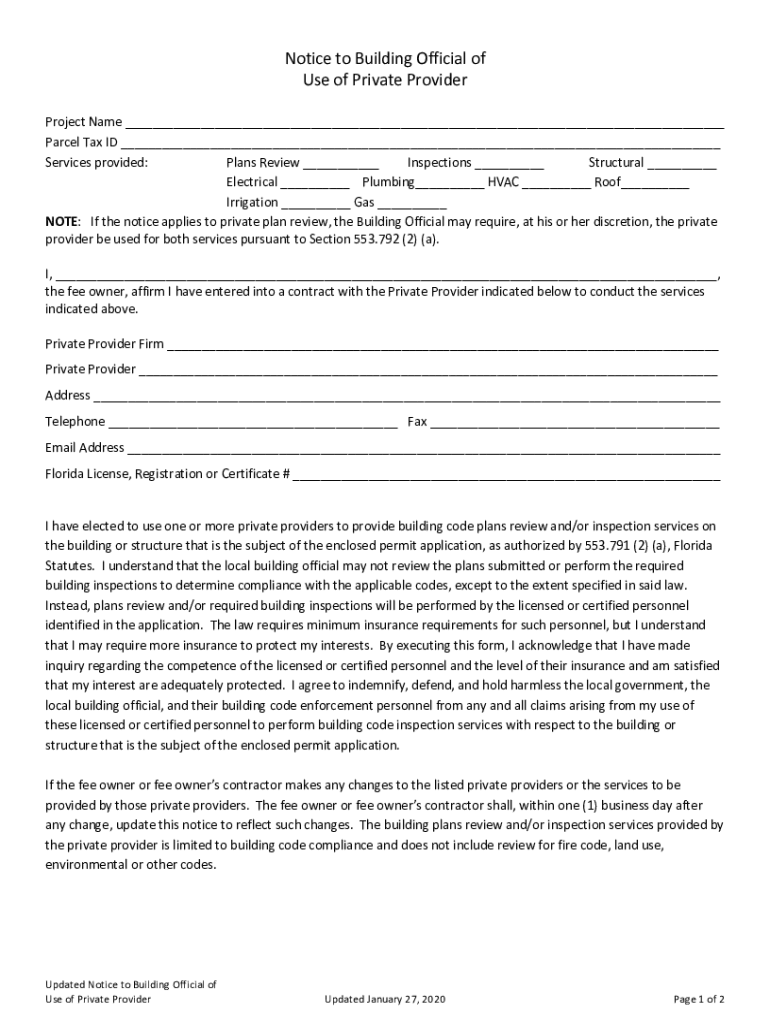

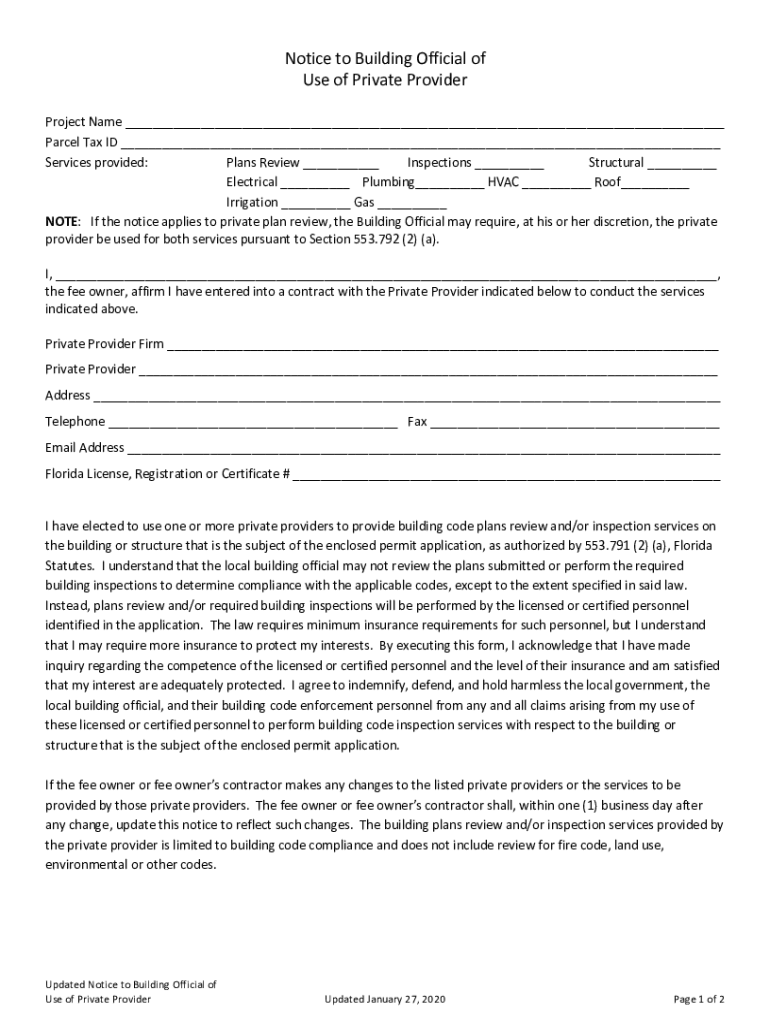

Notice to Building Official of Use of Private Provider Project Name Parcel Tax ID Services provided: Plans Review Inspections Structural Electrical Plumbing HVAC Roof Irrigation Gas NOTE: If the notice

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter abatement penalty irs

Edit your letter abatement penalty irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter abatement penalty irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit letter abatement penalty irs online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit letter abatement penalty irs. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter abatement penalty irs

How to fill out notice to building official

01

To fill out a notice to the building official, follow these steps:

02

Start by providing your personal information, including your name, address, and contact details.

03

Identify the property for which the notice is being submitted. Include the property address and any relevant details.

04

Specify the purpose of the notice and the reason for contacting the building official.

05

Clearly outline the issue or concern that you wish to address in the notice. Be as detailed and specific as possible.

06

If applicable, attach any supporting documents or evidence that supports your claim or concerns.

07

State the desired outcome or resolution you are seeking from the building official.

08

Sign and date the notice.

09

Submit the notice to the appropriate department or individual responsible for building permits or regulations.

Who needs notice to building official?

01

Anyone who has a concern or issue related to building regulations, permits, or violations may need to fill out a notice to the building official. This includes property owners, tenants, contractors, or anyone else who is directly affected by or involved in building activities or issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the letter abatement penalty irs in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your letter abatement penalty irs in seconds.

How can I edit letter abatement penalty irs on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing letter abatement penalty irs.

How do I edit letter abatement penalty irs on an iOS device?

Use the pdfFiller mobile app to create, edit, and share letter abatement penalty irs from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is notice to building official?

The notice to building official is a formal notification submitted to the local building authority detailing construction plans and activities.

Who is required to file notice to building official?

Property owners, contractors, or developers involved in construction projects are required to file a notice to the building official.

How to fill out notice to building official?

The notice to building official can be filled out by providing detailed information about the construction project, including plans, timelines, and contact information.

What is the purpose of notice to building official?

The purpose of the notice to building official is to inform the local building authority about upcoming construction projects and ensure compliance with building codes and regulations.

What information must be reported on notice to building official?

The notice to building official must include information such as the property address, project description, intended use of the building, construction timeline, and contacts for further inquiries.

Fill out your letter abatement penalty irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter Abatement Penalty Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.