Get the free NOTES - South African Revenue Service

Show details

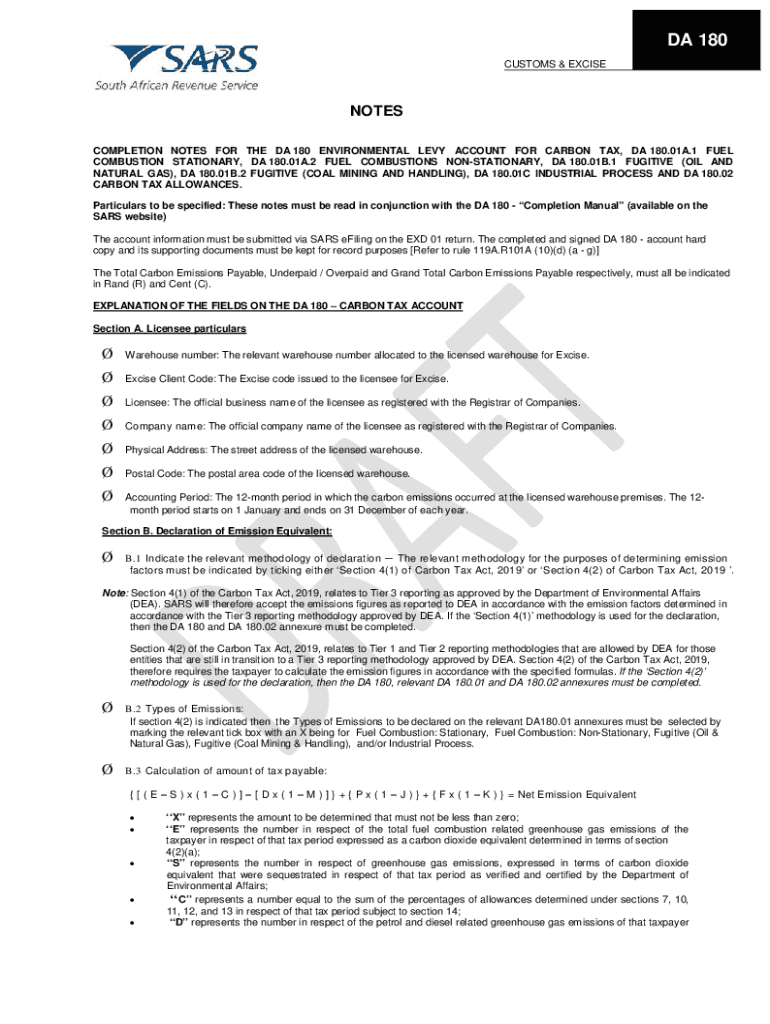

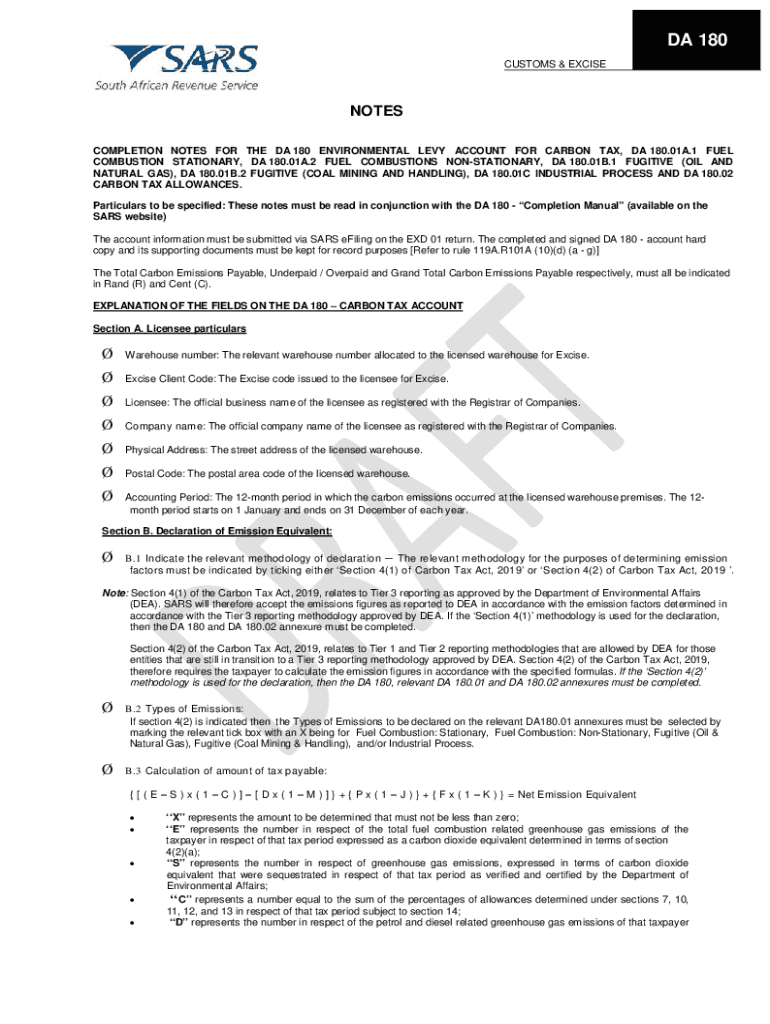

DA 180 CUSTOMS & EXCISENOTES COMPLETION NOTES FOR THE DA 180 ENVIRONMENTAL LEVY ACCOUNT FOR CARBON TAX, DA 180.01A.1 FUEL COMBUSTION STATIONARY, DA 180.01A.2 FUEL COMBUSTION STATIONARY, DA 180.01B.1

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notes - south african

Edit your notes - south african form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notes - south african form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notes - south african online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit notes - south african. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notes - south african

How to fill out notes - south african

01

Start by gathering all the necessary information that you want to include in the notes, such as important dates, key points, and any relevant facts or figures.

02

Begin by writing a brief introduction that provides an overview of the subject matter of the notes.

03

Use bullet points or numbered lists to organize the information in a clear and concise manner.

04

Make sure to include all relevant details and supporting evidence for each point.

05

Use clear and concise language to ensure that the notes are easy to understand and follow.

06

Review and proofread the notes before finalizing them to check for any errors or inconsistencies.

07

Once you are satisfied with the contents of the notes, neatly write or type them out on a separate sheet of paper or a digital document.

08

Ensure that the notes are well-organized and presented in a logical order to facilitate easy reference and understanding.

09

Keep the notes in a safe and accessible place for future reference.

10

Remember to update the notes as needed and make any necessary revisions or additions.

Who needs notes - south african?

01

Students - Notes are commonly used by students to take down important information during lectures, classes, or study sessions. They serve as a helpful tool for revision and reference when preparing for exams or completing assignments.

02

Professionals - Professionals in various fields, such as lawyers, doctors, researchers, and business executives, may need to take notes during meetings, conferences, or presentations to capture important details and key points.

03

Journalists - Journalists often rely on notes to record interviews, gather information, and consolidate facts for news articles or reports.

04

Researchers - Researchers use notes to document their findings, observations, and methodology during experiments or fieldwork. This helps them keep track of their progress and serve as a reference for future study.

05

Administrators - Administrative staff, such as secretaries or assistants, may need to take notes during meetings or phone calls to accurately record important information and instructions.

06

Individuals attending workshops, seminars, or training sessions can benefit from taking notes to retain and review the information shared during these sessions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notes - south african without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your notes - south african into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit notes - south african online?

The editing procedure is simple with pdfFiller. Open your notes - south african in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete notes - south african on an Android device?

Complete notes - south african and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is notes - south african?

Notes - South African refer to financial statements containing a detailed breakdown of an organization's financial performance and position specifically for entities registered in South Africa.

Who is required to file notes - south african?

All entities registered in South Africa are required to file notes - South African as part of their financial reporting obligations.

How to fill out notes - south african?

Notes - South African can be filled out by providing detailed information about the company's financial performance, position, and other relevant financial data in accordance with the accounting standards governing South Africa.

What is the purpose of notes - south african?

The purpose of notes - South African is to provide additional information and details to accompany the financial statements, providing stakeholders with a deeper understanding of the company's financial performance and position.

What information must be reported on notes - south african?

Notes - South African must include detailed information on the company's accounting policies, significant accounting estimates, contingent liabilities, related party transactions, and any other relevant financial information.

Fill out your notes - south african online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notes - South African is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.