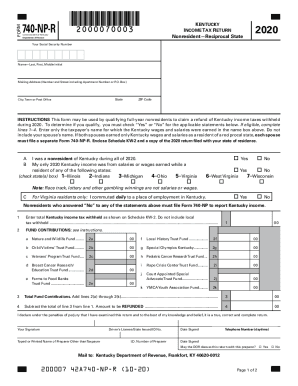

KY DoR 42A740-NP(P) 2020 free printable template

Show details

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

FRANKFORT, KENTUCKY 40620

42A740NP(P) (1020)(REV. 421)740NP

2020 Kentucky

Income Tax Return

Nonresident or

Part Year Resident

Who must file Form 740NP?

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 42A740-NPP

Edit your KY DoR 42A740-NPP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 42A740-NPP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR 42A740-NPP online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY DoR 42A740-NPP. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 42A740-NP(P) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 42A740-NPP

How to fill out KY DoR 42A740-NP(P)

01

Gather all necessary personal and financial information.

02

Download the KY DoR 42A740-NP(P) form from the official website.

03

Start filling out your name and address in the designated sections.

04

Provide your Social Security Number or Federal Employer Identification Number.

05

Complete the income sections accurately, including all sources of income.

06

Fill in the deductions and credits you may qualify for.

07

Review all information to ensure accuracy before submission.

08

Sign and date the form where indicated.

09

Submit the completed form by mail or electronically as per the instructions.

Who needs KY DoR 42A740-NP(P)?

01

Individuals and businesses seeking to apply for non-profit status in Kentucky.

02

Organizations aiming to request exemptions from certain taxes in Kentucky.

03

Tax preparers and accountants assisting clients with non-profit registrations.

Fill

form

: Try Risk Free

People Also Ask about

What is the standard deduction for 2023 in Kentucky?

(September 21, 2022) Each year, the Kentucky Department of Revenue (DOR) calculates the individual standard deduction in ance with KRS 141.081. After adjusting for inflation, the standard deduction for 2023 is $2,980, an increase of $210.

What is the family size tax credit in Kentucky?

The family size tax credit is based on modified gross income and the size of the family. If total modified gross income is $36,908 or less for 2022, you may qualify for the Kentucky family size tax credit.

How much is standard deduction for seniors?

For the 2022 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900.

How do I pay my Kentucky state income tax?

Electronic payment: Choose to pay directly from your bank account or by credit card. Service provider fees may apply. Tax Payment Solution (TPS): Register for EFT payments and pay EFT Debits online. Filing Login: Utility Gross Receipts License Tax online filing.

Do you pay local taxes where you live or work in Kentucky?

These laws allow workers to be taxed in the state in which they live, not in the state in which they earn wages. This eliminates double taxation of employees. For example, Mr. XYZ has a business in Covington, Kentucky, and his employee lives in Cincinnati, Ohio.

What is the standard deduction for KY 740?

You may itemize your deductions for Kentucky even if you do not itemize for federal purposes. Generally, if your deductions exceed $2,690, it will benefit you to itemize. If you do not itemize, you may elect to take the standard deduction of $2,690.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KY DoR 42A740-NPP without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including KY DoR 42A740-NPP. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send KY DoR 42A740-NPP for eSignature?

To distribute your KY DoR 42A740-NPP, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit KY DoR 42A740-NPP straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing KY DoR 42A740-NPP right away.

What is KY DoR 42A740-NP(P)?

KY DoR 42A740-NP(P) is a form used by the Kentucky Department of Revenue for nonprofit organizations to report their income, deductions, and tax obligations.

Who is required to file KY DoR 42A740-NP(P)?

Nonprofit organizations that operate in Kentucky and earn income that is subject to Kentucky state taxes are required to file KY DoR 42A740-NP(P).

How to fill out KY DoR 42A740-NP(P)?

To fill out KY DoR 42A740-NP(P), organizations should gather their financial information, including income and expenses, complete the form with accurate details, and submit it by the due date.

What is the purpose of KY DoR 42A740-NP(P)?

The purpose of KY DoR 42A740-NP(P) is to provide the state with necessary financial information about nonprofit organizations to ensure compliance with state tax regulations.

What information must be reported on KY DoR 42A740-NP(P)?

The form requires reporting information such as total revenue, total expenses, net income, and other relevant financial details pertinent to the organization’s activities.

Fill out your KY DoR 42A740-NPP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 42A740-NPP is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.